Question: normal Subtitle Title 1 No Spac... Subtle Em. Emphasis Intense E. Styles 1301 estion 1: CLO 2 Valuation Principles (20 marks) a) Jim Bowles is

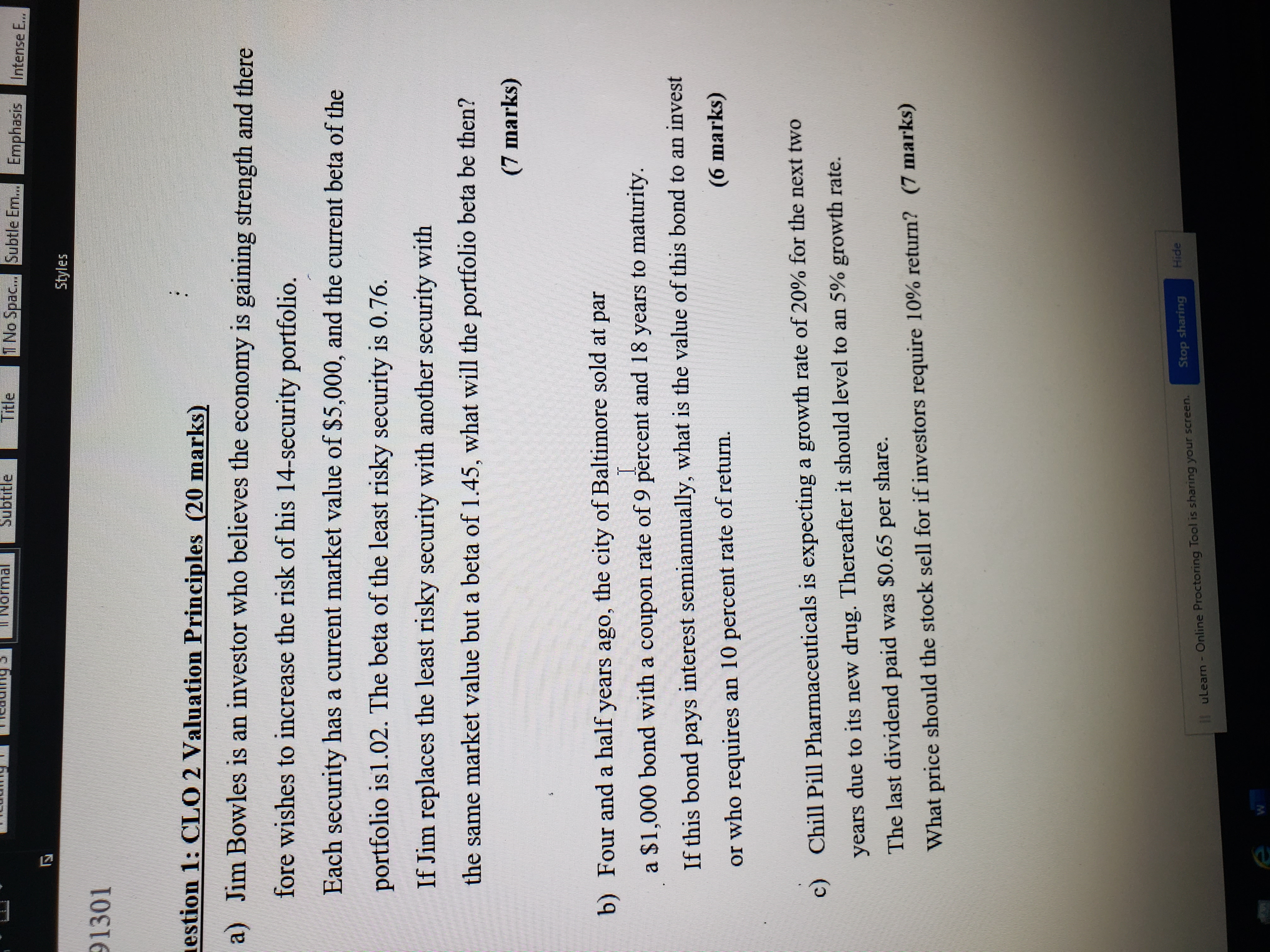

normal Subtitle Title 1 No Spac... Subtle Em. Emphasis Intense E. Styles 1301 estion 1: CLO 2 Valuation Principles (20 marks) a) Jim Bowles is an investor who believes the economy is gaining strength and there fore wishes to increase the risk of his 14-security portfolio. Each security has a current market value of $5,000, and the current beta of the portfolio is 1.02. The beta of the least risky security is 0.76. If Jim replaces the least risky security with another security with the same market value but a beta of 1.45, what will the portfolio beta be then? (7 marks) b) Four and a half years ago, the city of Baltimore sold at par I. a $1,000 bond with a coupon rate of 9 percent and 18 years to maturity. If this bond pays interest semiannually, what is the value of this bond to an invest or who requires an 10 percent rate of return. (6 marks) c) Chill Pill Pharmaceuticals is expecting a growth rate of 20% for the next two years due to its new drug. Thereafter it should level to an 5% growth rate. The last dividend paid was $0.65 per share. What price should the stock sell for if investors require 10% return? (7 marks) Stop sharing Hide ulearn - Online Proctoring Tool is sharing your screen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts