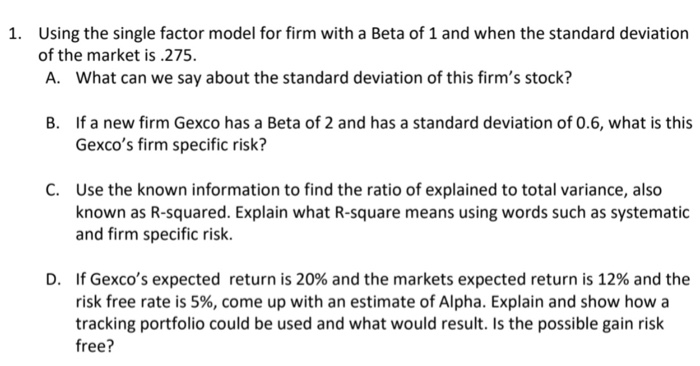

Question: not on excel Using the single factor model for firm with a Beta of 1 and when the standard deviation of the market is 275.

Using the single factor model for firm with a Beta of 1 and when the standard deviation of the market is 275. A. What can we say about the standard deviation of this firm's stock? 1. If a new firm Gexco has a Beta of 2 and has a standard deviation of 0.6, what is this Gexco's firm specific risk? B. Use the known information to find the ratio of explained to total variance, also known as R-squared. Explain what R-square means using words such as systematic and firm specific risk. C. If Gexco's expected return is 20% and the markets expected return is 12% and the risk free rate is 5%, come up with an estimate of Alpha. Explain and show how a tracking portfolio could be used and what would result. Is the possible gain risk free? D

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts