Question: 1. Using the single factor model for firm with a Beta of 1 and when the standard deviation of the market is.3. A. What can

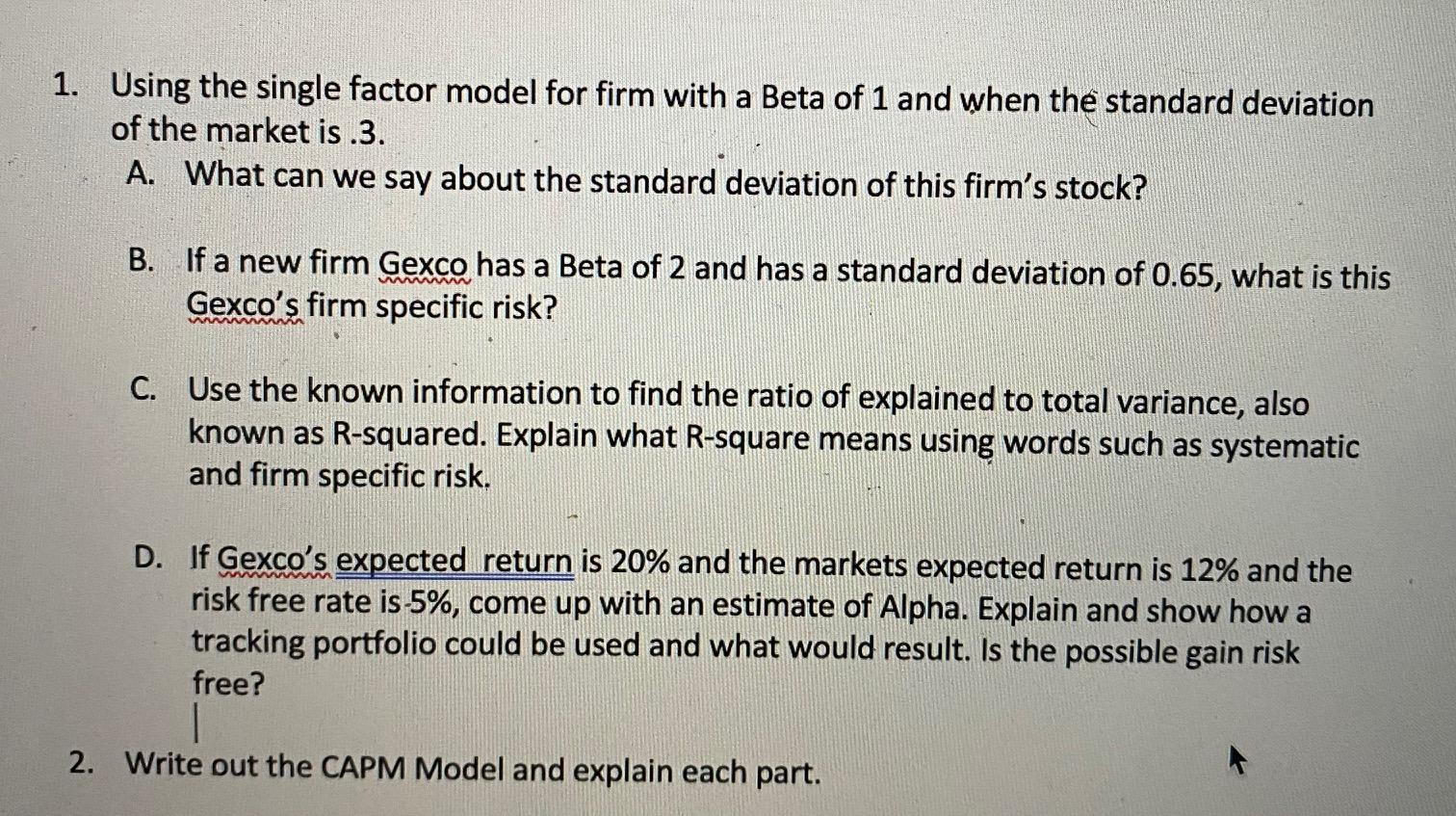

1. Using the single factor model for firm with a Beta of 1 and when the standard deviation of the market is.3. A. What can we say about the standard deviation of this firm's stock? B. If a new firm Gexco has a Beta of 2 and has a standard deviation of 0.65, what is this Gexco's firm specific risk? C. Use the known information to find the ratio of explained to total variance, also known as R-squared. Explain what R-square means using words such as systematic and firm specific risk. D. If Gexco's expected return is 20% and the markets expected return is 12% and the risk free rate is-5%, come up with an estimate of Alpha. Explain and show how a tracking portfolio could be used and what would result. Is the possible gain risk free? 2. Write out the CAPM Model and explain each part. 1. Using the single factor model for firm with a Beta of 1 and when the standard deviation of the market is.3. A. What can we say about the standard deviation of this firm's stock? B. If a new firm Gexco has a Beta of 2 and has a standard deviation of 0.65, what is this Gexco's firm specific risk? C. Use the known information to find the ratio of explained to total variance, also known as R-squared. Explain what R-square means using words such as systematic and firm specific risk. D. If Gexco's expected return is 20% and the markets expected return is 12% and the risk free rate is-5%, come up with an estimate of Alpha. Explain and show how a tracking portfolio could be used and what would result. Is the possible gain risk free? 2. Write out the CAPM Model and explain each part

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts