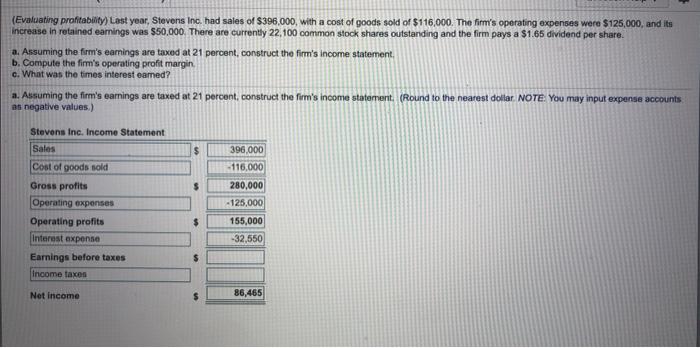

Question: Not sure about calculation of Interest Expense. Please help (Evaluating profitability) Last year, Stevens Inc. had sales of $396,000, with a cost of goods sold

(Evaluating profitability) Last year, Stevens Inc. had sales of $396,000, with a cost of goods sold of $116,000. The firm's operating expenses were $125,000, and its Increase in retained earnings was $50,000. There are currently 22,100 common stock shares outstanding and the firm pays a $1.65 dividend per share. a. Assuming the firm's earnings are taxed at 21 percent, construct the firm's income statement b. Compute the firm's operating profit margin c. What was the times interest oamed? a. Assuming the firm's earnings are taxed at 21 percont, construct the firm's income statement. (Round to the nearest dollar NOTE: You may input expense accounts as negative values) Stevens Inc. Income Statement Sales 396,000 -116,000 280,000 $ Cost of goods sold Gross profits Operating expenses Operating profits Interest expense Earnings before taxes Income taxes $ -125,000 155,000 32,550 Net income 86,465 Solving for r in compound interest) You lend a friend $6,000, for which your friend will repay you $11,000 at the end of 10 years. What interest rate are you charging your friend? The interest rate you are charging your friend is % (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts