Question: Not sure how to do number 3, I figured out 1&2 Intro 8 years ago, a new machine cost $8 million to purchase and an

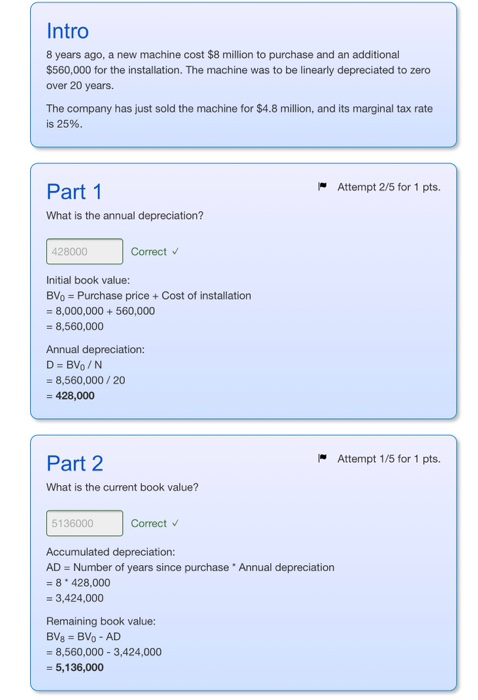

Intro 8 years ago, a new machine cost $8 million to purchase and an additional $560,000 for the installation. The machine was to be linearly depreciated to zero over 20 years. The company has just sold the machine for $4.8 million, and its marginal tax rate is 25%. Part 1 Attempt 2/5 for 1 pts. What is the annual depreciation? 428000 Correct Initial book value: BVo Purchase priceCost of installation -8,000,000560,000 - 8,560,000 Annual depreciation: 8,560,000/20 428,000 Part 2 * Attempt 1/5 for 1 pts What is the current book value? 5136000 Correct AD Number of years since purchase Annual depreciation 8 428,000 3,424,000 Remaining book value: 8,560,000 3,424,000 - 5,136,000 Part 3 What is the cash flow from salvage value? Attempt 1/5 for 1 pts. No decimals Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts