Question: Not sure how to journalize this. begin{tabular}{l|l|l|l} Problem 1 & Problem 2 Problem 2a Journalizing & Problem 3 & Problem 4 end{tabular} Compute the amount

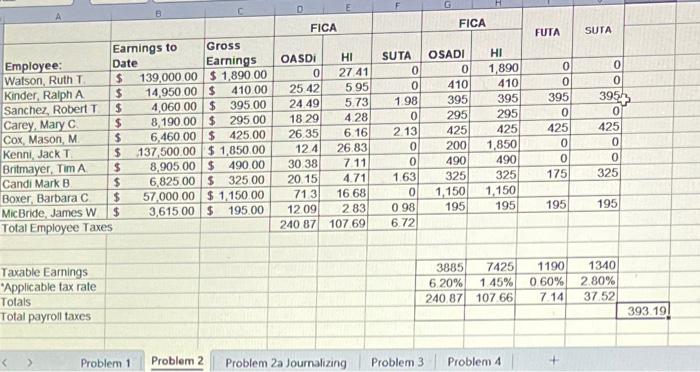

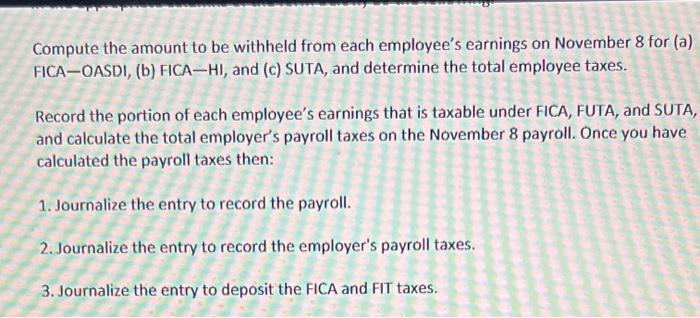

\begin{tabular}{l|l|l|l} Problem 1 & Problem 2 Problem 2a Journalizing & Problem 3 & Problem 4 \end{tabular} Compute the amount to be withheld from each employee's earnings on November 8 for (a) FICA-OASDI, (b) FICA-HI, and (c) SUTA, and determine the total employee taxes. Record the portion of each employee's earnings that is taxable under FICA, FUTA, and SUTA, and calculate the total employer's payroll taxes on the November 8 payroll. Once you have calculated the payroll taxes then: 1. Journalize the entry to record the payroll. 2. Journalize the entry to record the employer's payroll taxes. 3. Journalize the entry to deposit the FICA and FIT taxes. \begin{tabular}{l|l|l|l} Problem 1 & Problem 2 Problem 2a Journalizing & Problem 3 & Problem 4 \end{tabular} Compute the amount to be withheld from each employee's earnings on November 8 for (a) FICA-OASDI, (b) FICA-HI, and (c) SUTA, and determine the total employee taxes. Record the portion of each employee's earnings that is taxable under FICA, FUTA, and SUTA, and calculate the total employer's payroll taxes on the November 8 payroll. Once you have calculated the payroll taxes then: 1. Journalize the entry to record the payroll. 2. Journalize the entry to record the employer's payroll taxes. 3. Journalize the entry to deposit the FICA and FIT taxes

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts