Question: Not sure if my answer is correct. Fred, a self-employed taxpayer, travels from Denver to Miami primarily on business. He spends five days conducting business

Not sure if my answer is correct.

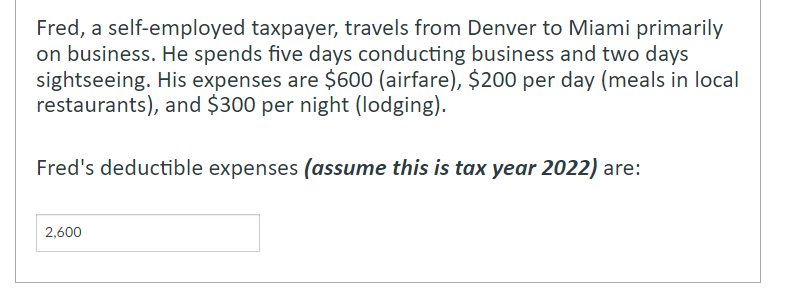

Fred, a self-employed taxpayer, travels from Denver to Miami primarily on business. He spends five days conducting business and two days sightseeing. His expenses are $600 (airfare), \$200 per day (meals in local restaurants), and $300 per night (lodging). Fred's deductible expenses (assume this is tax year 2022) are

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock