Question: not sure what im doing wrong. help A trust officer at the Blacksburg National Bank needs to determine how to invest $150,000 in the following

not sure what im doing wrong. help

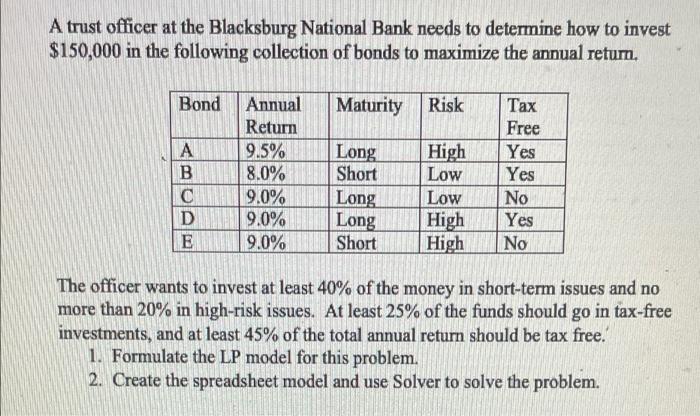

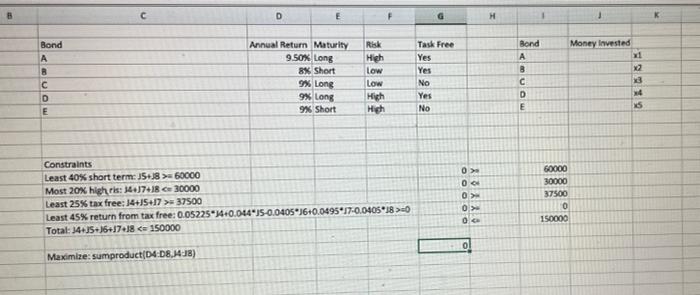

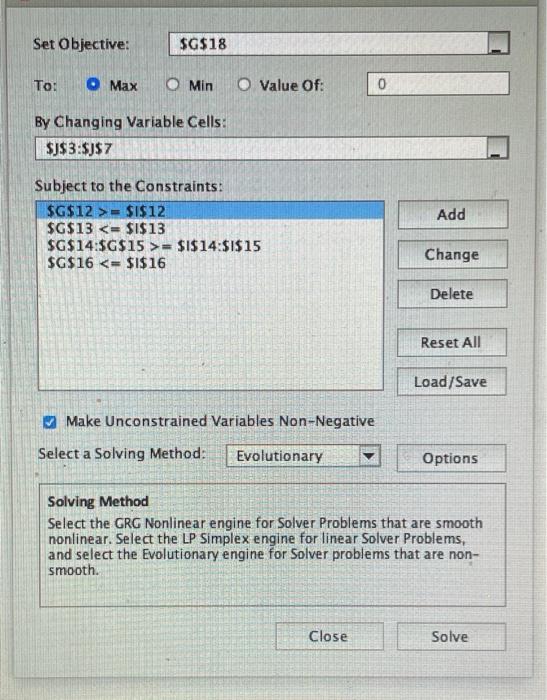

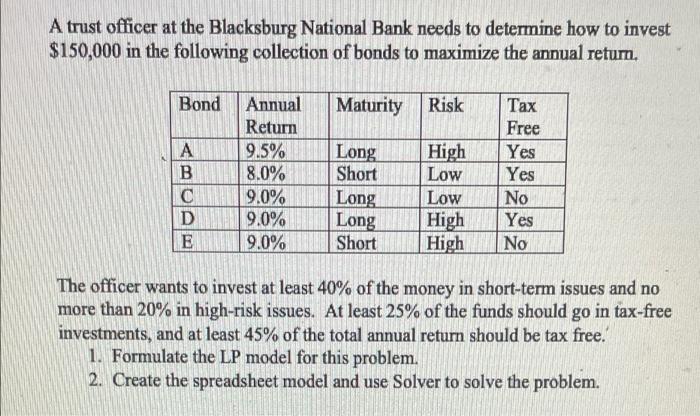

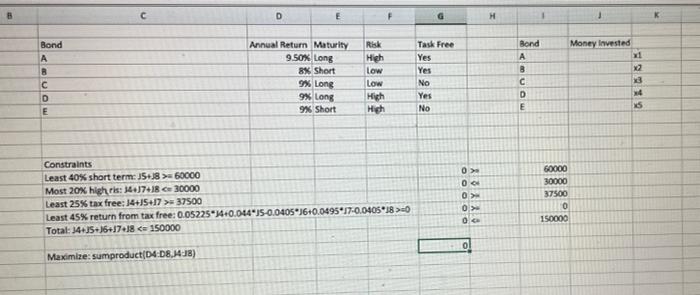

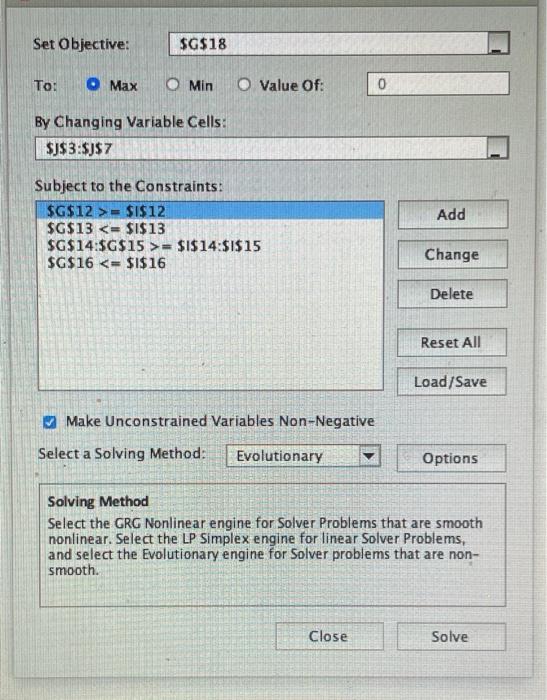

A trust officer at the Blacksburg National Bank needs to determine how to invest $150,000 in the following collection of bonds to maximize the annual return. Bond Maturity Risk A B C D E Annual Return 9.5% 8.0% 9.0% 9.0% 9.0% Long Short Long Long Short High Low Low High High Tax Free Yes Yes No Yes No The officer wants to invest at least 40% of the money in short-term issues and no more than 20% in high-risk issues. At least 25% of the funds should go in tax-free investments, and at least 45% of the total annual return should be tax free. 1. Formulate the LP model for this problem. 2. Create the spreadsheet model and use Solver to solve the problem. D H 1 1 Money Invested Bond A B D E Annual Return Maturity 9.50% Long 8% Short 9% Long 9% Long 9% Short Risk High Low Low High High Task Free Yes Yes No Bond A 8 D E X2 3 4 5 Yes No 0 0 0 Constraints Least 40% short term: J5+18 > 60000 Most 20% high ris: 347418 C 30000 Least 25% tax free: 14+15+17 > 37500 Least 45% return from tax free: 0.05225*140.044"JS-0.0405*36+0.049517-0.040518> Total: 34435+6+718 0 60000 30000 37500 0 150000 0 Maximize: sumproduct(04:08,44:38) Set Objective: $G$18 To: O Max O Min O Value Of: By Changing Variable Cells: $JS3:$J$ 7 Add Subject to the Constraints: $G$12 >= $1$12 $G$13 = $I$14:$I$15 $G$16

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock