Question: not sure what the answer is... Multiple Choice and short answer Please select the correct answer for the multiple choice questions. Type in your answer

not sure what the answer is...

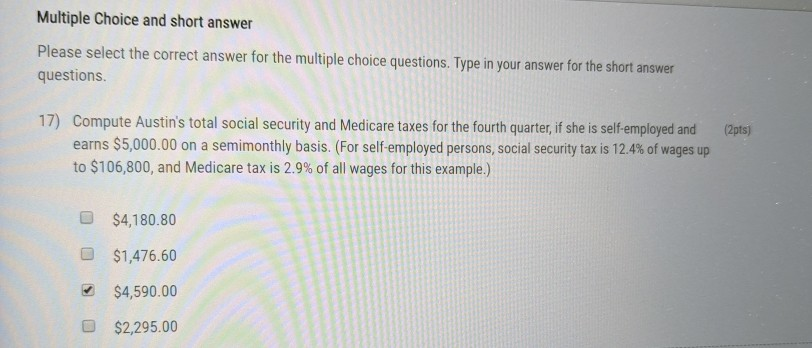

Multiple Choice and short answer Please select the correct answer for the multiple choice questions. Type in your answer for the short answer questions (2pts) 17) Compute Austin's total social security and Medicare taxes for the fourth quarter, if she is self-employed and earns $5,000.00 on a semimonthly basis. (For self-employed persons, social security tax is 12.4% of wages up to $106,800, and Medicare tax is 2.9% of all wages for this example.) $4,180.80 $1,476.60 $4,590.00 $2,295.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts