Question: not sure what the answer is... Multiple Choice and short answer Please select the correct answer for the multiple choice questions. Type in your answer

not sure what the answer is...

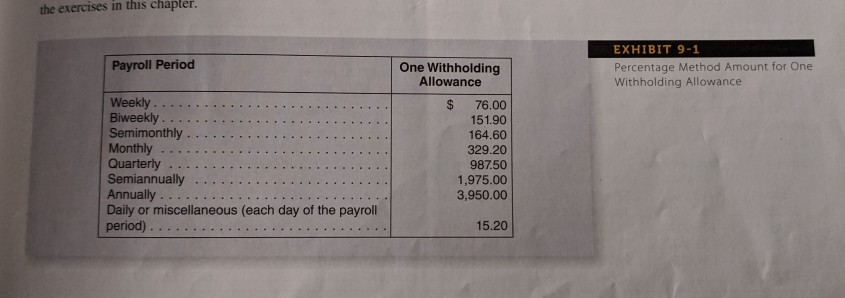

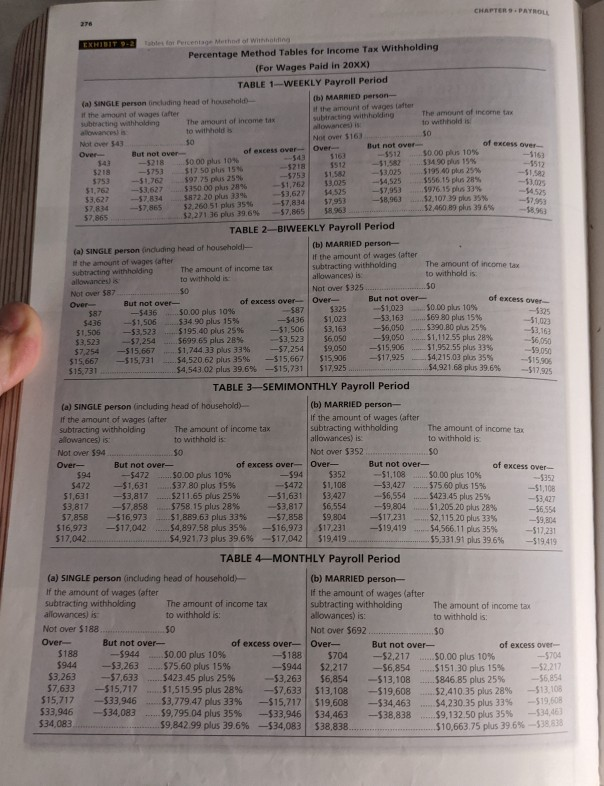

Multiple Choice and short answer Please select the correct answer for the multiple choice questions. Type in your answer for the short answer questions 2) Find the amount of income tax withheld from Sun Jung's monthly paycheck of $8,612.50 using the percentage (2pts) method tables in Exhibits 9-1 and 9-2 from your text. Sun Jung is single and claims 2 withholding allowances. $1,754.27 $1,156.36 $1,619.33 $1,279.24 Next the exercises in this chapter. Payroll Period EXHIBIT 9-1 Percentage Method Amount for One Withholding Allowance Weekly ........ Biweekly ....... Semimonthly ........ Monthly ............. Quarterly ........... Semiannually .................. Annually ....... Daily or miscellaneous (each day of the payroll period) ........ One Withholding Allowance $ 76.00 151.90 164.60 329.20 987.50 1,975.00 3,950.00 15.20 of excess over Over -5512 -- $ 3s 94525 of excess over -5325 EXHIBIT 9-2 table for rent Methof Withing Percentage Method Tables for Income Tax Withholding (For Wages Paid in 20XX) TABLE 1-WEEKLY Payroll Period (a) SINGLE person including head of household (b) MARRIED person If the amount of wages after the amount of wagestatter subtracting withholding The amount of income tax Subtracting withholding The amount of income tax to withhold is alowance is to withholds Not over $161 Not Over 543 50 But not over Over of excess over But not over 50.00 plus 10% -1153 543 -5218 5000 plus 10% 3512 54 90 Dus 15% $17.50 plus 15 -151 -5753 $1025 $195 40 plus 25% -51.52 5753 597,75 pks 25% 33015 $4,525 $556.15 plus 28% $1,762 -53.627 5350 00 plus 28% 53,627 14,525 -$7,953 $976.15 plus 33% 53,627 5.872 20 plus 339 -57.834 $7,834 57953 58.963 52, 107 39 plus 35% 52.260 51 plus 3596 57,865 58.963 52.460 89 plus 39.6% 52.271 36 plus 39.6% 57.865 TABLE 2-BIWEEKLY Payroll Period (b) MARRIED person- (a) SINGLE person induding head of household the amount of wages after If the amount of wages (after The amount of income tax subtracting withholding The amount of income tax to withhold is allowance is allowances) is to withhold is Not over $87 Not over $325........... But not over Over- of excess over But not over- Over- -5436 $0.00 plus 10% 587 $325 $1,023 $0.00 plus 10% -$1,506 $34.90 plus 15% -$436 5436 -53.163 $1,023 ..... 569 80 plus 15% -51,023 51.506 -53523 $195.40 plus 25% 51.506 53.163 -56,050 $390,00 plus 25% -53.167 $3.523 -57,254 ......5699 65 plus 28% $3.523 56050 -59,050 ....... $1,112.55 plus 28% --56050 $7.254 -$15.667 $1,744.33 plus 33% -$7,254 $9.050 -$15.906 ....... 51,952.55 plus 33% 59.050 515.667 --$15.731 ....54.520.62 plus 35% -$15,667 $15,906 __$17.925 $4,215.03 plus 35% ---$15.305 $15.731 $4,543 02 plus 39.6% $15,731 $17.925 54 921.68 plus 39.6% --$17.95 TABLE 3-SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- if the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is to withhold is allowances) is to withhold is Not over $94..................... Not over 5352 Over- But not over- of excess over Over- But not over- of excess over -$472 ..... $0.00 plus 10% -594 $352 - $1,108 50,00 plus 10% --$352 5472 - $1,631 $472 $1,108 -$3,427 ....... 575 60 plus 15% $1,631 -$1,108 -53,817 .....$211.65 plus 25% -$1,631 53.427 -56,554 ....$423.45 plus 25% -- $3.427 53.817 -57.858 $758.15 plus 28% $3,817 $6.554 -59,804 ......$1,205,20 plus 28% -56554 $7,856 $16.973 ... $1.889.63 plus 33% -$7,850 $9,804 -$17.231 .52.115.20 plus 33% $9,804 $16,973 -$17,042 ......$4,897.58 plus 35% -$16.973 $17,231 -$19,419 ....... $4,566.11 plus 35% -$17.231 $17,042............................... $4,921.73 plus 39,696 -517.042 519 419 ...........55,331.91 plus 39.6% --$19.419 TABLE 4 MONTHLY Payroll Period (a) SINGLE person (including head of household) (b) MARRIED person- If the amount of wages (after If the amount of wages (after subtracting withholding The amount of income tax subtracting withholding The amount of income tax allowances) is to withhold is: allowances) is: to withhold is: Not over $188... 50 Not over $692 Over But not over- of excess over- Over But not over- of excess over- $188 -5944 ......50.00 plus 10% 5188 $704 --$2,217 ..... 50.00 plus 10% -$3,263 -...$75.60 plus 15% -$944 $2,217 -$6,854 $151.30 plus 15% ---$2,217 --$7633 ......$423.45 plus 25% -$3,263 $6,854 -$13,108 .....5846.85 plus 25% --56,854 57,633 -515,717 5 1,515.95 plus 28% --$7,633 $13,108 ---$19,608 ... 52.410.35 plus 28% -513.105 $15.717 -$33,946 ...$3.779.47 plus 33% -$15.717 15,717 519,608 519,608 -$34 463 $4.230.35 plus 33% $19,608 $33,946 534,083 ... $9.795.04 plus 35% -$33,946 $34,463 --$38,838 $9,132.50 plus 35% -534.463 $34.083 ..... ........59,842.99 plus 39.6% -$34,083 538,838 $10,663.75 plus 39.6% -538838 594

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts