Question: not using excel calculation plss Owing to many complaints did by students and staff about the lack of parking spaces on campus, a parking garage

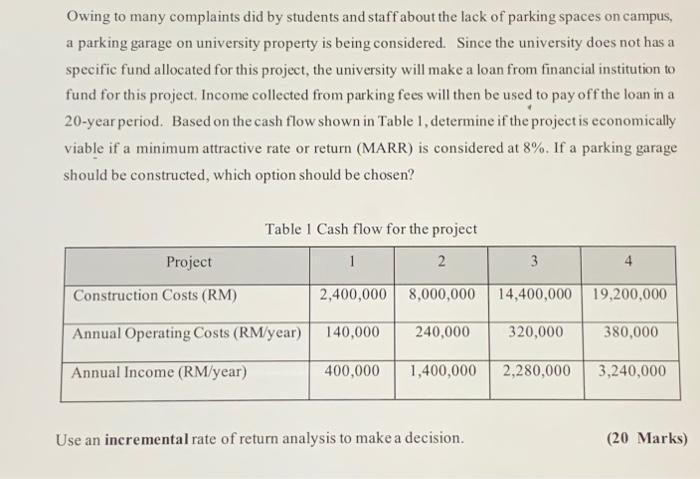

Owing to many complaints did by students and staff about the lack of parking spaces on campus, a parking garage on university property is being considered. Since the university does not has a specific fund allocated for this project, the university will make a loan from financial institution to fund for this project. Income collected from parking fees will then be used to pay off the loan in a 20-year period. Based on the cash flow shown in Table 1, determine if the project is economically viable if a minimum attractive rate or return (MARR) is considered at 8%. If a parking garage should be constructed, which option should be chosen? Table 1 Cash flow for the project Use an incremental rate of return analysis to make a decision. (20 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts