Question: Note about Chapter 6 problems and content: For each homework problem in Chapter 6, you will need to use the tables either in the textbook

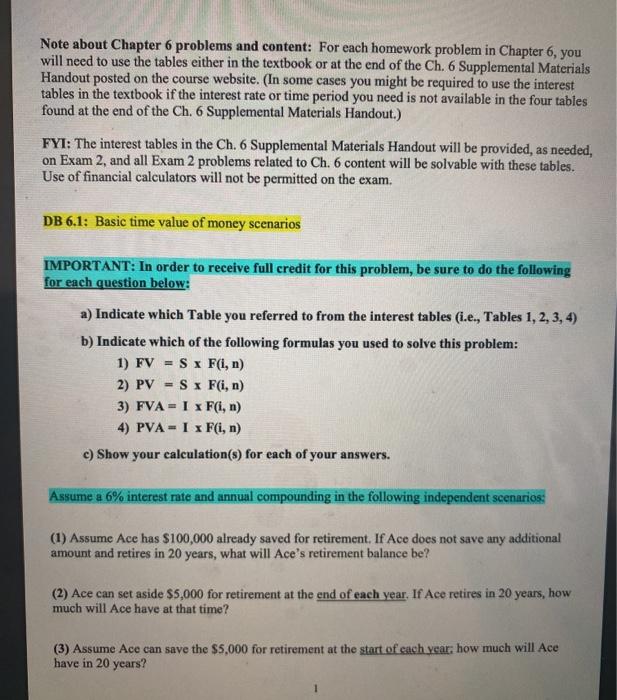

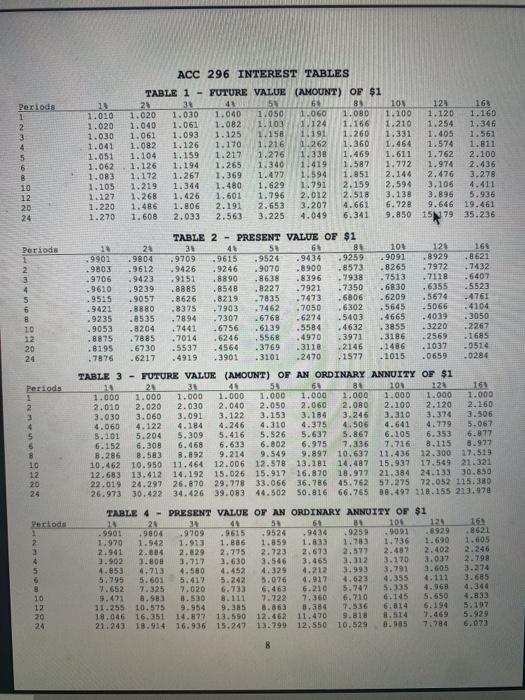

Note about Chapter 6 problems and content: For each homework problem in Chapter 6, you will need to use the tables either in the textbook or at the end of the Ch. 6 Supplemental Materials Handout posted on the course website. (In some cases you might be required to use the interest tables in the textbook if the interest rate or time period you need is not available in the four tables found at the end of the Ch. 6 Supplemental Materials Handout.) FYI: The interest tables in the Ch. 6 Supplemental Materials Handout will be provided, as needed, on Exam 2, and all Exam 2 problems related to Ch. 6 content will be solvable with these tables. Use of financial calculators will not be permitted on the exam. DB 6.1: Basic time value of money scenarios IMPORTANT: In order to receive full credit for this problem, be sure to do the following for each question below: a) Indicate which Table you referred to from the interest tables (i.e., Tables 1, 2, 3, 4) b) Indicate which of the following formulas you used to solve this problem: 1) FV = S F(1, n) 2) PV S F(i, n) 3) FVA = I x F(i, n) 4) PVA = I x F(i, n) c) Show your calculation(s) for each of your answers. Assume a 6% interest rate and annual compounding in the following independent scenarios: (1) Assume Ace has $100,000 already saved for retirement. If Ace does not save any additional amount and retires in 20 years, what will Ace's retirement balance be? (2) Ace can set aside $5,000 for retirement at the end of each year. If Ace retires in 20 years, how much will Ace have at that time? (3) Assume Ace can save the $5,000 for retirement at the start of each year: how much will Ace have in 20 years? Periods 1 2 3 4 5 6 1.010 1.020 1.030 1.041 1.051 1.062 1.083 1.105 1.122 1.220 1.270 ACC 296 INTEREST TABLES TABLE 1 - FUTURE VALUE (AMOUNT) OF $1 28 34 45 84 108 121 16 1.020 1.030 1.040 1.050 1.060 1.080 1.100 1.120 1.160 1.040 1.061 1.082 1.103 1.124 1.166 1.210 1.254 1.346 1.061 1.093 1.125 1.158 1.191 1.260 1.331 1.405 1.561 1.082 1.126 1.170 1.216 1.262 1.360 1.464 1.574 1.811 1.104 1.159 1.217 1.276 1.338 1.469 1.611 1.762 2.100 1.126 1.194 1.265 1.340 1.419 1.587 1.792 1.974 2.436 1.172 1.267 1.369 1.477 1.594 1.851 2.144 2.476 3.278 1.219 1.344 1.480 1.629 1.791 2.159 2.594 3.105 4.411 1.268 1.426 1.601 1.796 2.012 2.518 3.138 3.896 5.936 1.486 1.806 2.191 2.653 3.207 4.661 6.728 9.646 19.461 1.608 2.033 2.563 3.225 4.049 6.341 9.850 151 79 35.236 10 12 20 24 Periods 1 2 3 4 5 6 8 10 12 20 24 Periods 2 4 5 6 8 10 12 20 24 TABLE 2 - PRESENT VALUE OF $1 23 38 45 58 65 81 201 128 169 9901 -9804 .9709 .9615 9524 .9434 .9259 9091 .8929 .8621 9803 9612 9426 . 9246 9070 .8900 .8573 .8265 .7972 .7432 9706 . 9423 . 9151 .8890 .8638 .8396 .7938 -7513 .7118 :6407 . 9610 9239 .8885 .6548 .8227 7921 -7350 6830 .6355 25523 .9515 -9057 .8626 .8219 7835 7473 .6806 6209 .5674 -4761 .9421 .8880 .8375 7903 27462 -7050 .6302 .5645 -5066 4104 .9235 .8535 .7894 7307 .6768 .6274 .5403 4665 4039 .3050 .9053 .8204 7441 6756 .6139 .5584 .4632 3855 . 3220 -2267 .8875 7885 .7014 .6246 .5568 .4970 -3971 3186 -2569 1685 .8195 6730 -5537 .4564 .3769 .3110 .2146 1486 .1037 0514 .7876 6217 . 4919 3901 .3101 .2470 - 1577 1015 -0659 0284 TABLE 3 - FUTURE VALUE (AMOUNT) OF AN ORDINARY ANNUITY OF $1 31 55 84 120 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.080 2.100 2.120 2.160 3.030 3.060 3.091 3.122 3.153 3.184 3.246 3.310 3.374 3.506 4.060 4.122 4.184 4.246 4.310 4.375 4.506 4.641 4.779 5.067 5.101 5.204 5.309 5.416 5.526 5.637 5.867 6.105 6.353 6.877 6.152 6.308 6.468 6.633 6.802 6.975 7.336 7.716 8.115 5.977 8.286 8.583 8.892 9.214 9.549 9.897 10.637 11.436 12.300 17.519 10.462 10.950 11.464 12.006 12.579 13.181 14.487 15.93 17.549 212321 12.683 13.412 14.192 15.026 15.917 16.870 18.977 21.384 24.133 30.850 22.019 24.297 26.870 29.778 33.066 36.786 45.762 51.275 72.052 115.380 26.973 30.422 34.426 39.083 44.502 50.816 66.765 88.497 118.155 213.97 TABLE 4 - PRESENT VALUE OF AN ORDINARY ANNUITY OF $1 2 25 34 41 51 64 100 125 .9901 165 9604 9709 . 9615 .9524 -9434 9259 9021 8929 8621 1.970 1.942 1.913 1.886 1.859 1.833 10783 1.690 1.605 2.941 2.885 2.829 2.775 2.723 2.673 2.487 2.402 2.246 3.902 1.808 3.717 3.630 3.546 3.465 2,312 3.032 3.170 2.798 4.853 4.713 4.580 4.452 4.329 4.212 3.993 3.791 3.605 3.274 5.795 5.601 5.412 5.242 5.076 4.917 1.623 4.355 4.111 3.685 7.652 7.325 7.020 6.733 6.463 6.210 5.742 5.335 4.344 19.491 8.983 8.530 8.111 7.722 7.360 6.710 6.145 5.650 11.255 10.575 9.954 8.863 6.384 7.536 6.814 6.194 5.197 18.046 16.351 14.877 13.590 12.462 11.470 9.818 8.514 7.469 5.929 21.243 18.914 16.936 15.247 13.799 12.550 10.529 0.985 7.784 6.073 Periodo 1 2 4 5 8 10 12 24 8

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts