Question: Note all answers should be in text format with workings & formulas ** No excel in text. Question 1 (a) You would like to buy

Note all answers should be in text format with workings & formulas ** No excel in text.

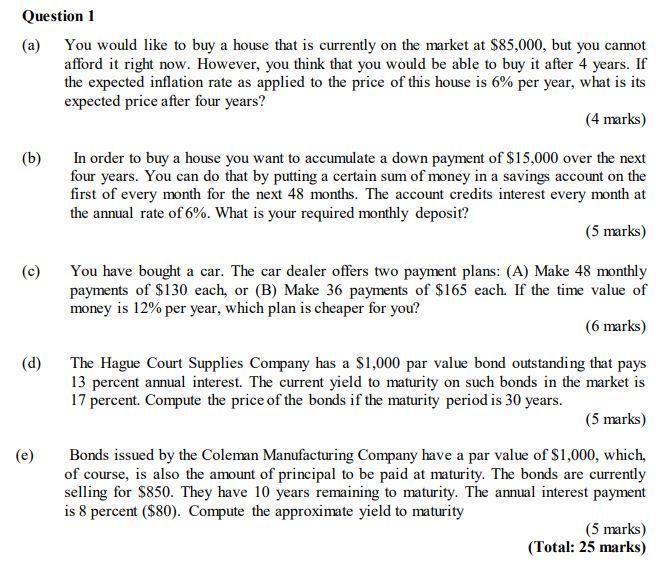

Question 1 (a) You would like to buy a house that is currently on the market at $85,000, but you cannot afford it right now. However, you think that you would be able to buy it after 4 years. If the expected inflation rate as applied to the price of this house is 6% per year, what is its expected price after four years? (4 marks) (b) In order to buy a house you want to accumulate a down payment of $15,000 over the next four years. You can do that by putting a certain sum of money in a savings account on the first of every month for the next 48 months. The account credits interest every month at the annual rate of 6%. What is your required monthly deposit? (5 marks) (c) (d) You have bought a car. The car dealer offers two payment plans: (A) Make 48 monthly payments of $130 each, or (B) Make 36 payments of $165 each. If the time value of money is 12% per year, which plan is cheaper for you? (6 marks) The Hague Court Supplies Company has a $1,000 par value bond outstanding that pays 13 percent annual interest. The current yield to maturity on such bonds in the market is 17 percent. Compute the price of the bonds if the maturity period is 30 years. (5 marks) Bonds issued by the Coleman Manufacturing Company have a par value of $1,000, which, of course, is also the amount of principal to be paid at maturity. The bonds are currently selling for $850. They have 10 years remaining to maturity. The annual interest payment is 8 percent ($80). Compute the approximate yield to maturity (5 marks) (Total: 25 marks) (e)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts