Question: Note all answers should be in text format with workings & formulas ** No excel in text. Question 3 (a) Jato Trading is considering these

Note all answers should be in text format with workings & formulas ** No excel in text.

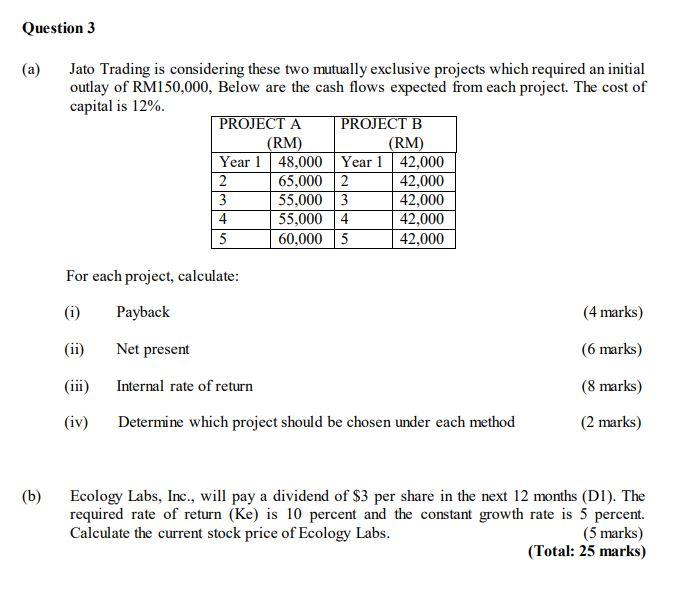

Question 3 (a) Jato Trading is considering these two mutually exclusive projects which required an initial outlay of RM150,000, Below are the cash flows expected from each project. The cost of capital is 12%. PROJECT A PROJECT B (RM) (RM) Year 1 48,000 Year 1 42,000 2 65,000 2 42,000 3 55,000 3 42,000 4 55,000 4 42,000 5 60,000 5 42,000 For each project, calculate: (i) Payback (4 marks) (ii) (6 marks) (ii) Net present Internal rate of return Determine which project should be chosen under each method (8 marks) (iv) (2 marks) (b) Ecology Labs, Inc., will pay a dividend of $3 per share in the next 12 months (D1). The required rate of return (Ke) is 10 percent and the constant growth rate is 5 percent. Calculate the current stock price of Ecology Labs. (5 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts