Question: NOTE: do not include GST (5%) or PST (6%) in any transaction other than the inventory purchase/sales entries, where applicable. November 15, 2016: Ajax Corp.,

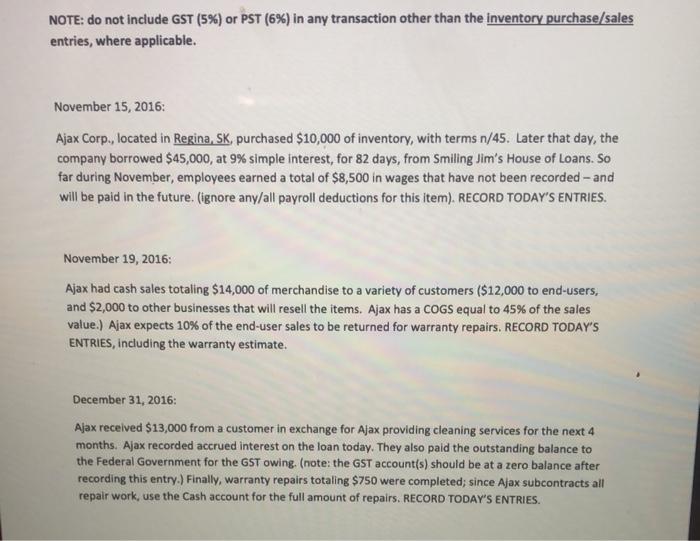

NOTE: do not include GST (5%) or PST (6%) in any transaction other than the inventory purchase/sales entries, where applicable. November 15, 2016: Ajax Corp., located in Regina, SK, purchased $10,000 of inventory, with terms n/45. Later that day, the company borrowed $45,000, at 9% simple interest, for 82 days, from Smiling Jim's House of Loans. So far during November, employees earned a total of $8,500 in wages that have not been recorded - and will be paid in the future. (ignore any/all payroll deductions for this item). RECORD TODAY'S ENTRIES. November 19, 2016: Ajax had cash sales totaling $14,000 of merchandise to a variety of customers ($12,000 to end-users, and $2,000 to other businesses that will resell the items. Ajax has a COGS equal to 45% of the sales value.) Ajax expects 10% of the end-user sales to be returned for warranty repairs. RECORD TODAY'S ENTRIES, including the warranty estimate. December 31, 2016: Ajax received $13,000 from a customer in exchange for Ajax providing cleaning services for the next 4 months. Ajax recorded accrued interest on the loan today. They also paid the outstanding balance to the Federal Government for the GST owing. (note: the GST account(s) should be at a zero balance after recording this entry.) Finally, warranty repairs totaling $750 were completed; since Ajax subcontracts all repair work, use the Cash account for the full amount of repairs. RECORD TODAY'S ENTRIES

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts