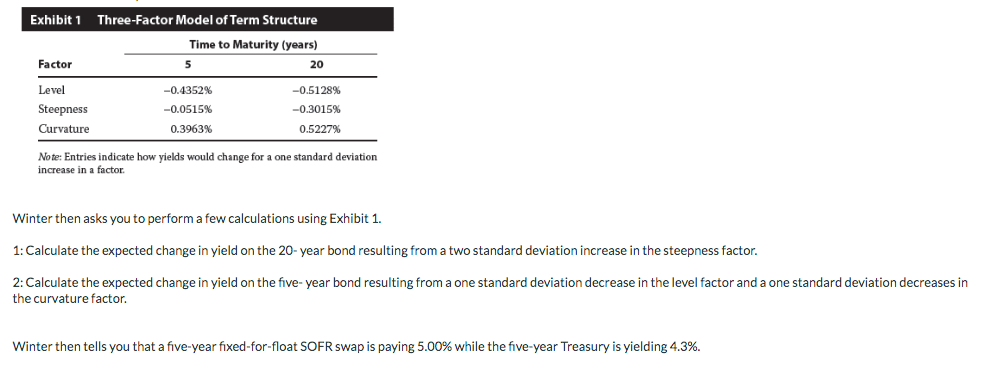

Question: Note: Entries indicate how yields would change for a one standard deviation increase in a factor. Winter then asks you to perform a few calculations

Note: Entries indicate how yields would change for a one standard deviation increase in a factor. Winter then asks you to perform a few calculations using Exhibit 1. 1: Calculate the expected change in yield on the 20 - year bond resulting from a two standard deviation increase in the steepness factor. 2: Calculate the expected change in yield on the five- year bond resulting from a one standard deviation decrease in the level factor and a one standard deviation the curvature factor. Winter then tells you that a five-year fixed-for-float SOFR swap is paying 5.00% while the five-year Treasury is yielding 4.3%. Note: Entries indicate how yields would change for a one standard deviation increase in a factor. Winter then asks you to perform a few calculations using Exhibit 1. 1: Calculate the expected change in yield on the 20 - year bond resulting from a two standard deviation increase in the steepness factor. 2: Calculate the expected change in yield on the five- year bond resulting from a one standard deviation decrease in the level factor and a one standard deviation the curvature factor. Winter then tells you that a five-year fixed-for-float SOFR swap is paying 5.00% while the five-year Treasury is yielding 4.3%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts