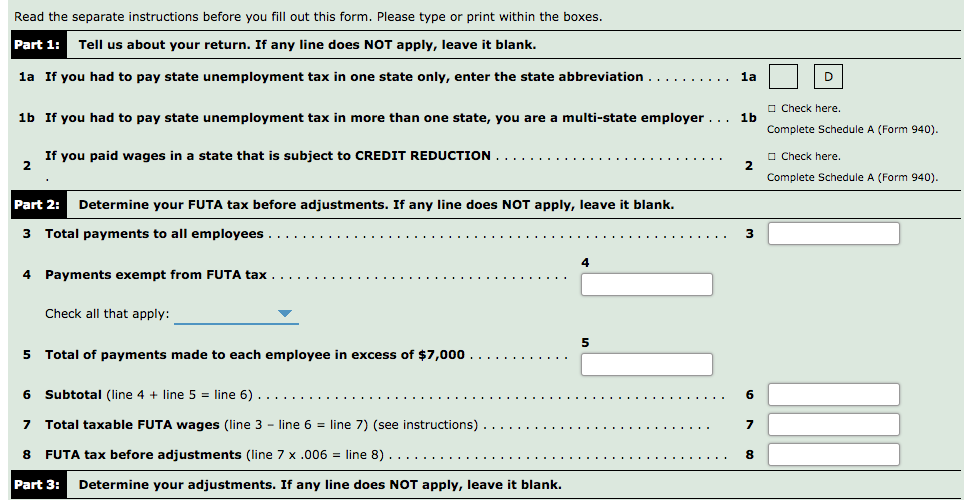

Question: Note: For this textbook edition the rate 0.6% was used for the FUTA tax rate for employers. The information listed below refers to the employees

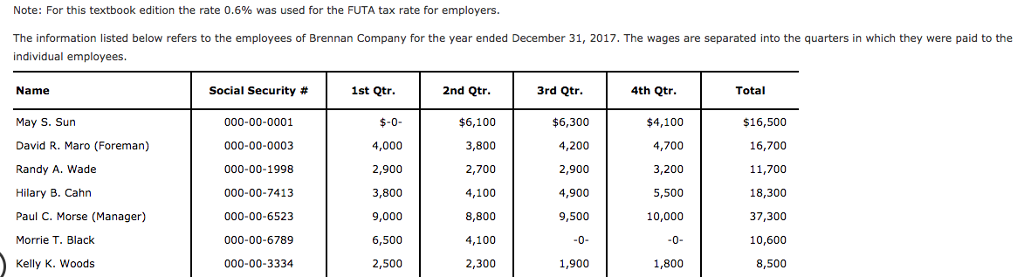

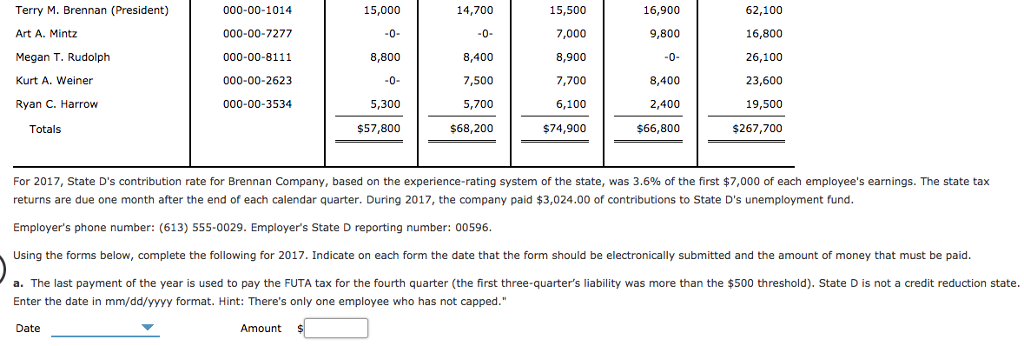

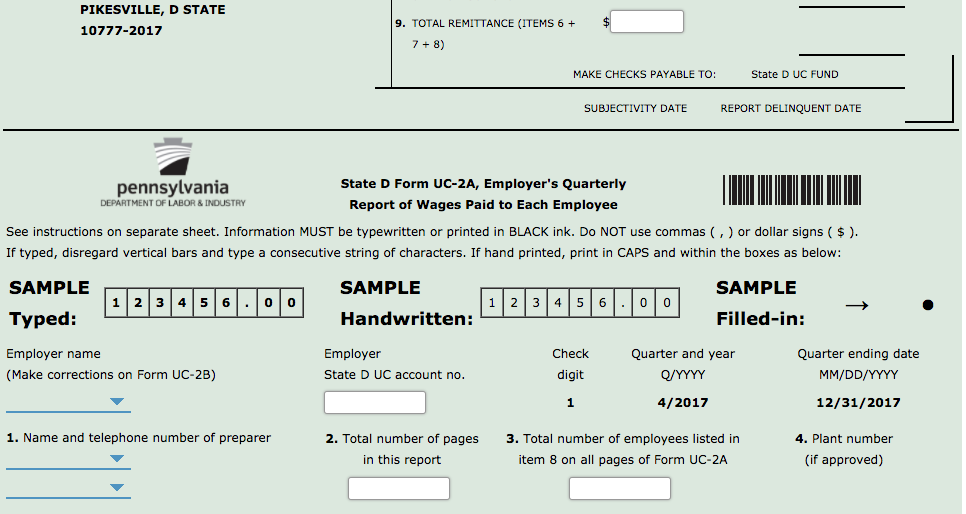

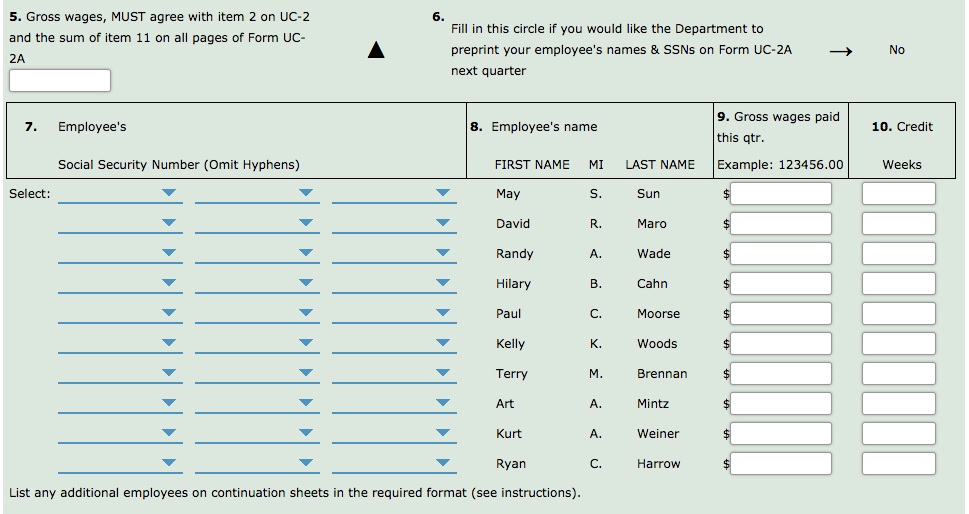

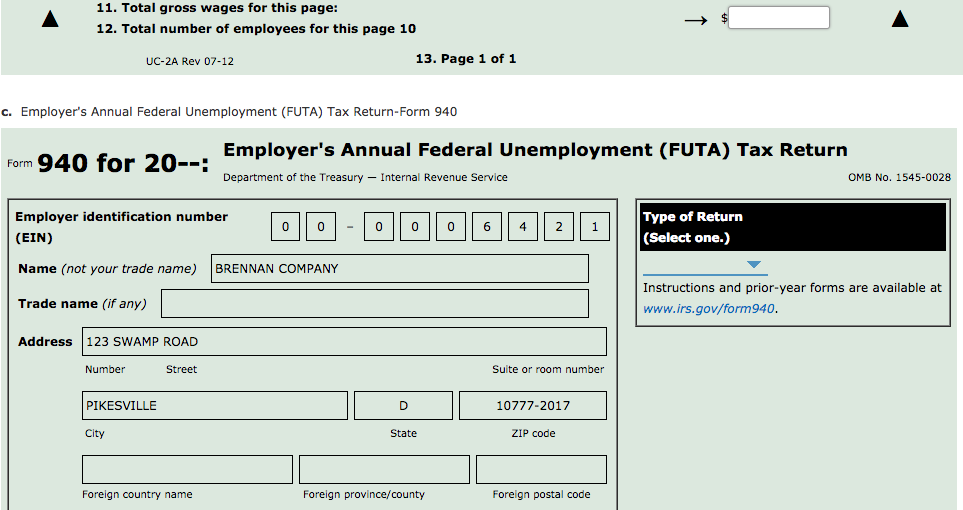

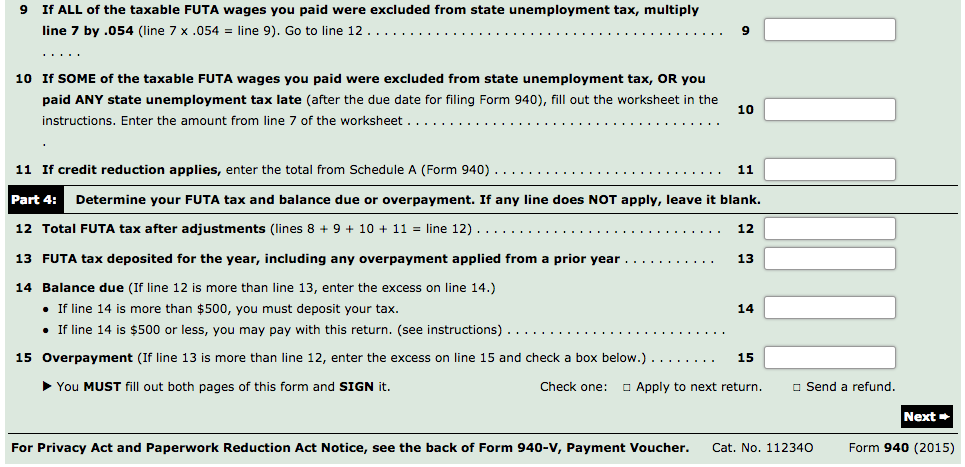

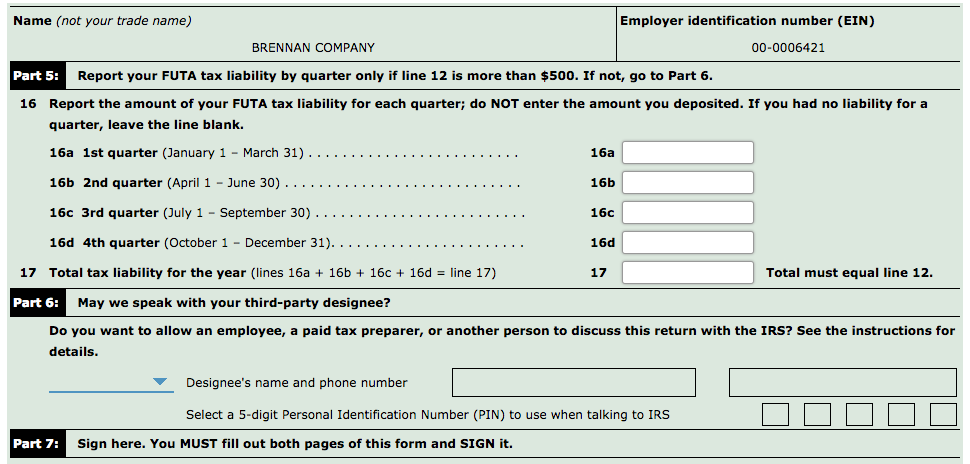

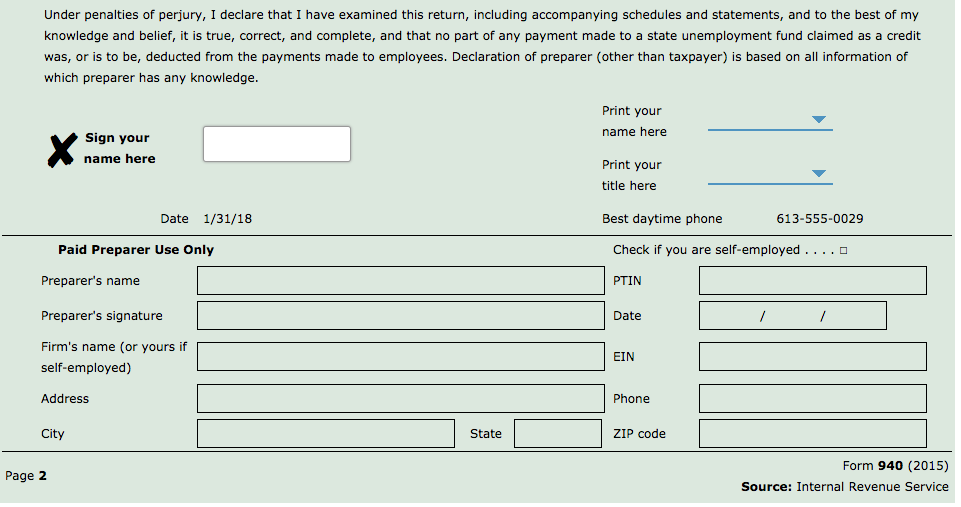

Note: For this textbook edition the rate 0.6% was used for the FUTA tax rate for employers. The information listed below refers to the employees of Brennan Company for the year ended December 31, 2017. The wages are separated into the quarters in which they were paid to the individual employees Name 4th Qtr Total Social Security # 000-00-0001 000-00-0003 000-00-1998 000-00-7413 000-00-6523 000-00-6789 000-00-3334 1st Qtr 2nd Qtr 3rd Qtr May S. Sun David R. Maro (Foreman) Randy A. Wade Hilary B. Cahn Paul C. Morse (Manager) Morrie T. Black Kelly K. Woods 4,000 2,900 3,800 9,000 6,500 2,500 $6,100 3,800 2,700 4,100 8,800 4,100 2,300 $6,300 4,200 2,900 4,900 9,500 $4,100 4,700 3,200 5,500 10,000 $16,500 16,700 11,700 18,300 37,300 10,600 8,500 1,900 1,800 Note: For this textbook edition the rate 0.6% was used for the FUTA tax rate for employers. The information listed below refers to the employees of Brennan Company for the year ended December 31, 2017. The wages are separated into the quarters in which they were paid to the individual employees Name 4th Qtr Total Social Security # 000-00-0001 000-00-0003 000-00-1998 000-00-7413 000-00-6523 000-00-6789 000-00-3334 1st Qtr 2nd Qtr 3rd Qtr May S. Sun David R. Maro (Foreman) Randy A. Wade Hilary B. Cahn Paul C. Morse (Manager) Morrie T. Black Kelly K. Woods 4,000 2,900 3,800 9,000 6,500 2,500 $6,100 3,800 2,700 4,100 8,800 4,100 2,300 $6,300 4,200 2,900 4,900 9,500 $4,100 4,700 3,200 5,500 10,000 $16,500 16,700 11,700 18,300 37,300 10,600 8,500 1,900 1,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts