Question: Note: I have answer for this question in excel but now I need a detailed Solution in Ms word format. please solve this like how

Note: I have answer for this question in excel but now I need a detailed Solution in Ms word format. please solve this like how a numerical problem is to be solved on paper but here this to be in Ms word

Answer in excel

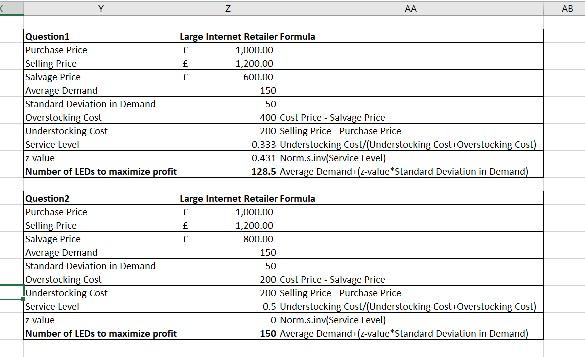

Assignment - Solution - key notes ( solution explanation ) Question No 1- large internet retailer A large internet retailer is about to place an order for LEDS . Each LED is purchased for 1000 and can be sold at a 20 % markup (1200). however, due to the short shelf life of electronics goods. If any of the LED are unsold atthe end of season ,they must be sold off for 600 at a loss of 400. The demand for this product this season is estimated at 150 units with a standard deviation of 50 LEDS. Q 1: how many LEDs should the retailer order in order to maximize expected profit? Q 2: Suppose the supplier decides to offer a buy back contract so that any unsold LEDs are returned to the supplier who refunds the retailer 800 per LEDs. How many more LEDs would the retailer order under the buy back contract relative to the original ? Z AA AB Question1 Large Internet Retailer Formula Purchase Price 1,11011.10 Selling Pric f 1,200.00 Salvage Price hONIC Averare Demand 150 Standard Deviation in Demand 50 Overlocking Cost 100 Cusl Price - Salvage Price Understorking cost 2110 Selling Price Purchase Price Service Level 0.333 Underslucking Cusl/(Understocking Cost: Overslucking Cust) 7 Value 0.431 Norm.s.inylservice level Number of LEDs to maximize profit 128.5 Average Demand (L-valuc*Slandard Devialiun in Demand) Question2 Large Internet Retailer Formula Purchase price 1,1101110 Selling Price f 1,200.00 Salvaga Price HOLLO Averare Demand 150 Standard deviation in Iemand 50 Overslocking Cost 200 Cusl Price - Salvage Price lunderstocking Cost 2110 Selling Price Purchase Price Service Level 0.5 Uriders luckin: CusL/(Understocking Cost Overslucking Cust) 7 value O Norm...inservice level) Number of LEDs to maximize profit 150 Average Demand (e-valueSlaricard Devialiun in Demand)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts