Question: Note: i have the solution for this exercise in my class already. But i still got stuck for every excersise relate for carryback and carryforward

Note: i have the solution for this exercise in my class already. But i still got stuck for every excersise relate for carryback and carryforward of NOL. I do not know when i should carry back or carry forward of NOL or which tax rate when carryback or carryforward. Can anybody show me the ways to do right for this exercise( For example, T account or table ) ? I have solution already, i just want to understand

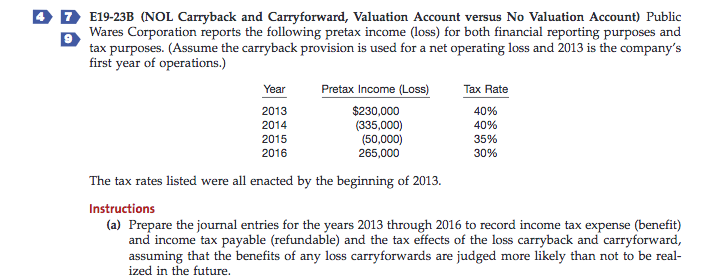

E19-23B (NOL Carryback and Carry forward, Valuation Account versus No Valuation Account) Public Wares Corporation reports the following pretax income (oss) for both financial reporting purposes and purposes. (Assume the carryback provision is used for a net operating loss and 2013 is the company's first year of operations.) Year Pretax Income (Loss) Tax Rate 40% $230,000 2013 2014 40% (335,000) (50,000) 35% 2015 265,000 30% 2016 The tax rates listed were all enacted by the beginning of 2013 Instructions (a) Prepare the journal entries for the years 2013 through 2016 to record income tax expense (benefit) and income tax payable (refundable) and the tax effects of the loss carryback and carryforward, assuming that the benefits of any loss carryforwards are judged more likely than not to be real- ized in the future

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts