Question: Note :- I need full detailed answer for all the questions not just hints. 2. Calculate the WACC for Murphy Stores and compare it with

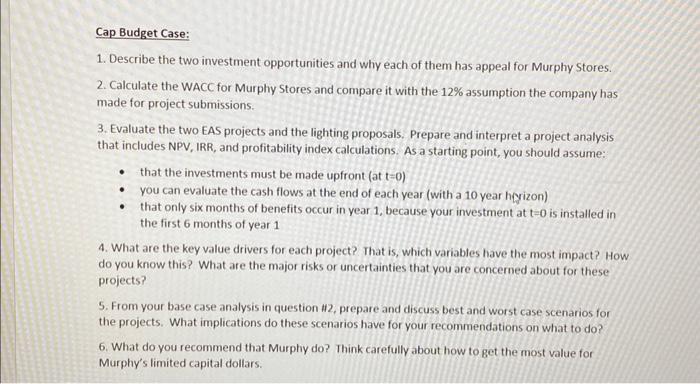

2. Calculate the WACC for Murphy Stores and compare it with the 12% assumption the company has made for project submissions. 3. Evaluate the two EAS projects and the lighting proposals. Prepare and interpret a project analysis that includes NPV, IRR, and profitability index calculations. As a starting point, you should assume: - that the investments must be made upfront (at t=0 ) - you can evaluate the cash flows at the end of each year (with a 10 year hyizon) - that only six months of benefits occur in year 1 , because your investment at t=0 is installed in the first 6 months of year 1 4. What are the key value drivers for each project? That is, which variables have the most impact? How do you know this? What are the major risks or uncertainties that you are concerned about for these projects? 5. From your base case analysis in question 12 , prepare and discuss best and worst case scenarios for the projects. What implications do these scenarios have for your recommendations on what to do? 6. What do you recommend that Murphy do? Think carefully about how to get the most value for Murphy's limited capital dollars

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts