Question: Note* if you need any information kindly google income statement or cash flow statement to get the numbers because I'm unable to upload the pdf

Note* if you need any information kindly google income statement or cash flow statement to get the numbers because I'm unable to upload the pdf file that has all these info. answer what you can and what you don't have enough data leave it.

Note* if you need any information kindly google income statement or cash flow statement to get the numbers because I'm unable to upload the pdf file that has all these info. answer what you can and what you don't have enough data leave it.

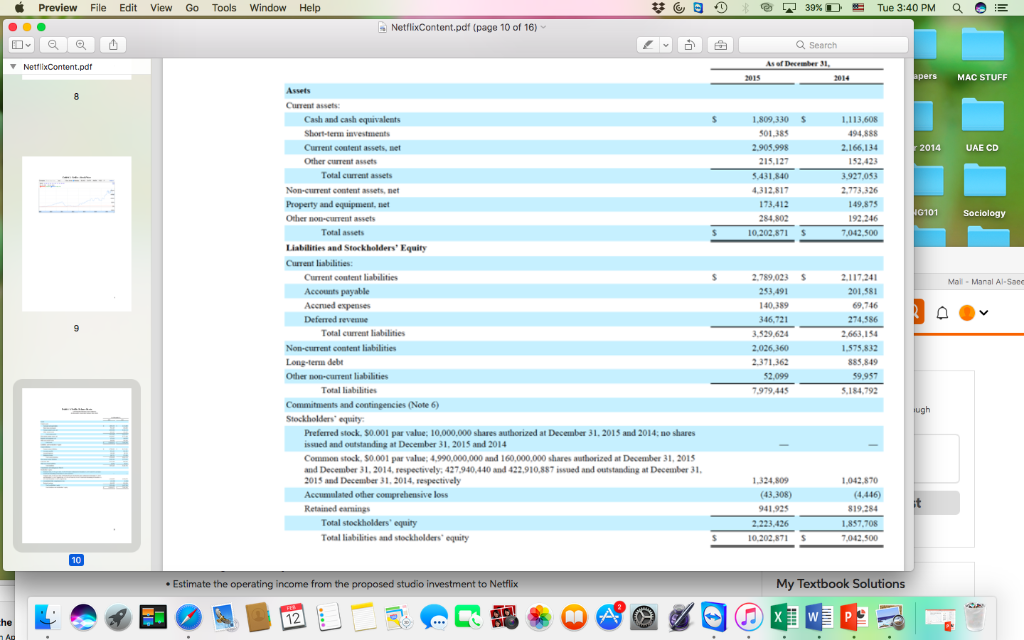

1. Accounting Return Analysis

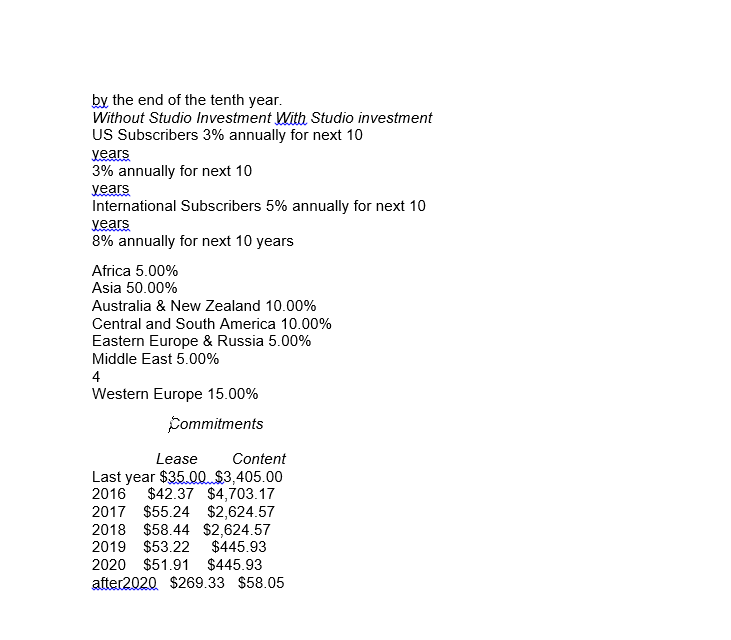

Estimate the operating income from the proposed studio investment to Netflix

over the next 10 years.

Estimate the after-tax return on capital for the investment over the 10-year

period.

Based upon the after-tax return on capital, would you accept or reject this

project?

This will require you to make some assumptions about allocation and expensing. Make

your assumptions as consistent as you can and estimate the return on capital.

2. Cash Flow Analysis

Estimate the after-tax incremental cash flows from the proposed studio

investment to Netflix over the next 10 years.

If the project is terminated at the end of the 10th year, and both working

capital and investment in other assets can be sold for book value at the end of

that year, estimate the net present value of this project to Netflix. Develop a

net present value profile and estimate the internal rate of return for this

project.

If the studio is expected to have a life much longer than 10 years, estimate the

net present value of this project, making reasonable assumptions about

investments needed and cash flows.

3. Sensitivity Analysis

Estimate the sensitivity of your numbers to changes in at least three of the key

assumptions underlying the analysis (You get to pick what you think are the

three key assumptions).

Based upon your analysis, and any other considerations you might have, tell me whether

you would accept this project or reject it. Explain, briefly, your decision.

Preview File Edit View Go Tools Window Help NetflixContent.pdf (page 10 of 16) Search Netflixcontent.pdt persMAC STUFF Current assets: 1809,330 s 01385 113,608 Cash and cash equivalents Short-term investments Curent content assets, net Other current assets 2.905,998 UAE CD 2.166,134 52.423 3.927,053 2014 215,127 Total current assets 5431,840 Non-current content assets, net Property and equipment, net Other nou-current assets 173.412 284,802 10.202.871 S 49.875 101 Sociology Total assets 7.042.500 Liabilities and Stockholders' Equity Current liabilities: Current content liabilities Accounts payable Accrued expenses Deferred revenue 2117.241 201,581 9,746 274.586 2.663.154 1,575,832 885.849 Mail Manal Al-Saec 253,491 140.389 346,721 3.529.624 Total current liabalities Non-current content liabilities Long-tern debt Odher nou-current liabilities 2.371362 2.099 Total liabilities 5,184,792 Commitments and contingencies (Note 6) Stockholders' equity Preferred stock, $0.001 par value: 10,000,000 shares authorized at December 31.2015 and 2014: no shares issued and outstanding at December 31, 2015 and 2014 Common stock, $0.001 par value: 4,990,000,000 and 160,000,000 shares authorized at Decessber 31, 2015 and December 31, 2014, respectively; 427.940,440 and 422,910,887 issued and outstanding at Decenber 31, 2015 and December 31, 2014, respectively 1,042.870 4.446) Retained earnings 41.925 Total stockholders' equity Total liabilities and stockholders" eqaity 819.284 1857.708 7042. 500 2.223.426 10 Estimate the operating income from the proposed studio investment to Netflix My Textbook Solutions 12 by the end of the tenth year Without Studio Investment With Studio investment US Subscribers 3% annually for next 10 years 3% annually for next 10 years International Subscribers 5% annually for next 10 years 8% annually for next 10 years Africa 5.00% Asia 50.00% Australia & New Zealand 10.00% Central and South America 10.00% Eastern Europe & Russia 5.00% Middle East 5.00% 4 Western Europe 15.00% Commitments Lease Content Last year $35.00..$3,405.00 2016 $42.37 $4,703.17 2017 $55.24 $2,624.57 2018 $58.44 $2,624.57 2019 $53.22 $445.93 2020 $51.91 $445.93 atter2020 $269.33 $58.05 Preview File Edit View Go Tools Window Help NetflixContent.pdf (page 10 of 16) Search Netflixcontent.pdt persMAC STUFF Current assets: 1809,330 s 01385 113,608 Cash and cash equivalents Short-term investments Curent content assets, net Other current assets 2.905,998 UAE CD 2.166,134 52.423 3.927,053 2014 215,127 Total current assets 5431,840 Non-current content assets, net Property and equipment, net Other nou-current assets 173.412 284,802 10.202.871 S 49.875 101 Sociology Total assets 7.042.500 Liabilities and Stockholders' Equity Current liabilities: Current content liabilities Accounts payable Accrued expenses Deferred revenue 2117.241 201,581 9,746 274.586 2.663.154 1,575,832 885.849 Mail Manal Al-Saec 253,491 140.389 346,721 3.529.624 Total current liabalities Non-current content liabilities Long-tern debt Odher nou-current liabilities 2.371362 2.099 Total liabilities 5,184,792 Commitments and contingencies (Note 6) Stockholders' equity Preferred stock, $0.001 par value: 10,000,000 shares authorized at December 31.2015 and 2014: no shares issued and outstanding at December 31, 2015 and 2014 Common stock, $0.001 par value: 4,990,000,000 and 160,000,000 shares authorized at Decessber 31, 2015 and December 31, 2014, respectively; 427.940,440 and 422,910,887 issued and outstanding at Decenber 31, 2015 and December 31, 2014, respectively 1,042.870 4.446) Retained earnings 41.925 Total stockholders' equity Total liabilities and stockholders" eqaity 819.284 1857.708 7042. 500 2.223.426 10 Estimate the operating income from the proposed studio investment to Netflix My Textbook Solutions 12 by the end of the tenth year Without Studio Investment With Studio investment US Subscribers 3% annually for next 10 years 3% annually for next 10 years International Subscribers 5% annually for next 10 years 8% annually for next 10 years Africa 5.00% Asia 50.00% Australia & New Zealand 10.00% Central and South America 10.00% Eastern Europe & Russia 5.00% Middle East 5.00% 4 Western Europe 15.00% Commitments Lease Content Last year $35.00..$3,405.00 2016 $42.37 $4,703.17 2017 $55.24 $2,624.57 2018 $58.44 $2,624.57 2019 $53.22 $445.93 2020 $51.91 $445.93 atter2020 $269.33 $58.05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts