Question: NOTE: MULTIPLE OPTIONS MAY BE CORRECT. PLS PROVIDE EXPLANATION FOR EACH QUESTION 7 The following is a performance report of a fund: Fact Sheet|December 31,

NOTE: MULTIPLE OPTIONS MAY BE CORRECT. PLS PROVIDE EXPLANATION FOR EACH

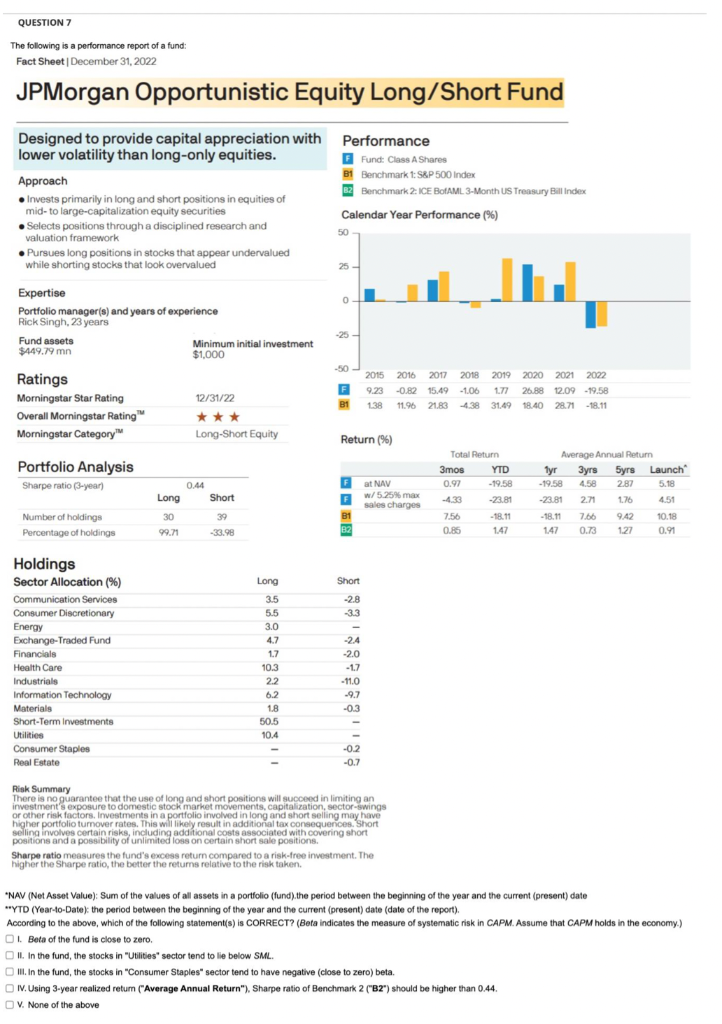

QUESTION 7 The following is a performance report of a fund: Fact Sheet|December 31, 2022 JPMorgan Opportunistic Equity Long/Short Fund Holdings SectorAllocation(%)CommunicationServicesConsumerDiscretionaryEnergyExchange-TradedFundFinancialsHealthCareIndustrialsInformationTechnologyMaterialsShort-TerminvestmentsUtilitiesConsumerStaplesRealEstateLong3.55.53.04.71.710.32.26.21.850.510.4Short2.83.32.42.01.711.09.70.30.20.7 Risk Summary There is no guarantee that the use of long and short positions will succeed in limiting an inwestment's exposure to domestic stock market movements, capitalization, sector-swings or other risk factors. Investments in a portfolio involved in long and short seling may have higher portfolio turnover rates. This mill likey result in additional tax consequences. Short pesitions and a possibility of unlimited loss on certain short sale positions. Sharpe ratio meesures the fund's excess return compared to a risk-free inwestment. The higher the Sharpe ratio, the better the returns relative to the risk taken. 'NAV (Net Asset Value): Sum of the values of all assets in a portfolio (fund),the period between the beginning of the year and the current (present) date "YTD (Year-to-Date): the period between the beginning of the year and the current (present) date (date of the report). According to the above, which of the following statement(s) is CORRECT? (Beta indicates the measure of systematic risk in CAPM. Assume that CAPM holds in the economy.) 1. Beta of the fund is close to zero. II. In the fund, the stocks in "Utilites" sector tend to lie below SML. Ili. In the fund, the stocks in "Consumer Staples" sector tend to have negative (close to zero) beta. Iv. Using 3-year realized retum ("Average Annual Return"), Sharpe ratio of Benchmark 2 ("B2") should be higher than 0.44. V. None of the above QUESTION 7 The following is a performance report of a fund: Fact Sheet|December 31, 2022 JPMorgan Opportunistic Equity Long/Short Fund Holdings SectorAllocation(%)CommunicationServicesConsumerDiscretionaryEnergyExchange-TradedFundFinancialsHealthCareIndustrialsInformationTechnologyMaterialsShort-TerminvestmentsUtilitiesConsumerStaplesRealEstateLong3.55.53.04.71.710.32.26.21.850.510.4Short2.83.32.42.01.711.09.70.30.20.7 Risk Summary There is no guarantee that the use of long and short positions will succeed in limiting an inwestment's exposure to domestic stock market movements, capitalization, sector-swings or other risk factors. Investments in a portfolio involved in long and short seling may have higher portfolio turnover rates. This mill likey result in additional tax consequences. Short pesitions and a possibility of unlimited loss on certain short sale positions. Sharpe ratio meesures the fund's excess return compared to a risk-free inwestment. The higher the Sharpe ratio, the better the returns relative to the risk taken. 'NAV (Net Asset Value): Sum of the values of all assets in a portfolio (fund),the period between the beginning of the year and the current (present) date "YTD (Year-to-Date): the period between the beginning of the year and the current (present) date (date of the report). According to the above, which of the following statement(s) is CORRECT? (Beta indicates the measure of systematic risk in CAPM. Assume that CAPM holds in the economy.) 1. Beta of the fund is close to zero. II. In the fund, the stocks in "Utilites" sector tend to lie below SML. Ili. In the fund, the stocks in "Consumer Staples" sector tend to have negative (close to zero) beta. Iv. Using 3-year realized retum ("Average Annual Return"), Sharpe ratio of Benchmark 2 ("B2") should be higher than 0.44. V. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts