Question: (Note: Parentheses indicate a credit balance) a. Show how Mcliroy determined the $422,239 Investment in Stinson account balance. Assume that Mcliroy defers 100 percent of

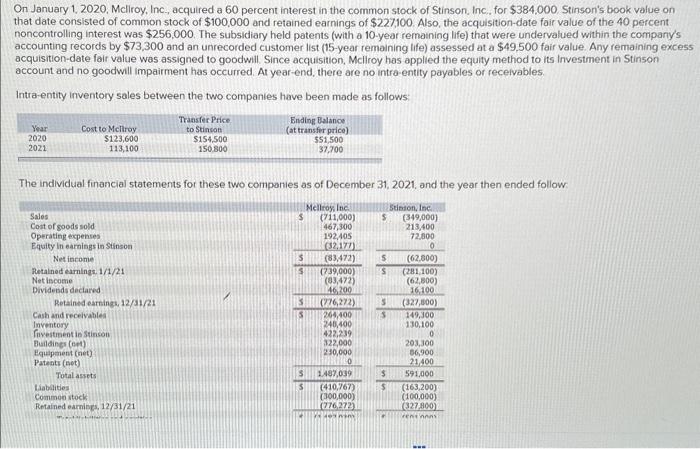

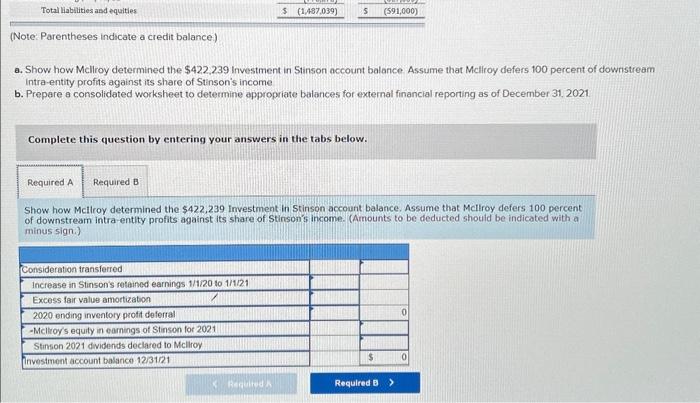

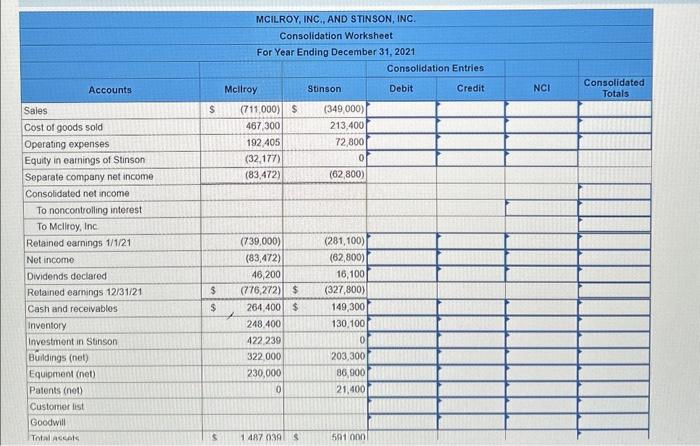

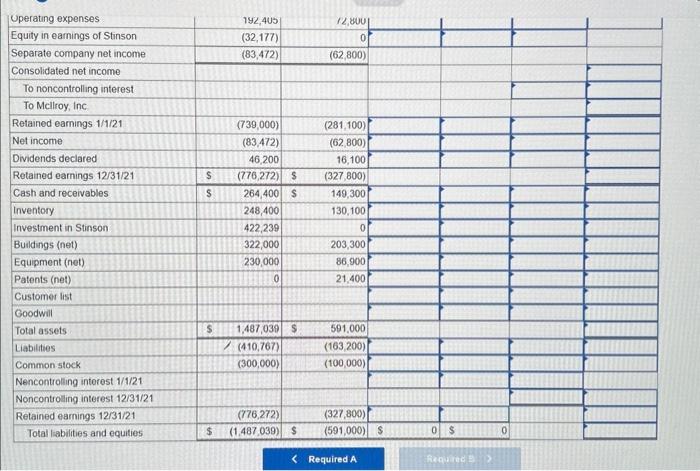

(Note: Parentheses indicate a credit balance) a. Show how Mcliroy determined the $422,239 Investment in Stinson account balance. Assume that Mcliroy defers 100 percent of downstream intra-entity profits against its share of Stinson's income b. Prepare a consolidated worksheet to determine appropriate balances for external financial reporting as of December 31,2021. Complete this question by entering your answers in the tabs below. Show how Mcilroy determined the $422,239 imvestment in Stinson account balance. Assume that Mcilroy defers 100 percent of downstream intra-entity profits against its share of Stinson's income. (Arnounts to be deducted should be indicated with a minus sign.) On January 1, 2020, Mcliroy, Inc., acquired a 60 percent interest in the common stock of Stinson, Inc. for $384.000. Stinson's book value on that date consisted of common stock of $100,000 and retained earnings of $227,100. Also, the acquisition-date fair value of the 40 percent noncontrolling interest was $256,000. The subsidiary held patents (with a 10-year remaining life) that were undervalued within the company's accounting records by $73,300 and an unrecorded customer list (15-year remaining life) assessed at a $49.500 fair value. Any remaining excess acquisition-date fair value was assigned to goodwill. Since acquisition, Mcilioy has applied the equity method to its Investment in Stinson account and no goodwill impairment has occurred. At year-end, there are no intra-entity payables or receivables. Intra-entity inventory sales between the two companies have been made as follows: The individual financial statements for these two companies as of December 31, 2021, and the year then ended follow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts