Question: NOTE: Perfect and complete solution needed 4. Consider a two-period world. Let the current stock price be $45 and the risk-free rate be 5%. Each

NOTE: Perfect and complete solution needed

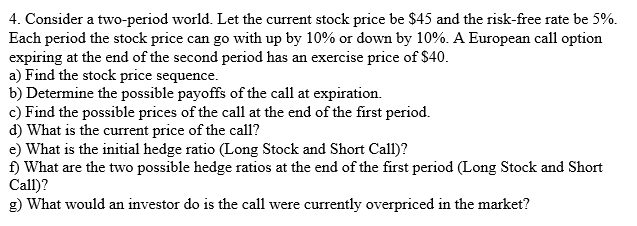

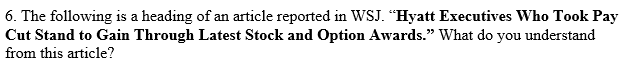

4. Consider a two-period world. Let the current stock price be $45 and the risk-free rate be 5%. Each period the stock price can go with up by 10% or down by 10%. A European call option expiring at the end of the second period has an exercise price of $40. a) Find the stock price sequence. b) Determine the possible payoffs of the call at expiration. c) Find the possible prices of the call at the end of the first period. d) What is the current price of the call? e) What is the initial hedge ratio (Long Stock and Short Call)? f) What are the two possible hedge ratios at the end of the first period (Long Stock and Short Call)? g) What would an investor do is the call were currently overpriced in the market? 6. The following is a heading of an article reported in WSJ. "Hyatt Executives Who Took Pay Cut Stand to Gain Through Latest Stock and Option Awards." What do you understand from this article? 4. Consider a two-period world. Let the current stock price be $45 and the risk-free rate be 5%. Each period the stock price can go with up by 10% or down by 10%. A European call option expiring at the end of the second period has an exercise price of $40. a) Find the stock price sequence. b) Determine the possible payoffs of the call at expiration. c) Find the possible prices of the call at the end of the first period. d) What is the current price of the call? e) What is the initial hedge ratio (Long Stock and Short Call)? f) What are the two possible hedge ratios at the end of the first period (Long Stock and Short Call)? g) What would an investor do is the call were currently overpriced in the market? 6. The following is a heading of an article reported in WSJ. "Hyatt Executives Who Took Pay Cut Stand to Gain Through Latest Stock and Option Awards." What do you understand from this article

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts