Question: Note: please answer asap it's a request universitat Discounted Cash Flows, Duration and Convexirgsbruck Exercise: Consider a straight bond with time to maturity of 5

Note: please answer asap it's a request

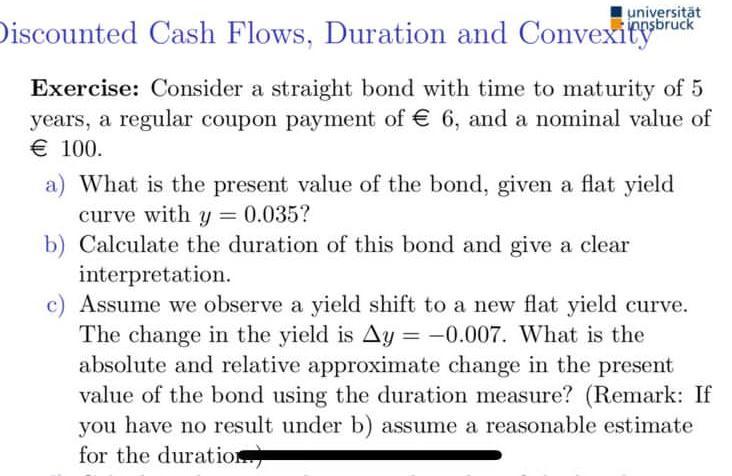

universitat Discounted Cash Flows, Duration and Convexirgsbruck Exercise: Consider a straight bond with time to maturity of 5 years, a regular coupon payment of 6, and a nominal value of 100. a) What is the present value of the bond, given a flat yield curve with y = 0.035? b) Calculate the duration of this bond and give a clear interpretation. c) Assume we observe a yield shift to a new flat yield curve. The change in the yield is Ay = -0.007. What is the absolute and relative approximate change in the present value of the bond using the duration measure? (Remark: If you have no result under b) assume a reasonable estimate for the duration

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts