Question: Note: answer required in 30 mnts please help Discounted Cash Flows, Duration and Convexity universitt ippsbruck Exercise: Consider a straight bond with time to maturity

Note: answer required in 30 mnts please help

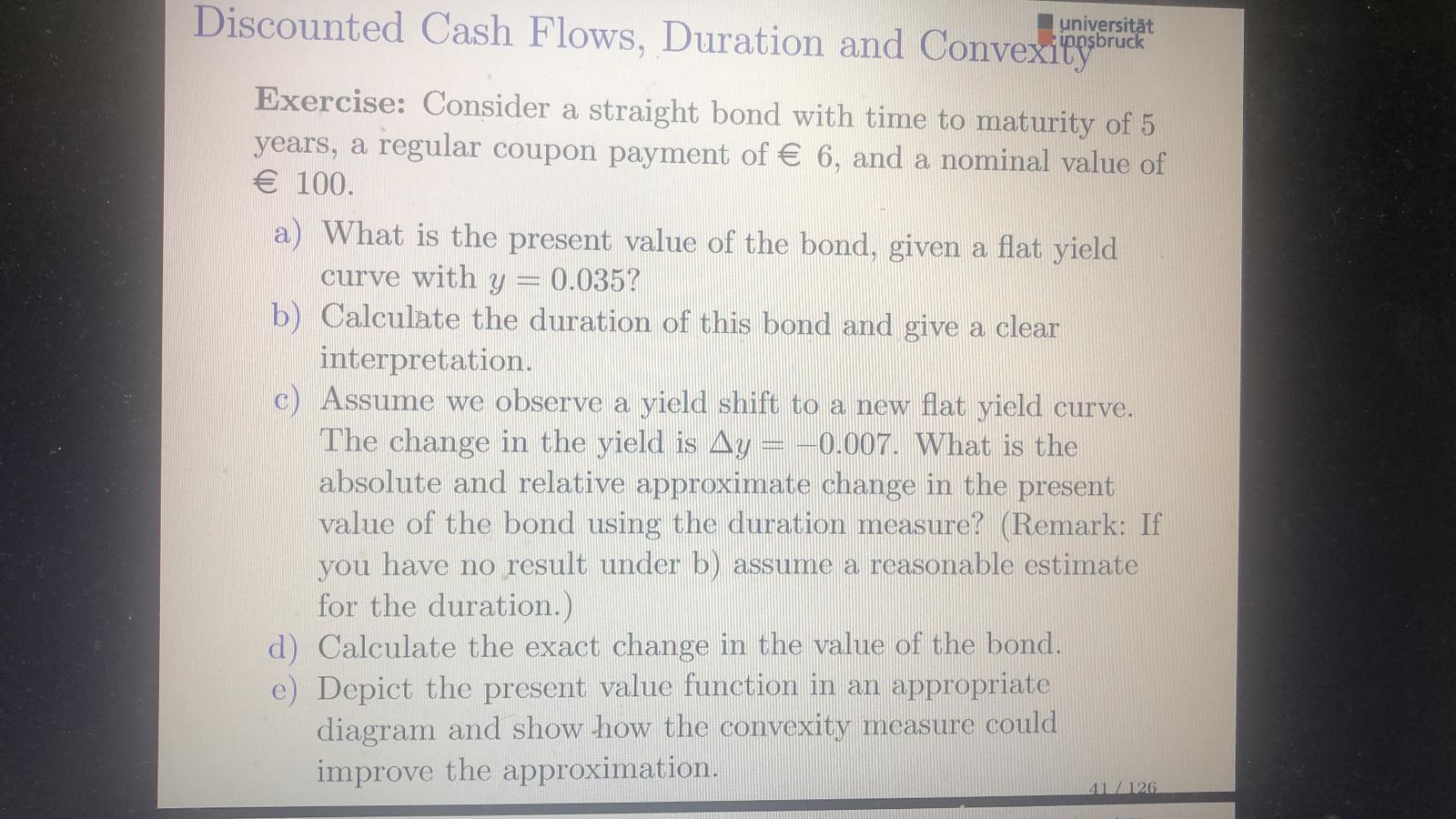

Discounted Cash Flows, Duration and Convexity universitt ippsbruck Exercise: Consider a straight bond with time to maturity of 5 years, a regular coupon payment of 6, and a nominal value of 100. a) What is the present value of the bond, given a flat yield curve with y 0.035? b) Calculate the duration of this bond and give a clear interpretation. Assume we observe a yield shift to a new flat yield curve. The change in the yield is Ay = -0.007. What is the absolute and relative approximate change in the present value of the bond using the duration measure? (Remark: If you have no result under b) assume a reasonable estimate for the duration.) d) Calculate the exact change in the value of the bond. e) Depict the present value function in an appropriate diagram and show how the convexity measure could improve the approximation. 4 / 126

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts