Question: NOTE: PLEASE ANSWER BOTH QUESTIONS. I NEED ANSWER IN TEXT. BEFORE ANSWER PLEASE MAKE SURE IT'S CORRECT. Question 5 Not yet answered Marked out of

NOTE: PLEASE ANSWER BOTH QUESTIONS. I NEED ANSWER IN TEXT. BEFORE ANSWER PLEASE MAKE SURE IT'S CORRECT.

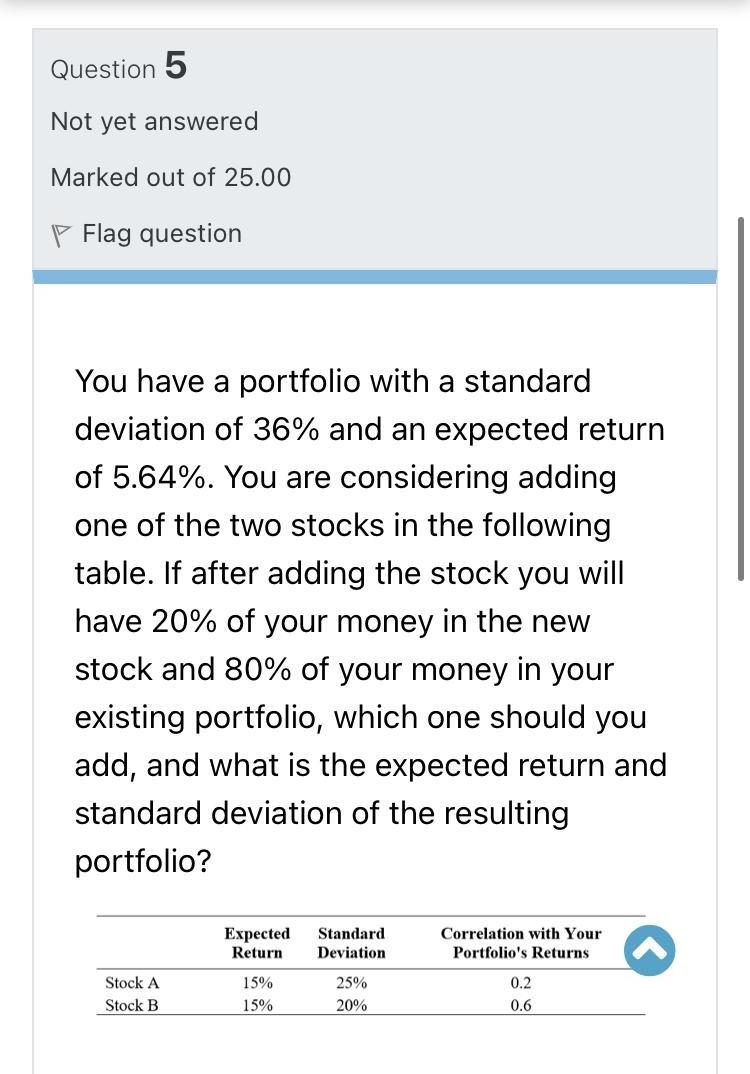

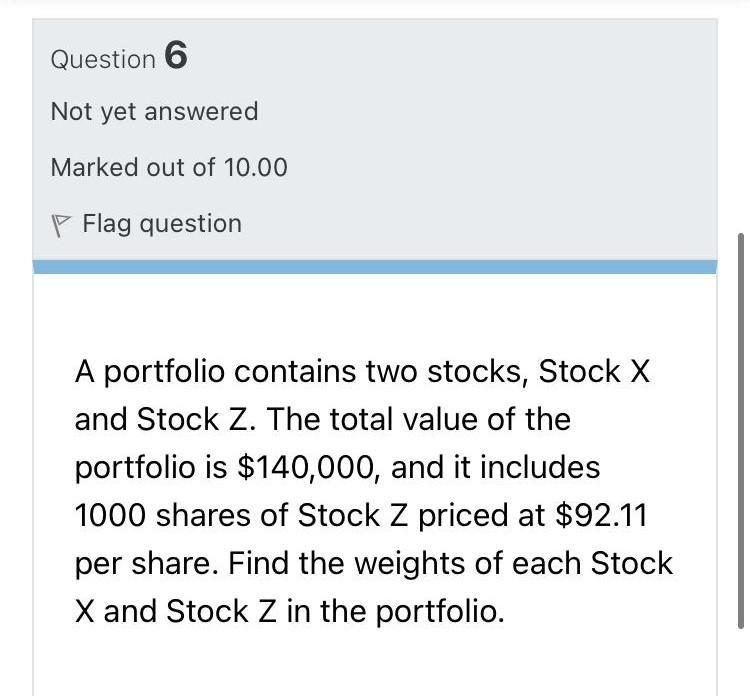

Question 5 Not yet answered Marked out of 25.00 P Flag question You have a portfolio with a standard deviation of 36% and an expected return of 5.64%. You are considering adding one of the two stocks in the following table. If after adding the stock you will have 20% of your money in the new stock and 80% of your money in your existing portfolio, which one should you add, and what is the expected return and standard deviation of the resulting portfolio? Standard Expected Return Correlation with Your Portfolio's Returns Deviation 15% 25% 0.2 Stock A Stock B 15% 20% 0.6 Question 6 Not yet answered Marked out of 10.00 P Flag question A portfolio contains two stocks, Stock X and Stock Z. The total value of the portfolio is $140,000, and it includes 1000 shares of Stock Z priced at $92.11 per share. Find the weights of each Stock X and Stock Z in the portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts