Question: (Note: Please Show ALL RELEVANT WORK PROCESS III) 1. Finding the required interest rate Your parents will retire in 18 years. They currently have $250,000,

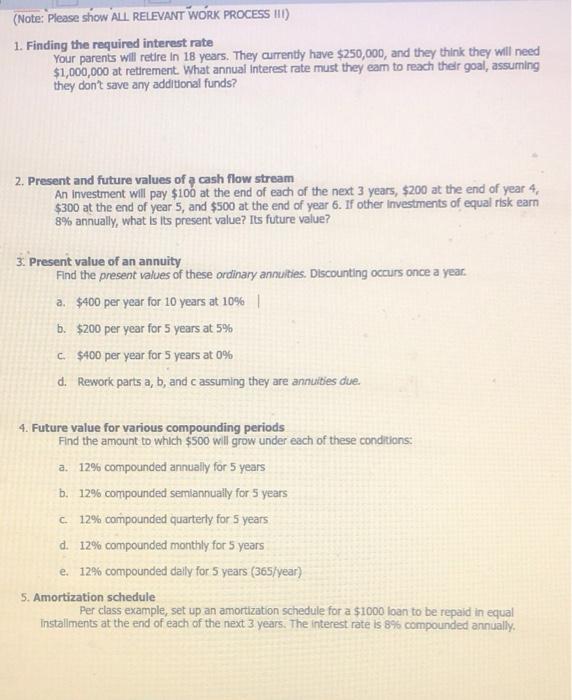

(Note: Please Show ALL RELEVANT WORK PROCESS III) 1. Finding the required interest rate Your parents will retire in 18 years. They currently have $250,000, and they think they will need $1,000,000 at retirement. What annual Interest rate must they eam to reach their goal, assuming they don't save any additional funds? 2. Present and future values of a cash flow stream An Investment will pay $100 at the end of each of the next 3 years, $200 at the end of year 4 $300 at the end of year 5, and $500 at the end of year 6. If other investments of equal risk earn 8% annually, what is its present value? Its future value? 3. Present value of an annuity Find the present values of these ordinary annuities. Discounting occurs once a year. a $400 per year for 10 years at 10% b. $200 per year for 5 years at 5% C $400 per year for 5 years at 0% d. Rework parts a, b, and c assuming they are annuities due 4. Future value for various compounding periods Find the amount to which $500 will grow under each of these conditions: a. 12% compounded annually for 5 years b. 12% compounded semiannually for 5 years C 12% compounded quarterly for 5 years d. 12% compounded monthly for 5 years e. 12% compounded dally for 5 years (365/year) 5. Amortization schedule Per class example, set up an amortization schedule for a $1000 loan to be repaid in equal Installments at the end of each of the next 3 years. The interest rate is 8% compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts