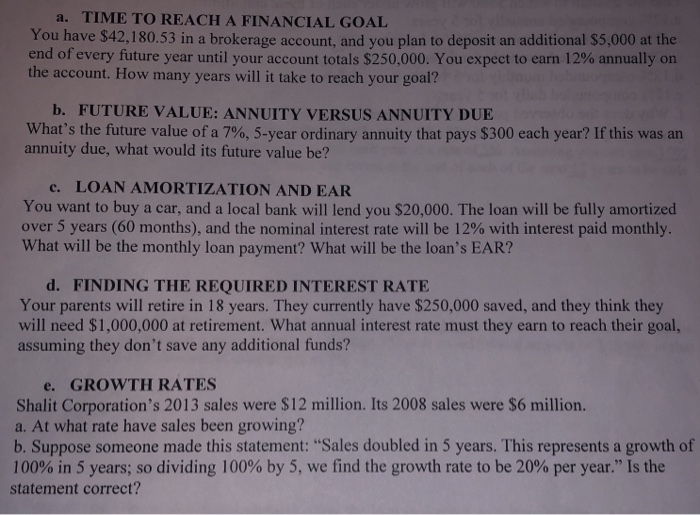

Question: please complete parts a, b, d, and E and show work and explain. a. TIME TO REACH A FINANCIAL GOAL You have $42,1 80.53 in

a. TIME TO REACH A FINANCIAL GOAL You have $42,1 80.53 in a brokerage account, and you plan to deposit end of every future year until your account totals $250,000. You expect to earn 12% annually or the account. How many years will it take to reach your goal? an additional $5,000 at the n b. FUTURE VALUE: ANNUITY VERSUS ANNUITY DUE What's the future value of a 7%, 5-year ordinary annuity that pays $300 each year? If this was an annuity due, what would its future value be? c. LOAN AMORTIZATION AND EAR You want to buy a car, and a local bank will lend you $20,000. The loan will be fully amortized over 5 years (60 months), and the nominal interest rate will be 12% with interest paid monthly. What will be the monthly loan payment? What will be the loan's EAR? d. FINDING THE REQUIRED INTEREST RATE Your parents will retire in 18 years. They currently have $250,000 saved, and they think they will need $1,000,000 at retirement. What annual interest rate must they earn to reach their goal, assuming they don't save any additional funds? e. GROWTH RATES Shalit Corporation's 2013 sales were $12 million. Its 2008 sales were $6 million. a.At what rate have sales been growing? b. Suppose someone made this statement: "Sales doubled in 5 years. This represents a growth of 100% in 5 years; so dividing 100 % by 5, we find the growth rate to be 20% per year." Is the statement correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts