Question: note please show working ( no Excel) and thank you. QUESTION 2 An analyst has predicted the free cash flows for Sanyen Banting Company Limited

note please show working ( no Excel) and thank you.

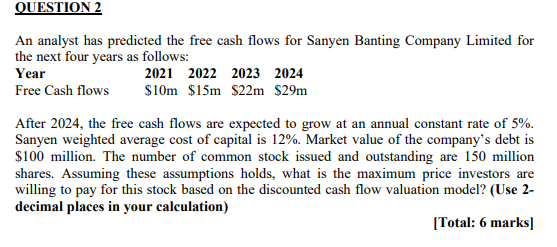

QUESTION 2 An analyst has predicted the free cash flows for Sanyen Banting Company Limited for the next four years as follows: Year 2021 2022 2023 2024 Free Cash flows $ 10m $15m $22m $29m After 2024, the free cash flows are expected to grow at an annual constant rate of 5%. Sanyen weighted average cost of capital is 12%. Market value of the company's debt is $100 million. The number of common stock issued and outstanding are 150 million shares. Assuming these assumptions holds, what is the maximum price investors are willing to pay for this stock based on the discounted cash flow valuation model? (Use 2- decimal places in your calculation) [Total: 6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts