Question: please answer 19 its the right answer but just dont know how Information for Questions 18-20. You have been asked to forecast financial results and

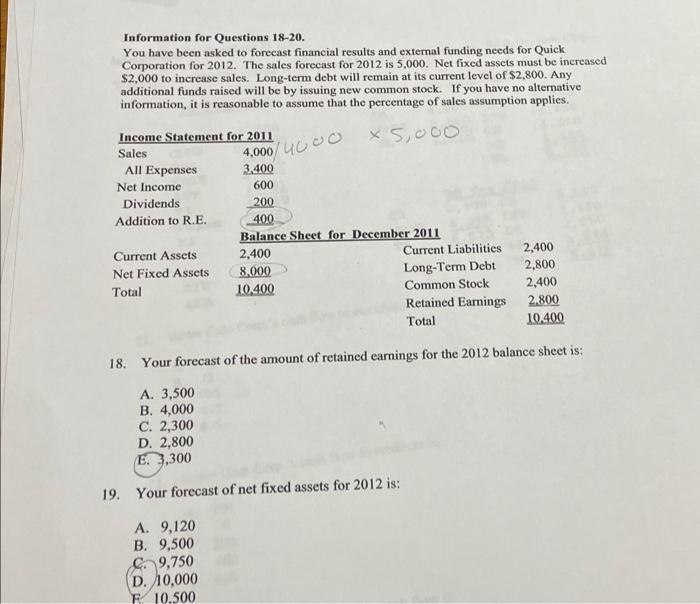

Information for Questions 18-20. You have been asked to forecast financial results and external funding needs for Quick Corporation for 2012. The sales forecast for 2012 is 5,000 . Net fixed assets must be increased $2,000 to increase sales. Long-term debt will remain at its current level of $2,800. Any additional funds raised will be by issuing new common stock. If you have no alternative information, it is reasonable to assume that the percentage of sales assumption applies. 10005,000 18. Your forecast of the amount of retained earnings for the 2012 balance sheet is: A. 3,500 B. 4,000 C. 2,300 D. 2,800 E. 3,300 19. Your forecast of net fixed assets for 2012 is: A. 9,120 B. 9,500 C. 9,750 D. 10,000 F 10.500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts