Question: note please solve everything is include. I have provided all the available information E F G H Questions #3A, 3B, & 3C: Given the Risk

note please solve everything is include.

I have provided all the available information

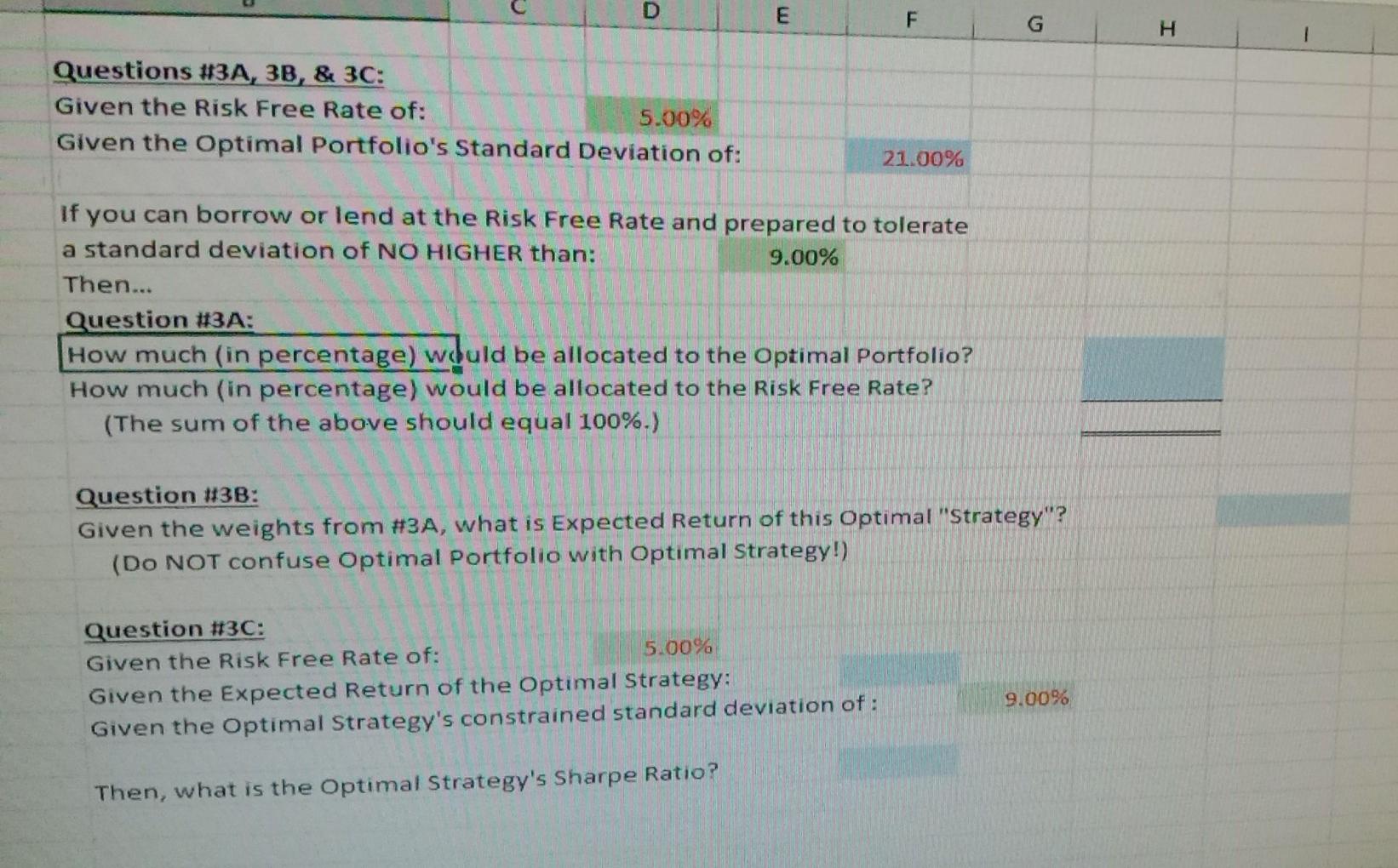

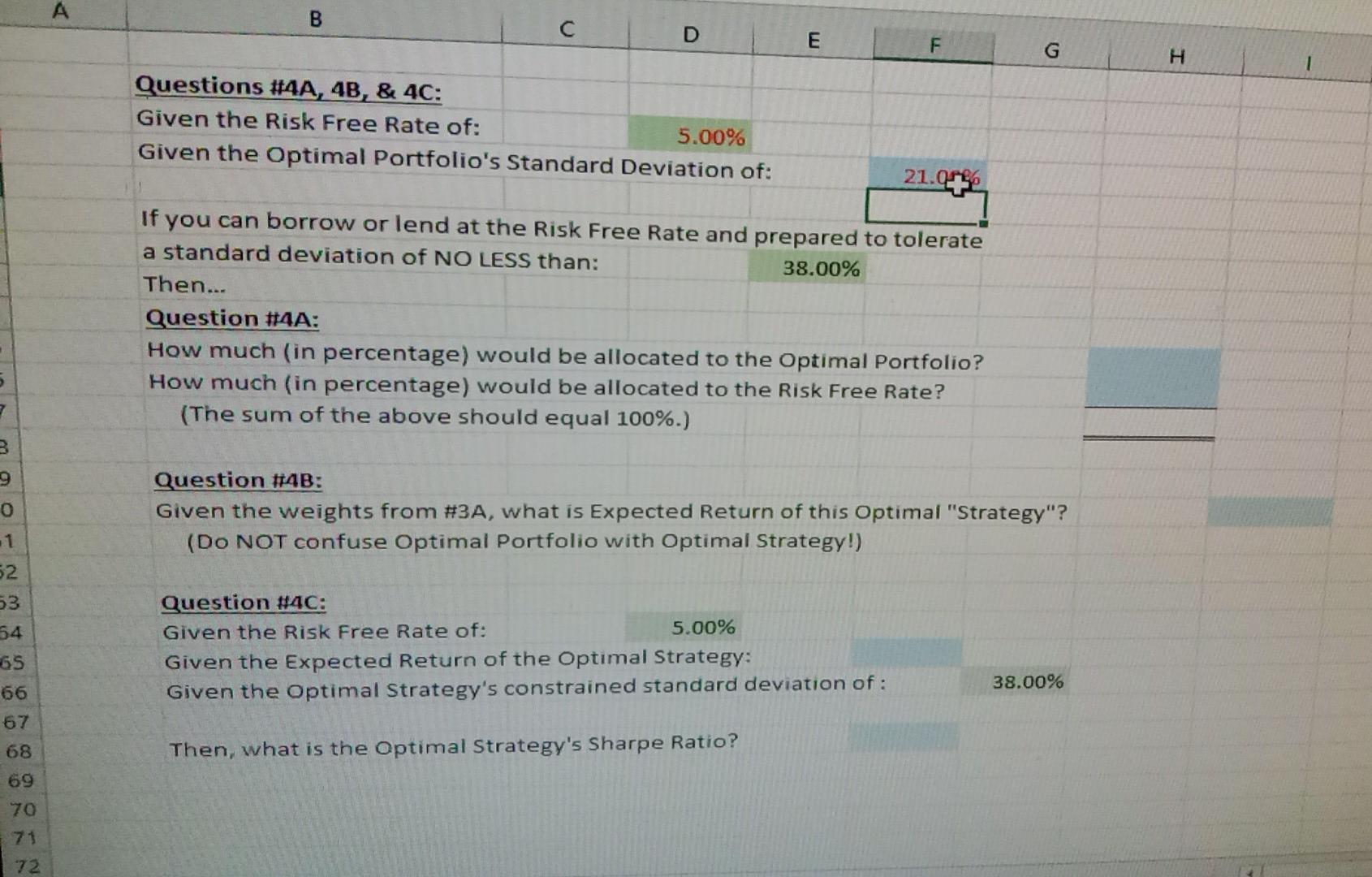

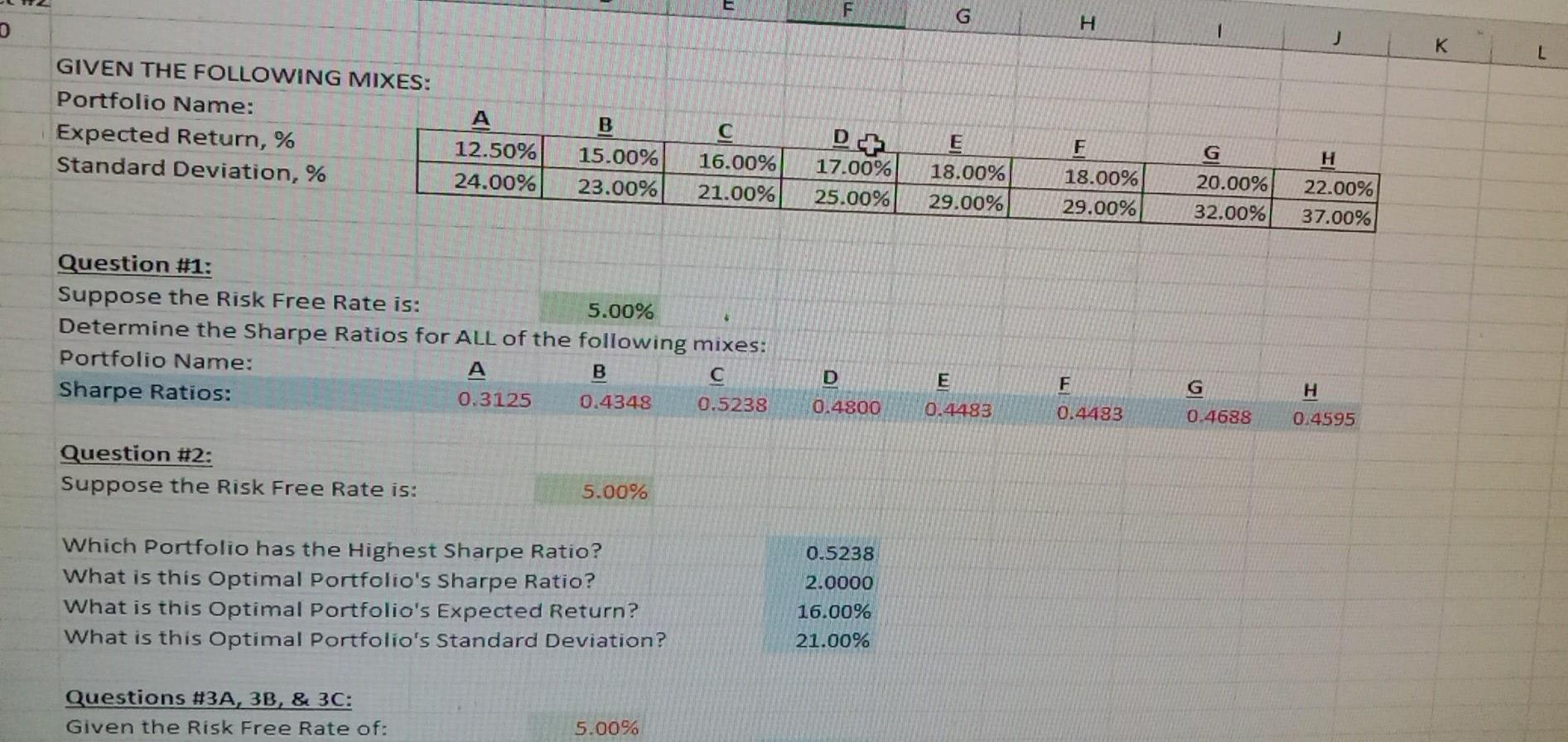

E F G H Questions #3A, 3B, & 3C: Given the Risk Free Rate of: 5.00% Given the optimal Portfolio's Standard Deviation of: 21.00% if you can borrow or lend at the Risk Free Rate and prepared to tolerate a standard deviation of NO HIGHER than: 9.00% Then... Question #3A: How much (in percentage) would be allocated to the optimal Portfolio? How much (in percentage) would be allocated to the Risk Free Rate? (The sum of the above should equal 100%.) Question #3B: Given the weights from #3A, what is Expected Return of this Optimal "Strategy"? (Do NOT confuse Optimal Portfolio with Optimal Strategy!) Question #3C: Given the Risk Free Rate of: 5.00% Given the Expected Return of the Optimal Strategy: Given the optimal Strategy's constrained standard deviation of: 9.0096 Then, what is the Optimal Strategy's Sharpe Ratio? A B D E F G H Questions #AA, 4B, & 4C: Given the Risk Free Rate of: 5.00% Given the optimal Portfolio's Standard Deviation of: 21.05 If you can borrow or lend at the Risk Free Rate and prepared to tolerate a standard deviation of NO LESS than: 38.00% Then... Question #4A: How much (in percentage) would be allocated to the optimal Portfolio? How much (in percentage) would be allocated to the Risk Free Rate? (The sum of the above should equal 100%.) 5 7 3 9 0 Question H4B: Given the weights from #3A, what is expected Return of this Optimal "Strategy"? (Do NOT confuse Optimal Portfolio with Optimal Strategy!) 1 52 53 54 65 Question #4C: Given the Risk Free Rate of: 5.00% Given the expected Return of the Optimal Strategy: Given the optimal Strategy's constrained standard deviation of: 66 38.00% 67 68 Then, what is the Optimal Strategy's Sharpe Ratio? 69 70 72 G H I 0 1 K L GIVEN THE FOLLOWING MIXES: Portfolio Name: Expected Return, % Standard Deviation, % A D + F 12.50% 24.00% B 15.00% 23.00% 16.00% 21.00% H 17.00% 25.00% E 18.00% 29.00% 18.00% 29.00% G 20.00% 32.00% 22.00% 37.00% Question #1: Suppose the Risk Free Rate is: 5.00% Determine the Sharpe Ratios for ALL of the following mixes: Portfolio Name: A B Sharpe Ratios: 0.3125 0.4348 0.5238 E F D 0.4800 0.4483 G 0.4688 0.4483 H 0.4595 Question #2: Suppose the Risk Free Rate is: 5.00% Which Portfolio has the Highest Sharpe Ratio? What is this Optimal Portfolio's Sharpe Ratio? What is this Optimal Portfolio's Expected Return? What is this Optimal Portfolio's Standard Deviation? 0.5238 2.0000 16.00% 21.00% Questions #3A, 3B, & 3C: Given the Risk Free Rate of: 5.00%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts