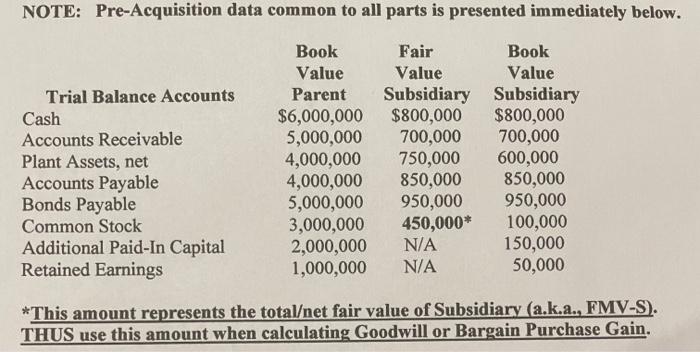

Question: NOTE: Pre-Acquisition data common to all parts is presented immediately below. Trial Balance Accounts Cash Accounts Receivable Plant Assets, net Accounts Payable Bonds Payable Common

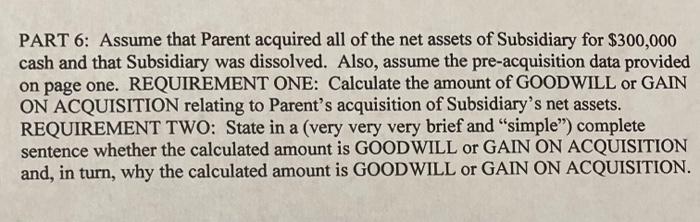

NOTE: Pre-Acquisition data common to all parts is presented immediately below. Trial Balance Accounts Cash Accounts Receivable Plant Assets, net Accounts Payable Bonds Payable Common Stock Additional Paid-In Capital Retained Earnings Book Value Parent $6,000,000 5,000,000 4,000,000 4,000,000 5,000,000 3,000,000 2,000,000 1,000,000 Fair Book Value Value Subsidiary Subsidiary $800,000 $800,000 700,000 700,000 750,000 600,000 850,000 850,000 950,000 950,000 450,000* 100,000 N/A 150,000 N/A 50,000 *This amount represents the totalet fair value of Subsidiary (a.k.a., FMV-S). THUS use this amount when calculating Goodwill or Bargain Purchase Gain. PART 6: Assume that Parent acquired all of the net assets of Subsidiary for $300,000 cash and that Subsidiary was dissolved. Also, assume the pre-acquisition data provided on page one. REQUIREMENT ONE: Calculate the amount of GOODWILL or GAIN ON ACQUISITION relating to Parent's acquisition of Subsidiary's net assets. REQUIREMENT TWO: State in a (very very very brief and "simple") complete sentence whether the calculated amount is GOODWILL or GAIN ON ACQUISITION and, in turn, why the calculated amount is GOODWILL or GAIN ON ACQUISITION

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts