Question: Note: Read this carefully! It may not have the same cash flows as the other real options problem although the situation looks similar. Consider the

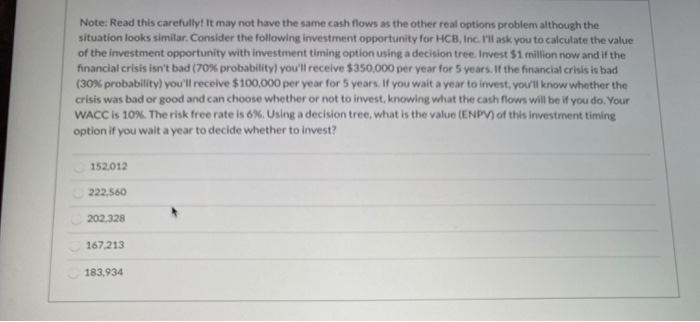

Note: Read this carefully! It may not have the same cash flows as the other real options problem although the situation looks similar. Consider the following investment opportunity for HCB, Inc. I'll ask you to calculate the value of the investment opportunity with investment timing option using a decision tree. Invest $1 million now and if the financial crisis isn't bad (70% probability) you'll receive $350,000 per year for 5 years, (30% probability) you'll receive $100,000 per year for 5 years. If you wait a year to invest, you'll know whether the crisis was bad or good and can choose whether or not to invest, knowing what the cash flows will be if you do. Your WACC is 10%. The risk free rate is 6%. Using a decision tree, what is the value (ENPV) of this investment timing option if you wait a year to decide whether to invest? 152,012 222,560 202,328 167.213 183.934

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts