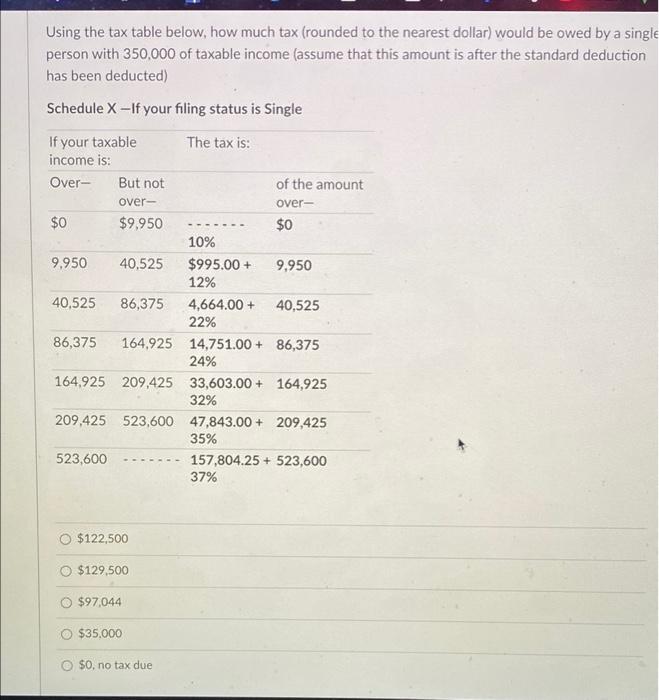

Question: Using the tax table below, how much tax (rounded to the nearest dollar) would be owed by a single person with 350,000 of taxable income

Using the tax table below, how much tax (rounded to the nearest dollar) would be owed by a single person with 350,000 of taxable income (assume that this amount is after the standard deduction has been deducted) Schedule X - If your filing status is Single $0 If your taxable The tax is: income is: Over- But not of the amount over- Over- $0 $9.950 10% 9.950 40,525 $995.00 + 9,950 12% 40.525 86,375 4,664.00 + 40,525 22% 86,375 164.925 14,751.00 + 86,375 24% 164.925 209,425 33,603.00 + 164,925 32% 209,425 523,600 47,843.00 + 209,425 35% 523,600 157,804.25 + 523,600 37% O $122,500 O $129,500 O $97,044 O $35,000 $0, no tax due

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts