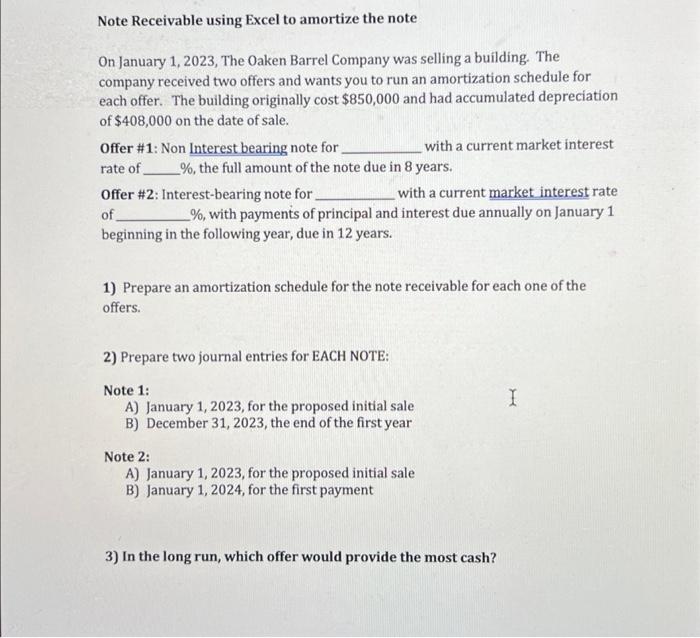

Question: Note Receivable using Excel to amortize the note On January 1, 2023, The Oaken Barrel Company was selling a building. The company received two offers

On January 1,2023, The Oaken Barrel Company was selling a building. The company received two offers and wants you to run an amortization schedule for each offer. The building originally cost $850,000 and had accumulated depreciation of $408,000 on the date of sale. Offer \#1: Non Interest bearing note for with a current market interest rate of %, the full amount of the note due in 8 years. offer \#2: Interest-bearing note for with a current market interest rate of %, with payments of principal and interest due annually on January 1 beginning in the following year, due in 12 years. 1) Prepare an amortization schedule for the note receivable for each one of the offers. 2) Prepare two journal entries for EACH NOTE: Note 1: A) January 1, 2023, for the proposed initial sale B) December 31,2023, the end of the first year Note 2: A) January 1, 2023, for the proposed initial sale B) January 1,2024, for the first payment 3) In the long run, which offer would provide the most cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts