Question: Note: Show all your calculations and graphs using Excel. You can use the template from Session 2 as a reference. You can use up to

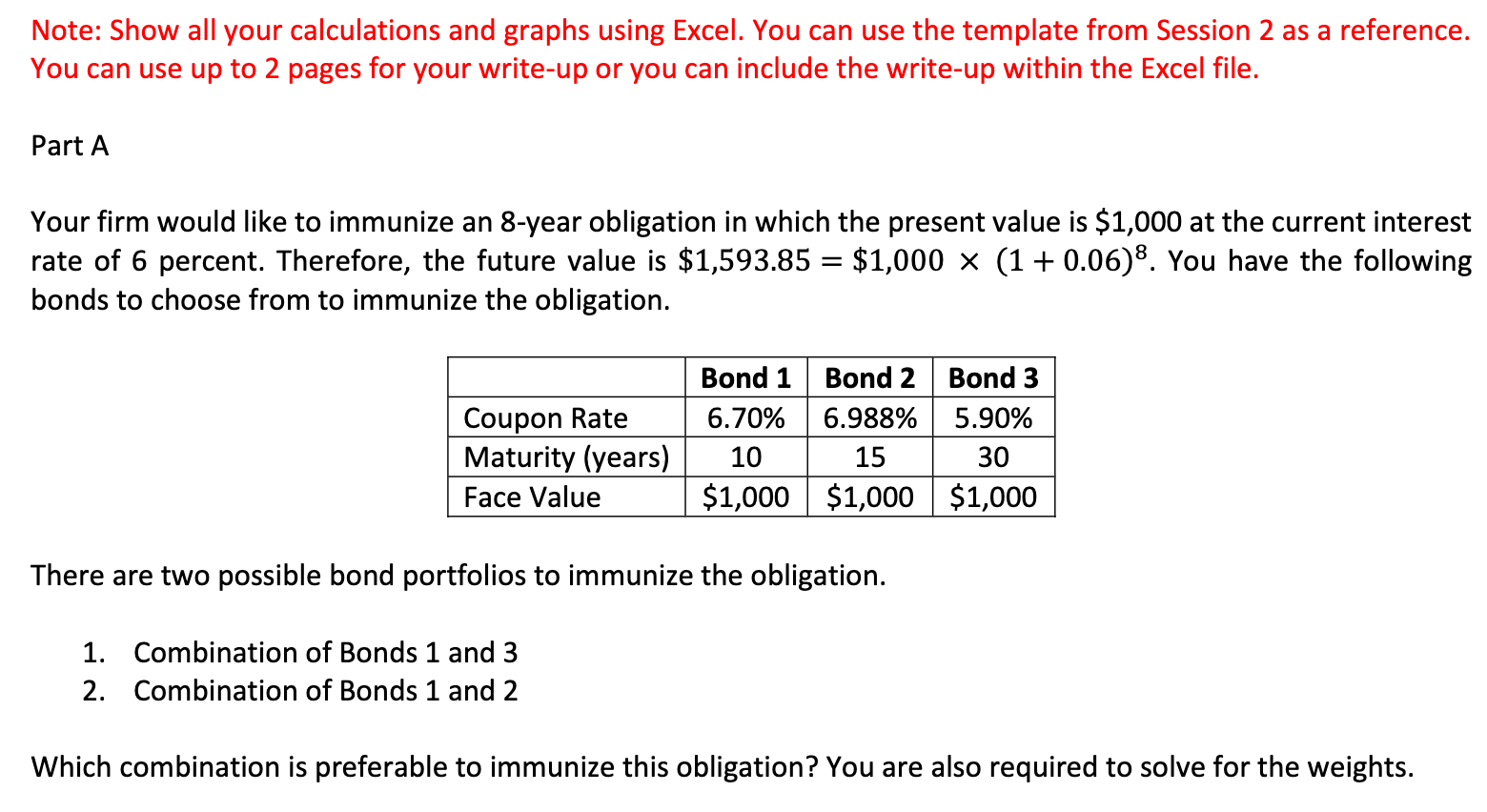

Note: Show all your calculations and graphs using Excel. You can use the template from Session 2 as a reference. You can use up to 2 pages for your write-up or you can include the write-up within the Excel file. Part A Your firm would like to immunize an 8-year obligation in which the present value is $1,000 at the current interest rate of 6 percent. Therefore, the future value is $1,593.85=$1,000(1+0.06)8. You have the following bonds to choose from to immunize the obligation. There are two possible bond portfolios to immunize the obligation. 1. Combination of Bonds 1 and 3 2. Combination of Bonds 1 and 2 Which combination is preferable to immunize this obligation? You are also required to solve for the weights

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts