Question: note that the two pictures makes one question QUESTION 4 GANYO plc has embarked on a programme of growth through acquisitions and has identified Alpha

note that the two pictures makes one question

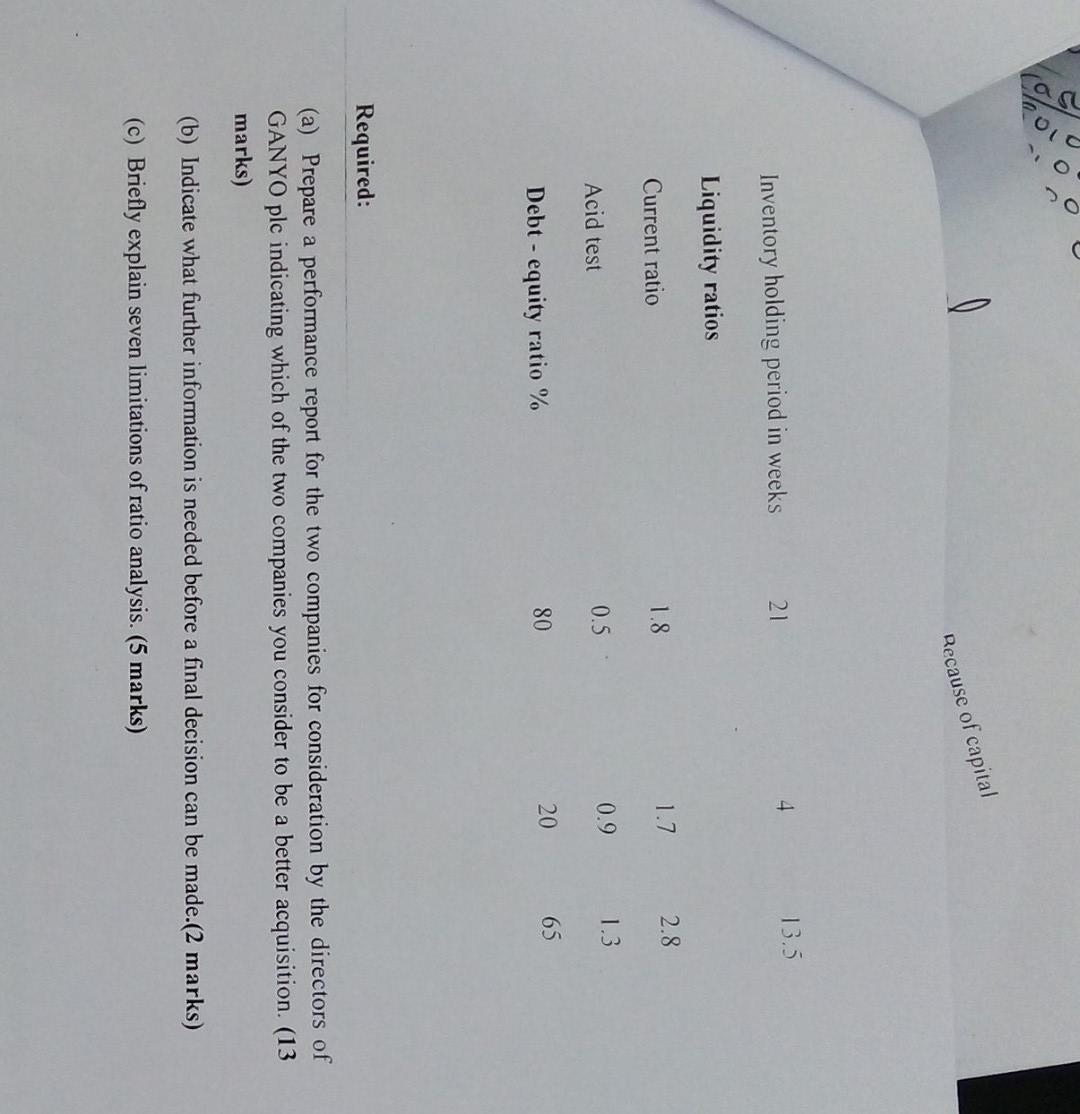

QUESTION 4 GANYO plc has embarked on a programme of growth through acquisitions and has identified Alpha Ltd and Beta Ltd as companies in the same industrial sector, as potential targets. Using recent financial statement of both Alpha and Beta and further information obtained from a trade association, GANYO plc has managed to build up the following comparability table: Industrial Alpha Beta average Profitability ratios 22 28 20 ROCE before tax % 18 22 15 Return on equity % 5. 7 11 Net profit margin % 25 12 20 Gross profit margin% Activity ratios 1.5 4 2.5 Total assets turnover = times 2.3 12. Non-current asset turnover = times 5.1 Receivables collection period in weeks 8 5.1 6.5 Tag Recause of capital 13.5 4 21 Inventory holding period in weeks Liquidity ratios 2.8 1.7 1.8 Current ratio 0.9 0.5 1.3 Acid test 20 80 65 Debt - equity ratio % Required: (a) Prepare a performance report for the two companies for consideration by the directors of GANYO plc indicating which of the two companies you consider to be a better acquisition. (13 marks) (b) Indicate what further information is needed before a final decision can be made.(2 marks) (c) Briefly explain seven limitations of ratio analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts