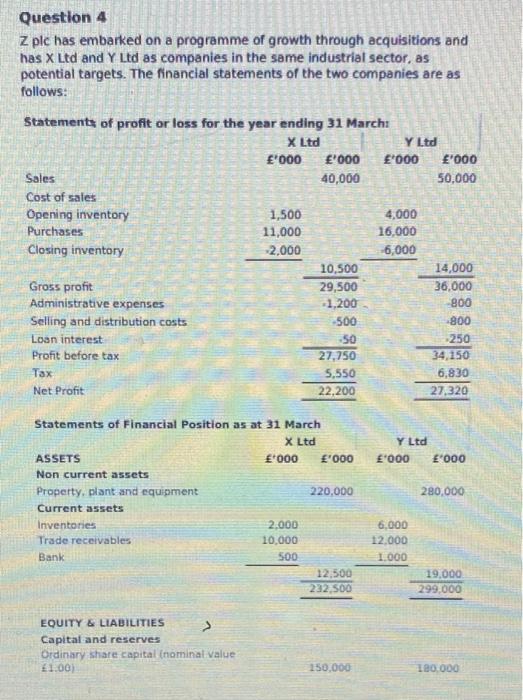

Question: Question 4 Z plc has embarked on a programme of growth through acquisitions and has X Ltd and Y Ltd as companies in the same

acquisitions and has X Ltd and Y Ltd as companies in the same

industrial sector, as potential targets. The financial statements of

the two companies are as follows:

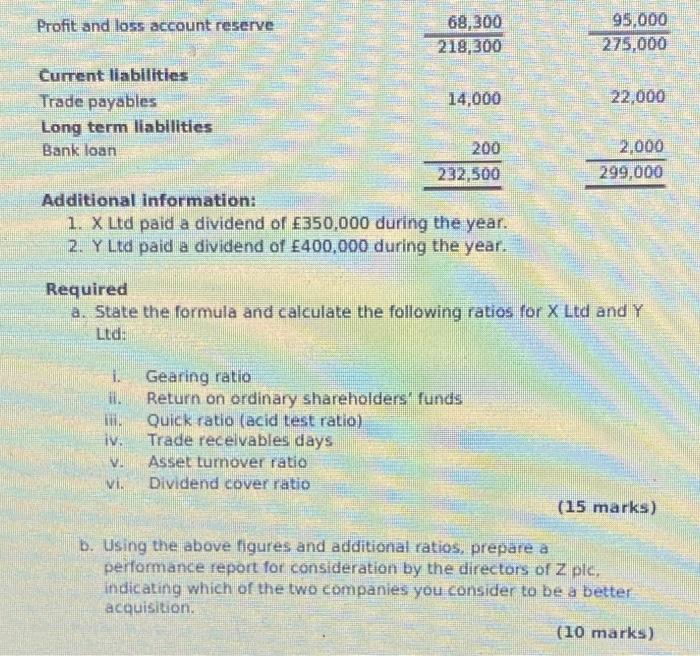

Question 4 Z plc has embarked on a programme of growth through acquisitions and has X Ltd and Y Ltd as companies in the same industrial sector, as potential targets. The financial statements of the two companies are as follows: Statements of profit or loss for the year ending 31 March: X Ltd Y Ltd '000 '000 '000 Sales 40,000 Cost of sales Opening inventory 1,500 4,000 Purchases 11,000 16,000 Closing inventory -2,000 -6,000 10,500 Gross profit 29,500 Administrative expenses -1,200 -500 Selling and distribution costs Loan interest -50 Profit before tax 27,750 Tax 5,550 Net Profit 22,200 Statements of Financial Position as at 31 March X Ltd ASSETS *000 '000 Non current assets Property, plant and equipment 220,000 Current assets Inventories 2,000 Trade receivables 10,000 Bank 500 EQUITY & LIABILITIES > Capital and reserves Ordinary share capital (nominal value 1.00) 12,500 232,500 150,000 '000 50,000 14,000 36,000 800 -800 -250 34,150 6,830 27,320 Y Ltd '000 '000 280,000 6,000 12,000 1.000 19,000 299,000 180,000 Profit and loss account reserve 68,300 95,000 218,300 275,000 Current liabilities Trade payables 14,000 22,000 Long term liabilities Bank loan 200 2,000 232,500 299,000 Additional information: 1. X Ltd paid a dividend of 350,000 during the year. 2. Y Ltd paid a dividend of 400,000 during the year. Required a. State the formula and calculate the following ratios for X Ltd and Y Ltd: 1. Gearing ratio Return on ordinary shareholders' funds M. Quick ratio (acid test ratio) iv. Trade receivables days V. Asset turnover ratio vi. Dividend cover ratio (15 marks) b. Using the above figures and additional ratios, prepare a performance report for consideration by the directors of Z plc, indicating which of the two companies you consider to be a better acquisition. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts