Question: Note that these are the same facts as Question for the lessee, On April 1, 2020, Star Inc. leased a machine to Dust Ltd, under

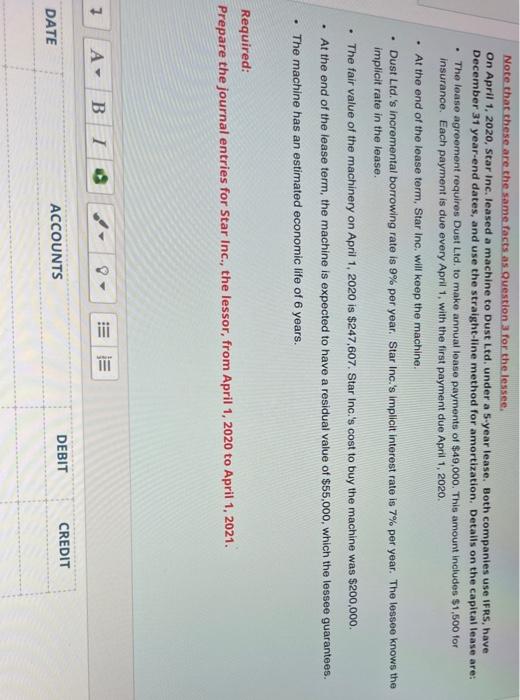

Note that these are the same facts as Question for the lessee, On April 1, 2020, Star Inc. leased a machine to Dust Ltd, under a 5-year lease. Both companies use IFRS, have December 31 year-end dates, and use the straight-line method for amortization. Details on the capital lease are: The loase agreement requires Dust Ltd. to make annual lease payments of $49,000. This amount includes $1,500 for insurance. Each payment is due every April 1, with the first payment due April 1, 2020. . At the end of the lease term, Star Inc. will keep the machine. Dust Ltd. 's incremental borrowing rate is 9% per year. Star Inc.'s implicit interest rate is 7% per year. The lessee knows the implicit rate in the lease. The fair value of the machinery on April 1, 2020 is $247,607. Star Inc.'s cost to buy the machine was $200,000 At the end of the lease term, the machine is expected to have a residual value of $55,000, which the lessee guarantees. The machine has an estimated economic life of 6 years. Required: Prepare the journal entries for Star Inc., the lessor, from April 1, 2020 to April 1, 2021. A- iii 7 B I TII DEBIT CREDIT DATE ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts