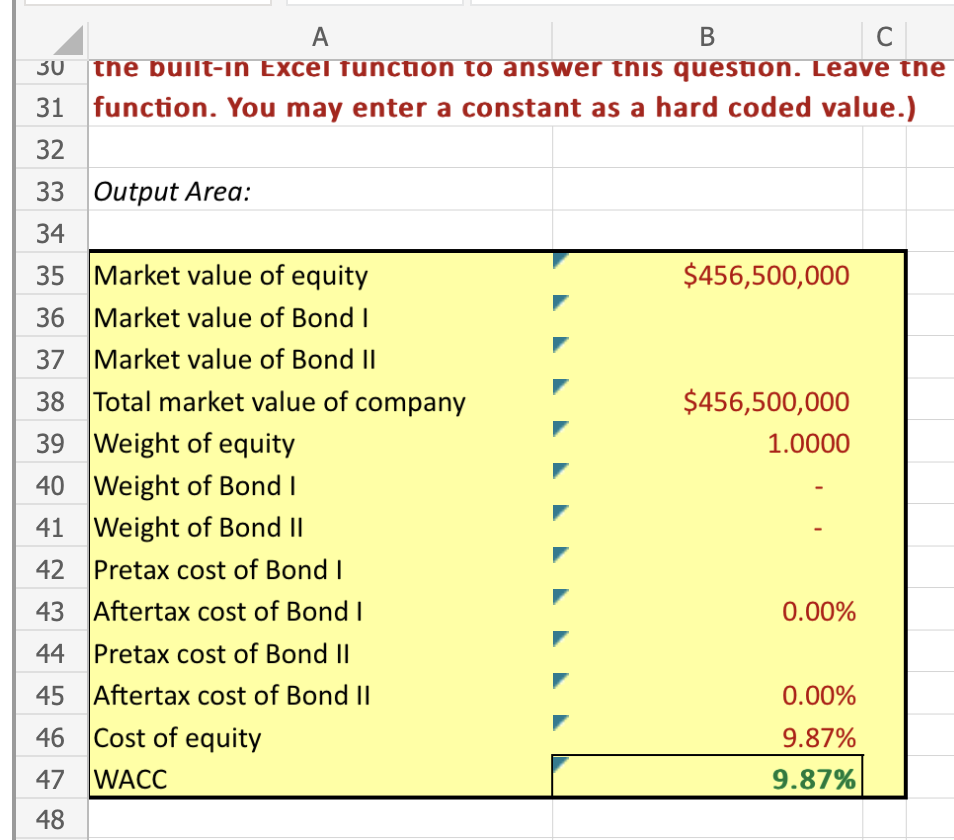

Question: NOTE: The cells that have values already have the correct forumula but they rely on other cells to generate an answer and the blank yellow

NOTE: The cells that have values already have the correct forumula but they rely on other cells to generate an answer and the blank yellow cells are incorrect and need an answer.

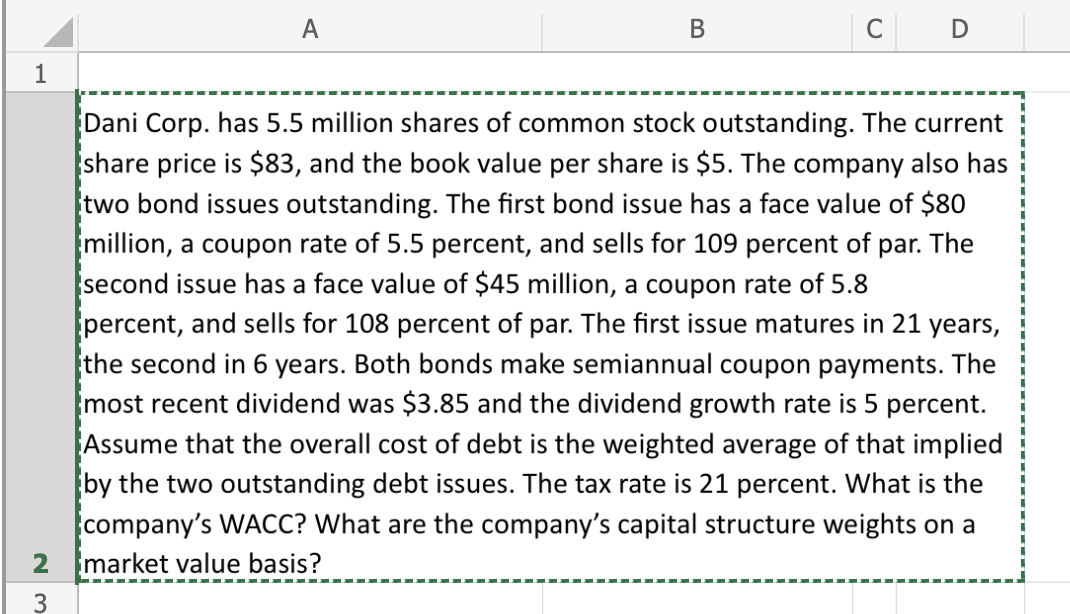

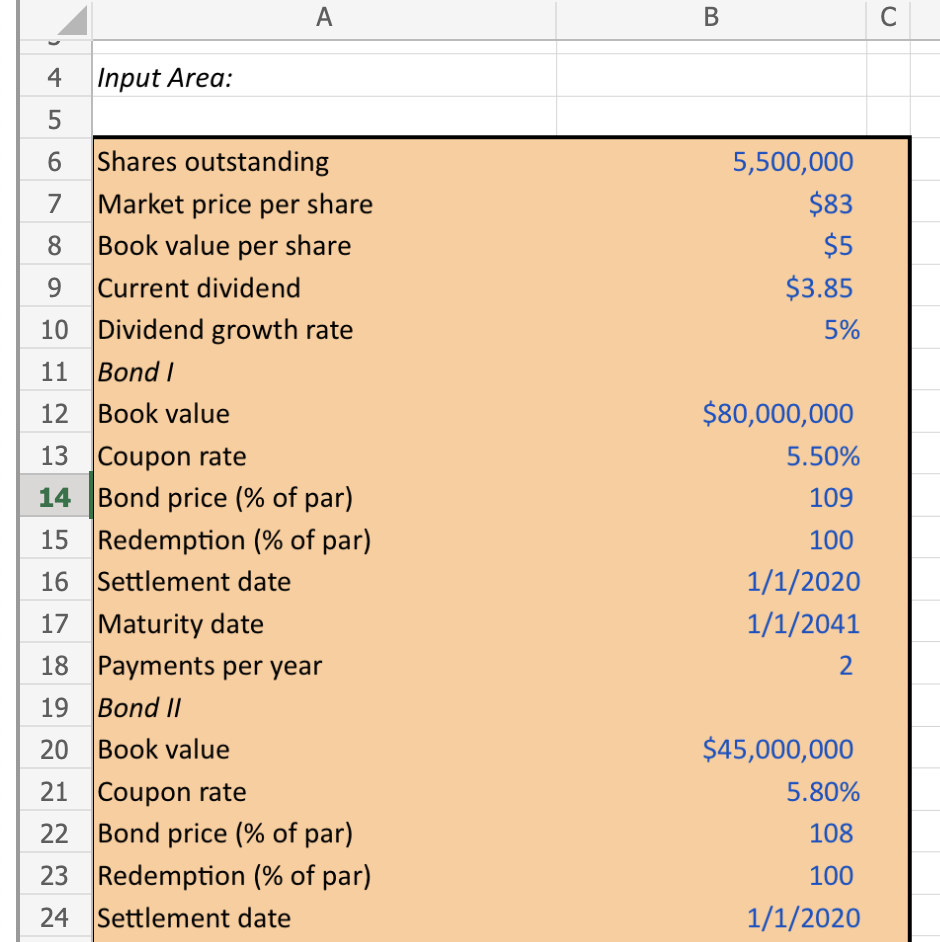

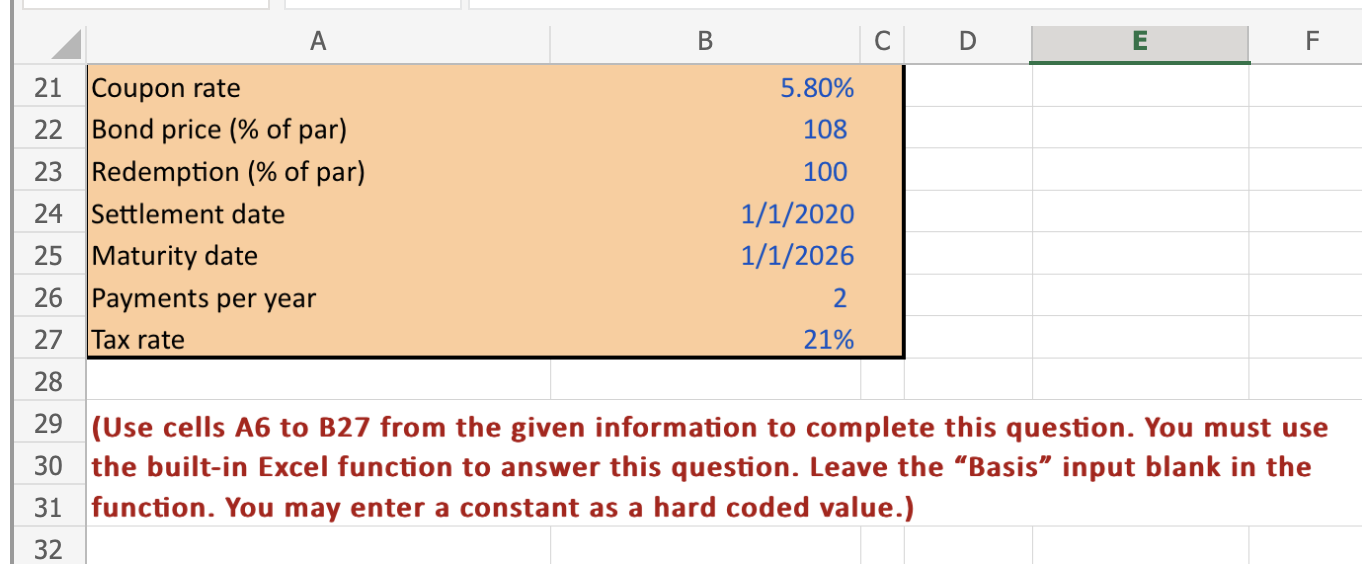

29 (Use cells A6 to B27 from the given information to complete this question. You must use the built-in Excel function to answer this question. Leave the "Basis" input blank in the function. You may enter a constant as a hard coded value.) Dani Corp. has 5.5 million shares of common stock outstanding. The current share price is $83, and the book value per share is $5. The company also has two bond issues outstanding. The first bond issue has a face value of $80 million, a coupon rate of 5.5 percent, and sells for 109 percent of par. The second issue has a face value of $45 million, a coupon rate of 5.8 percent, and sells for 108 percent of par. The first issue matures in 21 years, the second in 6 years. Both bonds make semiannual coupon payments. The most recent dividend was $3.85 and the dividend growth rate is 5 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. The tax rate is 21 percent. What is the company's WACC? What are the company's capital structure weights on a 2 market value basis? 29 (Use cells A6 to B27 from the given information to complete this question. You must use the built-in Excel function to answer this question. Leave the "Basis" input blank in the function. You may enter a constant as a hard coded value.) Dani Corp. has 5.5 million shares of common stock outstanding. The current share price is $83, and the book value per share is $5. The company also has two bond issues outstanding. The first bond issue has a face value of $80 million, a coupon rate of 5.5 percent, and sells for 109 percent of par. The second issue has a face value of $45 million, a coupon rate of 5.8 percent, and sells for 108 percent of par. The first issue matures in 21 years, the second in 6 years. Both bonds make semiannual coupon payments. The most recent dividend was $3.85 and the dividend growth rate is 5 percent. Assume that the overall cost of debt is the weighted average of that implied by the two outstanding debt issues. The tax rate is 21 percent. What is the company's WACC? What are the company's capital structure weights on a 2 market value basis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts