Question: Note the concepts covered in class regarding the 5 categories of accounts (assets, expenses, liabilities, equity, revenue) and double entries when answering the questions.

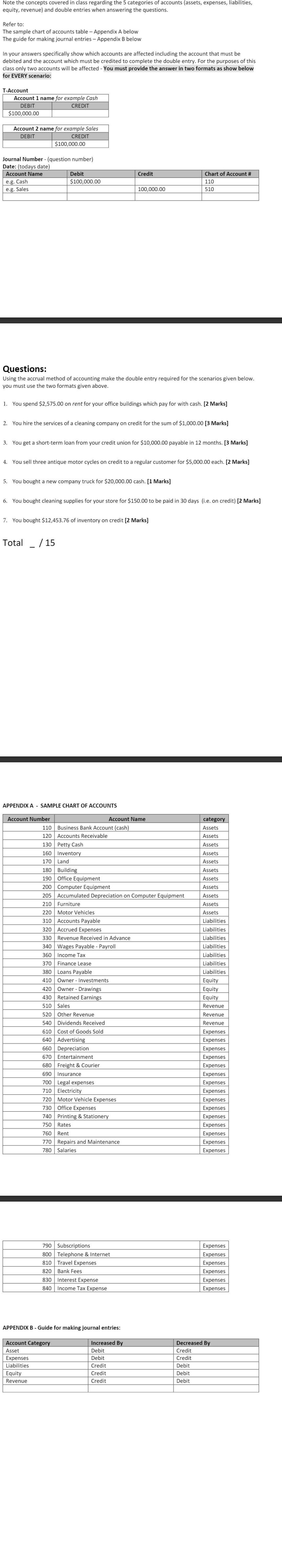

Note the concepts covered in class regarding the 5 categories of accounts (assets, expenses, liabilities, equity, revenue) and double entries when answering the questions. Refer to: The sample chart of accounts table - Appendix A below The guide for making journal entries - Appendix B below In your answers specifically show which accounts are affected including the account that must be debited and the account which must be credited to complete the double entry. For the purposes of this class only two accounts will be affected - You must provide the answer in two formats as show below for EVERY scenario: T-Account Account 1 name for example Cash DEBIT CREDIT $100,000.00 Account 2 name for example Sales DEBIT CREDIT $100,000.00 Journal Number (question number) Date: (todays date) Account Name e.g. Cash e.g. Sales Debit $100,000.00 Credit Chart of Account # 110 100,000.00 510 Questions: Using the accrual method of accounting make the double entry required for the scenarios given below. you must use the two formats given above. 1. You spend $2,575.00 on rent for your office buildings which pay for with cash. [2 Marks] 2. You hire the services of a cleaning company on credit for the sum of $1,000.00 [3 Marks] 3. You get a short-term loan from your credit union for $10,000.00 payable in 12 months. [3 Marks] 4. You sell three antique motor cycles on credit to a regular customer for $5,000.00 each. [2 Marks] 5. You bought a new company truck for $20,000.00 cash. [1 Marks] 6. You bought cleaning supplies for your store for $150.00 to be paid in 30 days (i.e. on credit) [2 Marks] 7. You bought $12,453.76 of inventory on credit [2 Marks] Total / 15 APPENDIX A SAMPLE CHART OF ACCOUNTS Account Number Account Name category 110 Business Bank Account (cash) Assets 120 Accounts Receivable Assets 130 Petty Cash Assets 160 Inventory Assets 170 Land Assets 180 Building Assets 190 Office Equipment Assets 200 Computer Equipment Assets 205 Accumulated Depreciation on Computer Equipment Assets 210 Furniture Assets 220 Motor Vehicles Assets 310 Accounts Payable Liabilities 320 Accrued Expenses Liabilities 330 Revenue Received in Advance Liabilities 340 Wages Payable - Payroll Liabilities 360 Income Tax 370 Finance Lease 380 Loans Payable 410 Owner Investments Liabilities Liabilities Liabilities Equity 420 Owner - Drawings Equity 430 Retained Earnings Equity 510 Sales Revenue 520 Other Revenue Revenue 540 Dividends Received Revenue 610 Cost of Goods Sold Expenses 640 Advertising Expenses 660 Depreciation Expenses 670 Entertainment Expenses 680 Freight & Courier Expenses 690 Insurance Expenses 700 Legal expenses Expenses 710 Electricity Expenses 720 Motor Vehicle Expenses Expenses 730 Office Expenses Expenses 740 Printing & Stationery Expenses 750 Rates Expenses 760 Rent Expenses 770 Repairs and Maintenance Expenses 780 Salaries Expenses 790 Subscriptions Expenses 800 Telephone & Internet Expenses 810 Travel Expenses Expenses 820 Bank Fees Expenses 830 Interest Expense Expenses 840 Income Tax Expense Expenses APPENDIX B - Guide for making journal entries: Account Category Asset Expenses Liabilities Increased By Decreased By Debit Credit Debit Credit Credit Debit Equity Credit Debit Revenue Credit Debit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts