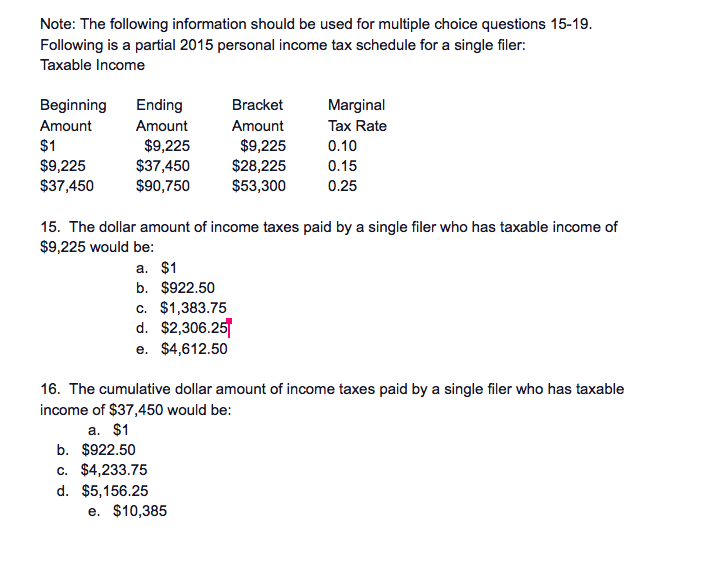

Question: Note: The following information should be used for multiple choice questions 15-19. Following is a partial 2015 personal income tax schedule for a single filer:

Note: The following information should be used for multiple choice questions 15-19. Following is a partial 2015 personal income tax schedule for a single filer: Taxable income Beginning Amount $1 $9,225 $37,450 Ending Amount $9,225 $37,450 $90,750 Bracket Amount $9,225 $28,225 $53,300 Marginal Tax Rate 0.10 0.15 0.25 15. The dollar amount of income taxes paid by a single filer who has taxable income of $9,225 would be: a. $1 b. $922.50 C. $1,383.75 d. $2,306.25 e. $4,612.50 16. The cumulative dollar amount of income taxes paid by a single filer who has taxable income of $37,450 would be: a. $1 b. $922.50 c. $4,233.75 d. $5,156.25 e. $10,385

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts