Question: Please help me answer the following questions: please also include brief & concise explanations why you choose the answer. Multiple Choice Questions Read and analyze

Please help me answer the following questions: please also include brief & concise explanations why you choose the answer.

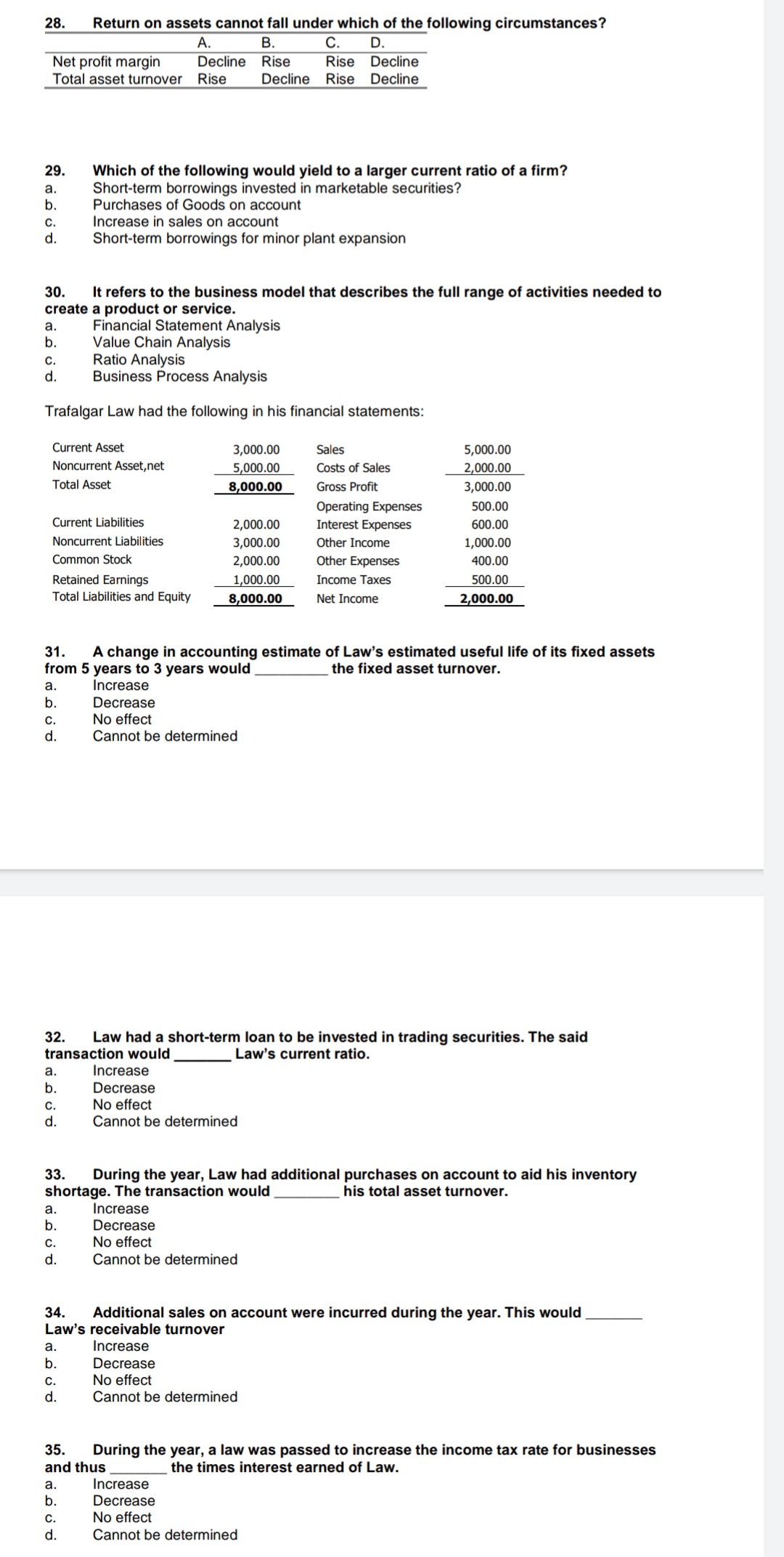

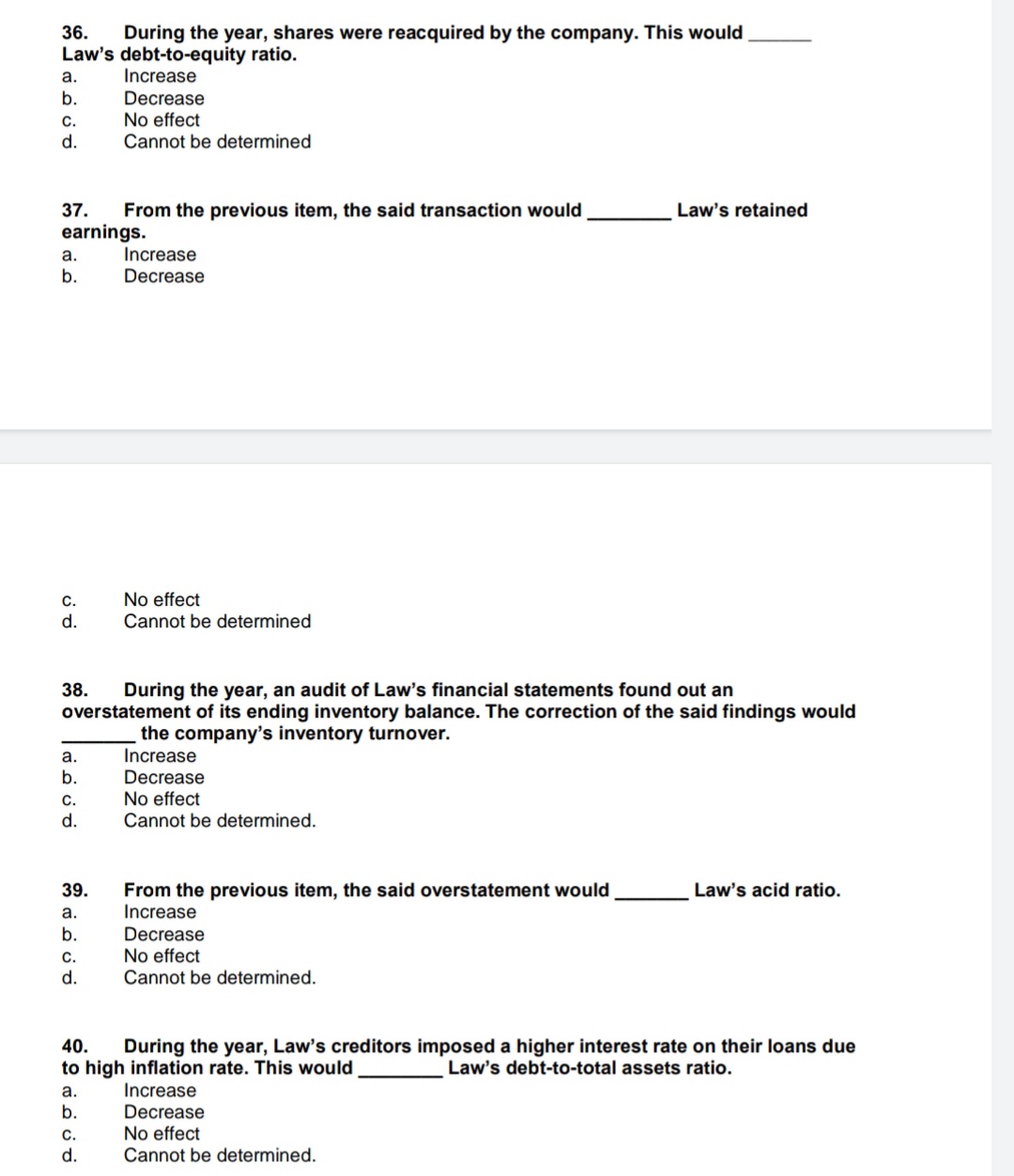

Multiple Choice Questions Read and analyze the statements below and choose the best answer in each of the following: 1. Which is not within the definition of an asset under the Revised Conceptual Framework? a. An asset is a present economic resource b. The economic resource is a right that has the potential to produce economic benefits c The economic resource is controlled by the entity as a result of past event. d Future economic benefit is expected to flow to entity. 2. What is the new definition of liability under the Revised Conceptual Framework? a. A present obligation of the entity arising from past event the settlement of which is expected to result in an inflow of economic benefit. b. A present obligation of the entity arising from present event. c. A present obligation of the entity to transfer an economic resource as a result of past evenL d. An obligation that the entity has practical ability to avoid. Which statement is not true about accrual and deferral? An accrued expense is an amount not paid and currently matched with earnings. A prepaid expense is an amount paid and not currently matched with earnings. An accrued income is an amount not collected and currently matched with expenses. A deferred income is an amount collected and currently matched with expenses. 99??? Which is not a possible combination of a journal entry? Increase in asset and increase in liability. Decrease in equity and increase in liability. Decrease liability and decrease in asset. Increase in asset and decrease in equity. eevee A reversing entry should never be made for an adjusting entry that Accrues unrecorded revenue. Accrues unrecorded expenses. Adjusts expired costs from an asset account to an expense account. Adjusts unexpired costs from expense account to an asset account. 99??? 6. An entity is a resort located in Boracay. The entity collects cash when guests make a reservation. During December 2021 , the entity collected P5.000.000 of cash and recorded the receipt by recognizing unearned revenue. The entity had earned P2.000.000 of this amount and the balance will be earned during January 2022. What is the impact of the adjusting entry on December 31, 2021 ? a. 3,000,000 increase in revenue b. 2,000,000 decrease in liability c. 5,000,000 increase in asset d. 2,000,000 increase in liability 7. An entity recorded all purchases of supplies as expense. Prepaid supplies totaled Pit-00,000 on January 1, 2021. Supplies in the amount of P5,000,000 were purchased during the current year. Actual year-end supplies unused amounted to P1 .000.000. No reversing entry was made on January 1, 2021. What is the adjusting entry on December 31 . 2021 ? a. Debit prepaid supplies and credit supplies expense P600,000 b. Debit supplies expense and credit prepaid supplies P600.000 c. Debit prepaid supplies and credit supplies expense P1 ,000,000 d. Debit supplies expense and credit prepaid supplies P1 ,000,000 8. An entity reported wages expense of P6.000,000 for 2021. The wages payable at the beginning of year amounted to P1 ,500.000. Wage payments during the year totaled P5,000.000. The previous year's adjusting entry for unpaid wages was reversed on January 1I 2021. What is the adjusting entry for accrued wages payable on December 31, 2021 ? a. Debit wages expense and credit wages payable P1 ,000,000 b. Debit wages expense and credit wages payable P1,500,000 c. Debit wages expense and credit wages payable P2,500.000 d. Debit wages payable and credit wages expense P2.500.000 9. The postcloslng trial balance a. Provides a convenient listing of balances that can be used to prepare nancial statements. b. Does not include nominal accounts. o. Is identical to the statement of nancial position. d. Proves that accounts have been closed properly. 10. Accounting Information is considered relevant when it a. Can be depended on to represent the economic conditions that it is intended to represent b. Is capable of making a difference in a decision o. Is understandable by reasonably informed users of accounting information d. Is verifiable and neutral 11. A firm has the following operating income rates for the last four years: 2000, 9.0%; 2001, 8.9%; 2002. 9.1%; 2003, 8.8%. From a standpoint of trend analysis. what conclusion might an analyst reach regarding the firm's revenue growth? a. The trend analysis indicates the firm's operating income has been flat over time. b. The trend analysis indicates the rm's operating income has materially declined over time and is cause for investor concern. c. The trend analysis indicates the rm's operating income has been increasing at a scally healthy rate over time. d. The conclusion is indeterminable from the information given. 12. The analyst must exercise caution when using ratios as part of the analysis of a firm. The fact that ratios often vary across industries is an example of what is called: a. an acc0unting method discrepancy b. an industry and business difference c. a business environment change d. an ambiguous ratio definition 13. Which of the following is not a limitation of ratio analysis affecting comparability among firms? a. Provision of useful information regarding the efficiency of operations and the stability of financial conditions b. Different sources of information o. Different accounting periods d. Different accounting policies. 14. in assessing the financial health of a firm. financial analysts use different techniques. One technique is the vertical. common-size analysis. an example of which is a. Total current assets is 20% of the total assets as of a certain date b. Total current assets as of certain date is 20% greater compared with the previous year c. The finished goods inventory turnover is twelve times during the year d. Cash provided by operations is P100000. 15. Which of the following statements is not correct? A limitation of ratio analysis affecting comparability from one Interim period to the next within a firm Is that a. In a seasonal business, inventory and receivables may vary widely with year-end balances not reflecting the averages for the period. b. Management has less incentive to window dress nancial statements to improve results. c. Comparability is impaired if different firms use different accounting policies. d. Misleading conclusions may result if improper comparisons are selected. 16. Companies A and B are in the same industry and have similar characteristics except that Company A is more leveraged than Company 8. Both companies have the same income before interest and taxes and the same total assets. Based on this information we could conclude that Company A has higher net income than Company B Company A has a lower return on assets than company B Company A is riskier than Company B. Company A has a lower debt ratio than company 9.0.55 17. A firm with a total asset turnover lower than the industry standard and a current ratio which meets Industry standard might have excessive: a. Accounts receivable b. Debt c. Fixed assets d. Inventory 18. Which of the following actions will increase a firrn's current ratio if it is now less than 1.0? a. Convert marketable securities to cash. b. Pay accounts payable with cash. (3. Buy inventory with short term credit (Le. accounts payable). d. Sell inventory at cost. 19. If a company has an acid-test ratio of 1.2:1 , what respective effects will the borrowing of cash by shun-term debt and collection of accounts receivable have on the ratio? A. B. C. D. Short-term borrowing Increase Increase Decrease Decrease Collection of receivable No effect Increase No effect Decrease 20. A ratio has little meaning until it is compared to a benchmark. Financial analysts use several common benchmarks to help them better understand and interpret financial ratios. The benchmark in which ratios from several different companies or an industry segment are analyzed is known as a: cross-sectional analysis trend analysis cause-of-change analysis cause-of-action analysis so as\" 21. Which of the following circumstances will cause sales to fixed assets to be abnormally high? a. A labor-intensive industry. b. The use of units-of-production depreciation. c. A highly mechanized facility. d. High direct labor costs from a new union contract. 22. Which of the following would most likely cause a rise in net profit margin? a. increased sales decreased preferred dividends decreased operating expenses increased cost of sales 9-9? 23. Which of the following will not cause times interest earned to drop? Assume no other changes than those listed. A rise in preferred stock dividends. A drop in sales with no change in interest expense. An increase in interest rates. An increase in bonds payable with no change in operating income. 9-9?!\" 24. Recentlythe Mall Company has been having problems. As a result, its nancial situation has deteriorated. HIM approached die First National Bank for a badly needed loan. but the loan officer insisted that the current ratio (now 0.5) be improved to at least 0.8 before the bani: would even consider granting the credit. Which of the following actions would do the most to improve the ratio in the short run? a. Using some cash to pay off some Current liabilities. b. Collecting some of the current accounts receivable. c. Paying off some long-term debt. d. Purchasing additional inventory on credit (accounts payable). 25. Which of the following would be most detrimental to a firm's current ratio if that ratio is currently 2.0? Buy raw materials on credit Sell marketable securities at cost Pay off accounts payable with cash Pay off a portion of long-tenn debt with cash 9-9.3!\" 26. An acceleration in the collection of receivables will tend to cause the accounts receivable turnover to: a. decrease b. remain the same c. either increase or decrease it. increase 27. Financial statements analysis is not without problems and limitations. Among such limitations is as follows. except: a. A ratio that is acceptable to one company may not be acceptable to another when some other factors are considered. b. There may be some differences in the accounting methods and estimates used by companies so that comparison of their ratios may not be advisable. c. Financial statements are based on current market value of the lm's assets. lherofore they do not reflect historical costs. it. The tim'ng of transactions and use of averages 'n apply'ng the various tedtniques in financial statements analysis affect the results to be obtained. 28. Return on assets cannot fall under which of the following circumstances? A. B. C. D. Net profit margin Decline Rise Rise Decline Total asset turnover Rise Decline Rise Decline 29. Which of the following would yield to a larger current ratio of a firm? a. Short-term borrowings invested in marketable securities? b. Purchases of Goods on account C. Increase in sales on account Short-term borrowings for minor plant expansion 30. It refers to the business model that describes the full range of activities needed to create a product or service. a Financial Statement Analysis b. Value Chain Analysis Ratio Analysis Business Process Analysis Trafalgar Law had the following in his financial statements: Current Asset 3,000.00 Sales 5,000.00 Noncurrent Asset, net 5,000.00 Costs of Sales 2,000.00 Total Asset 8,000.00 Gross Profit 3,000.00 Operating Expenses 500.00 Current Liabilities 2,000.00 Interest Expenses 600.00 Noncurrent Liabilities 3,000.00 Other Income 1,000.00 Common Stock 2,000.00 Other Expenses 400.00 Retained Earnings 1,000.00 Income Taxes 500.00 Total Liabilities and Equity 8,000.00 Net Income 2,000.00 31. A change in accounting estimate of Law's estimated useful life of its fixed assets from 5 years to 3 years would the fixed asset turnover. a. Increase b. Decrease C. No effect Cannot be determined 32. Law had a short-term loan to be invested in trading securities. The said transaction would Law's current ratio. a. Increase Decrease C. No effect Cannot be determined 33. During the year, Law had additional purchases on account to aid his inventory shortage. The transaction would his total asset turnover. a Increase b Decrease C. No effect Q Cannot be determined 34. Additional sales on account were incurred during the year. This would Law's receivable turnover a. Increase b. Decrease C. No effect d. Cannot be determined 35. During the year, a law was passed to increase the income tax rate for businesses and thus the times interest earned of Law. a. Increase Decrease No effect Cannot be determined36. During the year, shares were reacquired by the company. This would Law's debt-to-equity ratio. a Increase b. Decrease C . No effect Cannot be determined 37. From the previous item, the said transaction would Law's retained earnings. a. Increase b. Decrease No effect Cannot be determined 38. During the year, an audit of Law's financial statements found out an overstatement of its ending inventory balance. The correction of the said findings would the company's inventory turnover. a. Increase b. Decrease C. No effect 2 Cannot be determined. 39. From the previous item, the said overstatement would Law's acid ratio. a. Increase b. Decrease No effect Cannot be determined. 40. During the year, Law's creditors imposed a higher interest rate on their loans due to high inflation rate. This would Law's debt-to-total assets ratio. a. Increase b. Decrease No effect Cannot be determined