Question: Note: the solution should not in handwriting, it should be copy paste able from here to word file. so dont send in hand writing formt.

Note: the solution should not in handwriting, it should be copy paste able from here to word file. so dont send in hand writing formt.

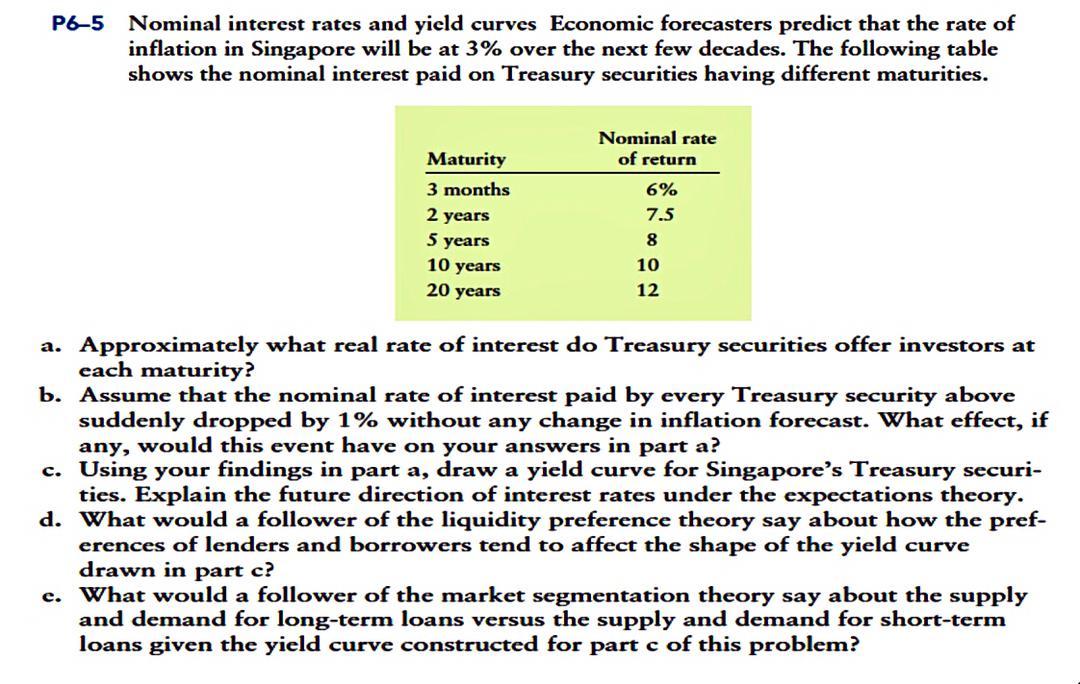

P6-5 Nominal interest rates and yield curves Economic forecasters predict that the rate of inflation in Singapore will be at 3% over the next few decades. The following table shows the nominal interest paid on Treasury securities having different maturities. Nominal rate of return Maturity 3 months 2 years 5 years 10 years 20 years 6% 7.5 8 10 12 a. Approximately what real rate of interest do Treasury securities offer investors at each maturity? b. Assume that the nominal rate of interest paid by every Treasury security above suddenly dropped by 1% without any change in inflation forecast. What effect, if any, would this event have on your answers in part a? c. Using your findings in part a, draw a yield curve for Singapore's Treasury securi- ties. Explain the future direction of interest rates under the expectations theory. d. What would a follower of the liquidity preference theory say about how the pref- erences of lenders and borrowers tend to affect the shape of the yield curve drawn in part c? c. What would a follower of the market segmentation theory say about the supply and demand for long-term loans versus the supply and demand for short-term loans given the yield curve constructed for part c of this problem? P6-5 Nominal interest rates and yield curves Economic forecasters predict that the rate of inflation in Singapore will be at 3% over the next few decades. The following table shows the nominal interest paid on Treasury securities having different maturities. Nominal rate of return Maturity 3 months 2 years 5 years 10 years 20 years 6% 7.5 8 10 12 a. Approximately what real rate of interest do Treasury securities offer investors at each maturity? b. Assume that the nominal rate of interest paid by every Treasury security above suddenly dropped by 1% without any change in inflation forecast. What effect, if any, would this event have on your answers in part a? c. Using your findings in part a, draw a yield curve for Singapore's Treasury securi- ties. Explain the future direction of interest rates under the expectations theory. d. What would a follower of the liquidity preference theory say about how the pref- erences of lenders and borrowers tend to affect the shape of the yield curve drawn in part c? c. What would a follower of the market segmentation theory say about the supply and demand for long-term loans versus the supply and demand for short-term loans given the yield curve constructed for part c of this

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts