Question: Note: This is an optional problem. Solve this problem only if you would like to get extra points. Otherwise, you may skip this problem, Cathie

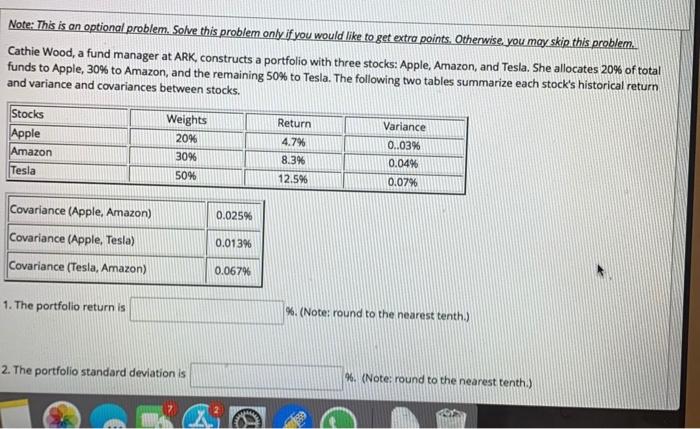

Note: This is an optional problem. Solve this problem only if you would like to get extra points. Otherwise, you may skip this problem, Cathie Wood, a fund manager at ARK, constructs a portfolio with three stocks: Apple, Amazon, and Tesla. She allocates 20% of total funds to Apple, 30% to Amazon, and the remaining 50% to Tesla. The following two tables summarize each stock's historical return and variance and covariances between stocks. Stocks Apple Amazon Tesla Weights 20% 30% Variance 0..03% Return 4.7% 8.3% 12.5% 0.04% 50% 0.07% Covariance (Apple, Amazon) 0.025% Covariance (Apple, Tesla) 0.013% Covariance (Tesla, Amazon) 0.067% 1. The portfolio return is %. (Note: round to the nearest tenth.) 2. The portfolio Standard deviation is %. (Note: round to the nearest tenth.) DI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts