Question: Note: This problem is for the 2022 tax vear. Legan B. Tapiler is a widerwer whose spouse, Sara, died an June 6, 2020. He limes

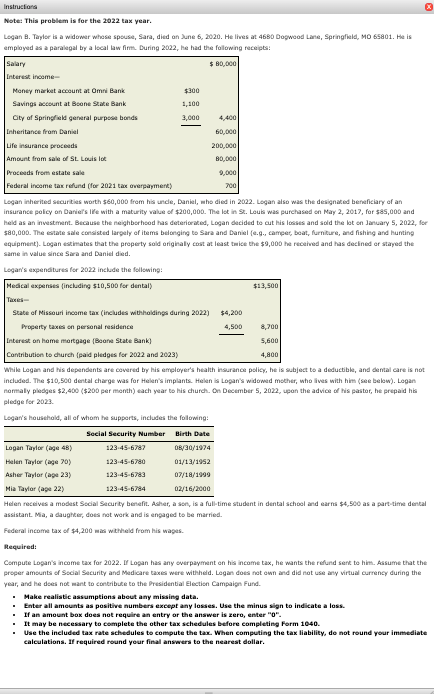

Note: This problem is for the 2022 tax vear. Legan B. Tapiler is a widerwer whose spouse, Sara, died an June 6, 2020. He limes at 4680 Oopwood Lane, Springfiald, Mo 65801. He is employed as a paralegal by a lscal law fimt. During 2022, he had the following receipts: Legan inherited scaurties worth $60,000 frem his unde, Danial, who died in 2022. Legan also was the designaked befaficiary af an insuranee policy on Dariefs IVe with a maturity value of $200,000. The ist in 5 . Louk was purchased en Mary 2, 2017, for $85,000 and $80,000. The estate sale consisted larpely of items belonging to Sara and Daniel fe.9., camper, beat, furnicure, and fishing afd humting equipment]. Logan estimates that the property soild originaly cont at least teice the $9,000 he receined and has decined of stared the same in value since Sara and Daniel died. Legan's expenditures for 2022 include the following: While Legan and his dependents are covered by his employer's health insuranoe pelicy, he is subject to a deductible, and demtal care is not included. The \$10,500 dental charge was for Helen's implants. Helen is Lopan's widomed mother, who lves with him (see belaw). Logan nomaly plodges $2,400 (\$200 per momth) each year to his dhurdh. On December 5,2022 , upon the advioe of his pastor, he prepaid his pledge for 2023 . Legar's household, all of whom he supports, includes the following: Heden receives a modest Sscial Securty benteft. Ashef, a son, is a full-time student in dental school and earns $4,500 as a part-time dental assistant. Ma, a daughter, does fot work and is enpaged to be married. Federal income tax of $4,200 mas witheld from his wapes. Required: Compute Lopan's income tax for 2022. If Logan has any everpayment on his incume tax, he wants the refund serk to him, Aasume that the proper amounts of Sscial Security and Madicare taxis were withheld. Logan does fot awn and did not use any virtual ourreney during the vear, and he dsei not mant to contribute to the Presidential Election Campaign Fund. - Make realistic assumptions abeut any missing data. - Enter all ameunts as positive numbers except any losses. Use the minus slen to indicate a lass. - If an amount box does not require an entry or the answer is zero, enter " 0 ". - It may be necessary to complete the other tax schedules before completing form 1040. - Use the included tax rate schedules to compute the tax. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest doliar

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts