Question: NOTE: This question is double mark (+2) and has a penalty mark (-2) if answered incorrectly. Leaving it blank will have no impact. Zero mark.

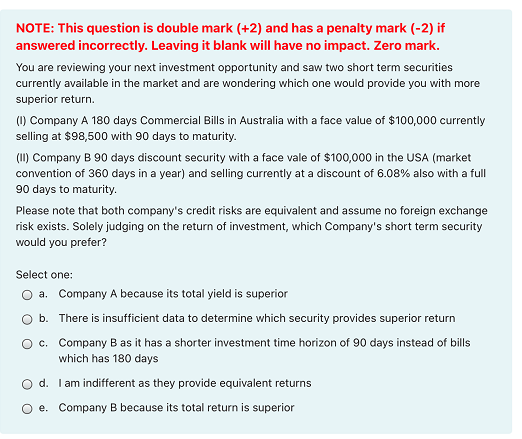

NOTE: This question is double mark (+2) and has a penalty mark (-2) if answered incorrectly. Leaving it blank will have no impact. Zero mark. You are reviewing your next investment opportunity and saw two short term securities currently available in the market and are wondering which one would provide you with more superior return. (1) Company A 180 days Commercial Bills in Australia with a face value of $100,000 currently selling at $98,500 with 90 days to maturity. (II) Company B 90 days discount security with a face vale of $100,000 in the USA (market convention of 360 days in a year) and selling currently at a discount of 6.08% also with a full 90 days to maturity. Please note that both company's credit risks are equivalent and assume no foreign exchange risk exists. Solely judging on the return of investment, which company's short term security would you prefer? Select one: O a. Company A because its total yield is superior b. There is insufficient data to determine which security provides superior return Oc Company B as it has a shorter investment time horizon of 90 days instead of bills which has 180 days Od. I am indifferent as they provide equivalent returns Oe. Company B because its total return is superior

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts