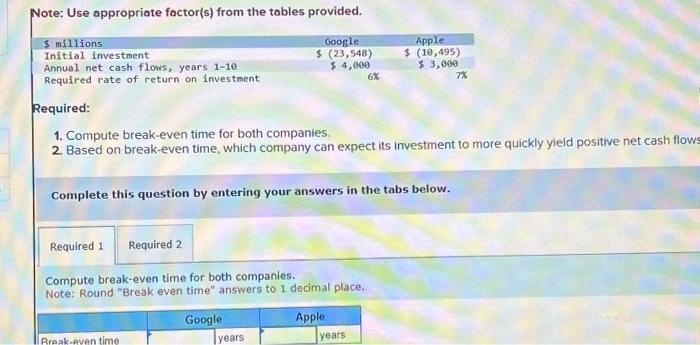

Question: Note: Use appropriate factor(s) from the tables provided. $ millions Initial investment Annual net cash flows, years 1-10 Required rate of return on investment

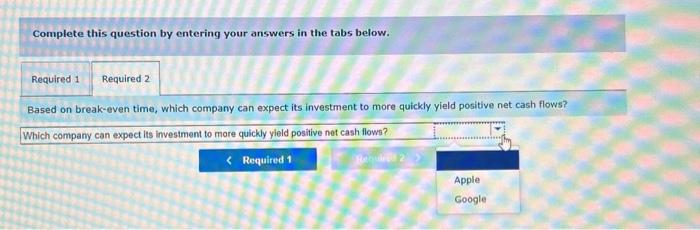

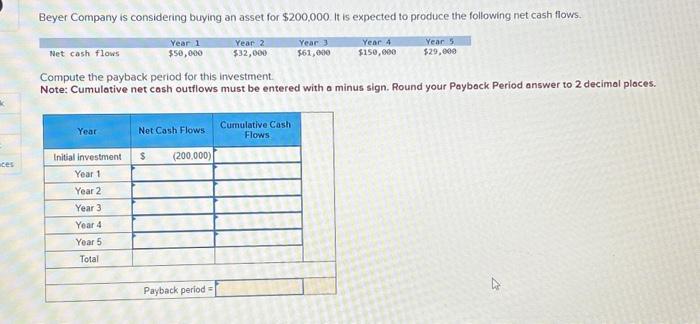

Note: Use appropriate factor(s) from the tables provided. $ millions Initial investment Annual net cash flows, years 1-10 Required rate of return on investment Required 1 Required 2 Google $ (23,548) $ 4,000 Required: 1. Compute break-even time for both companies. 2. Based on break-even time, which company can expect its investment to more quickly yield positive net cash flows Complete this question by entering your answers in the tabs below. Compute break-even time for both companies. Note: Round "Break even time" answers to 1 decimal place. Google Apple Rreak-even time years 6% Apple $ (10,495) $3,000 years 7% Complete this question by entering your answers in the tabs below. Required 1 Required 2 Based on break-even time, which company can expect its investment to more quickly yield positive net cash flows? Which company can expect its investment to more quickly yield positive net cash flows? < Required 1 Requli 2 Apple Google Beyer Company is considering buying an asset for $200,000. It is expected to produce the following net cash flows. Year 4 $150,000 Year Initial investment Year 1 Year 2 Year 31 Year 4 Year 5 Total Year 1 $50,000 Net cash flows Compute the payback period for this investment. Note: Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places. Net Cash Flows $ (200,000) Year 2 $32,000 Payback period= Year 3 $61,000 Cumulative Cash Flows Year 5 $29,000 4

Step by Step Solution

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Required 1 To compute the breakeven time for both companies we need to use the given information and ... View full answer

Get step-by-step solutions from verified subject matter experts