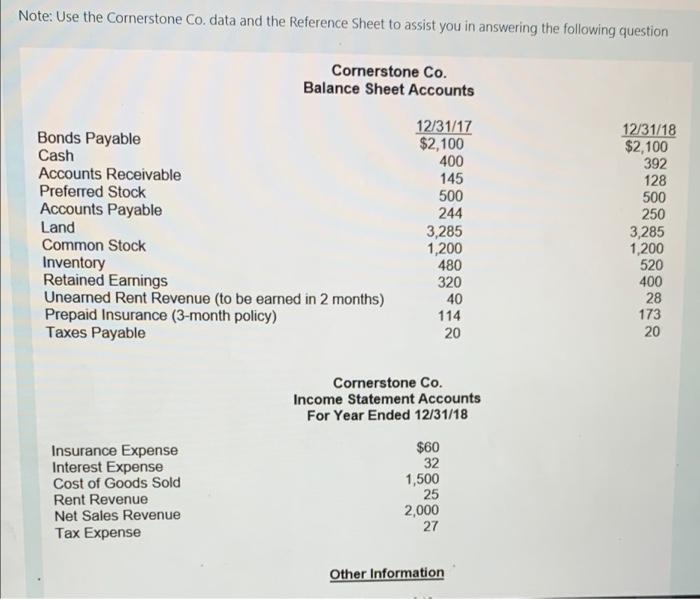

Question: Note: Use the Cornerstone Co. data and the Reference Sheet to assist you in answering the following question Cornerstone Co. Balance Sheet Accounts Bonds Payable

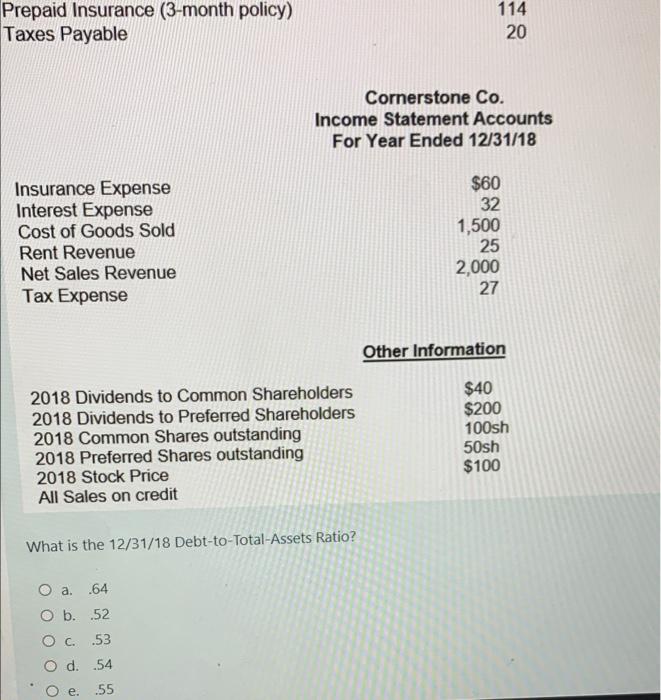

Note: Use the Cornerstone Co. data and the Reference Sheet to assist you in answering the following question Cornerstone Co. Balance Sheet Accounts Bonds Payable Cash Accounts Receivable Preferred Stock Accounts Payable Land Common Stock Inventory Retained Earnings Uneared Rent Revenue (to be earned in 2 months) Prepaid Insurance (3-month policy) Taxes Payable 12/31/17 $2,100 400 145 500 244 3,285 1,200 480 320 40 114 20 12/31/18 $2,100 392 128 500 250 3,285 1,200 520 400 28 173 20 Cornerstone Co. Income Statement Accounts For Year Ended 12/31/18 $60 Insurance Expense Interest Expense Cost of Goods Sold Rent Revenue Net Sales Revenue Tax Expense 32 1,500 25 2,000 27 Other Information Prepaid Insurance (3-month policy) Taxes Payable 114 20 Cornerstone Co. Income Statement Accounts For Year Ended 12/31/18 Insurance Expense Interest Expense Cost of Goods Sold Rent Revenue Net Sales Revenue Tax Expense $60 32 1,500 25 2,000 27 Other Information 2018 Dividends to Common Shareholders 2018 Dividends to Preferred Shareholders 2018 Common Shares outstanding 2018 Preferred Shares outstanding 2018 Stock Price All Sales on credit $40 $200 100sh 50sh $100 What is the 12/31/18 Debt-to-Total-Assets Ratio? O a .64 O b. 52 Oc..53 O d. 54 .55

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts